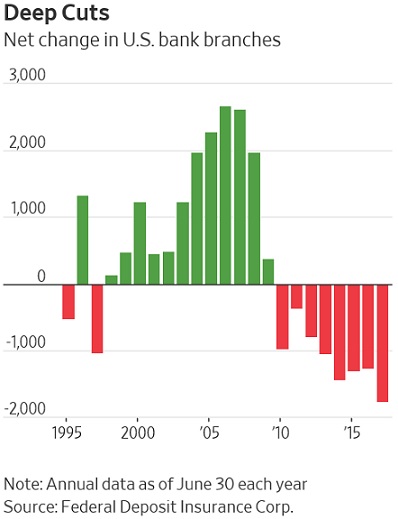

U.S. banks are closing branches at the fastest pace in decades. More, is the longest stretch of closures since the Great Depression

The number of branches in the U.S. shrank by more than 1,700 in the 12 months ended in June 2017, the biggest decline on record, according to a Wall Street Journal analysis of federal data.

Branch numbers fell again in the second half of 2017, according to related data submitted to bank regulators and reviewed by the Journal. That would add to the thousands of locations closed following the financial crisis, and is the longest stretch of closures since the Great Depression.

Many of the closings were in big cities and surrounding suburbs, where branches were consolidated largely because of falling foot traffic. Others were in rural areas, where some large regional lenders are leaving town altogether.

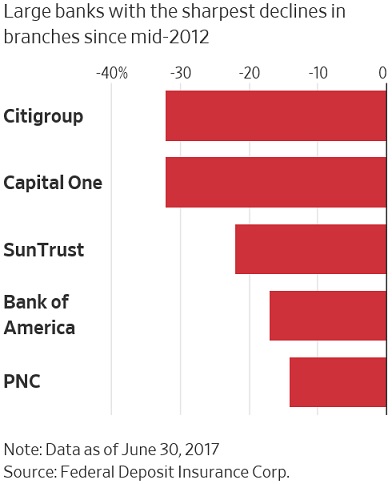

While banks battered during the financial crisis such as Citigroup Inc. and Bank of America Corp. started cutting branches years ago, regional banks have only accelerated their closures more recently. From mid-2012 to mid-2017, Capital One Financial Corp. cut 32% of its branches, SunTrust Banks Inc. 22% and Regions Financial Corp. 12%. For all three, the sharpest cuts came in the most recent 12-month period.

Banks say they carefully consider which branches to close, examining deposit levels at each branch and commute time to the nearest location. “We continue to evolve and optimize our branch network to ensure that we’re operating as efficiently and effectively as possible,” a Capital One spokeswoman said.

For decades, banks needed to add new locations to grow, pushing the number of U.S. branches to a peak in 2009. But in the aftermath of the financial crisis, some started closing branches to save money—and then kept closing them to contend with low interest rates and higher regulatory costs.

Along the way, lenders realized they could maintain their deposit levels with fewer locations in a digital world where customers often prefer banks’ mobile apps and ATMs.

The shift in strategy is helping some banks reach profit records.

For instance, Bank of America’s adjusted earnings in 2017 matched its highest annual profit ever. The bank closed or sold more than 1,500 branches since 2009, including the vast majority of its rural branches. The closures have helped the bank save on occupancy and employee costs, bringing down overall expenses. The lower expense levels have bolstered bank profit.

Real estate auction firm Ten-X says more banks are using its site to sell properties, many at a discount. The firm, which got its start focusing on distressed real estate, is now considering a new group dedicated to branches.

For example, Wells Fargo & Co., which preserved its branch network even as rivals trimmed, has started cutting it back since its sales-practice scandal imploded in 2016.

Regional banks Fifth Third Bancorp in Cincinnati, Ohio, and Regions, based in Birmingham, Ala., disclosed in regulatory filings that they have been selling land that they had once bought for future branch locations.

Banks are still opening new branches, just not enough to make up for the ones they are closing. Bank of America, for instance, has expanded into big cities where it previously didn’t have branches. JP Morgan Chase & Co. similarly announced plans to open as many as 400 branches in new markets in coming years.

Some closures involve banks leaving rural areas because branches there aren’t profitable enough, according to the Journal analysis. Since mid-2012, PNC has cut its branches in rural areas and small towns by nearly one-third. SunTrust has cut its rural branches almost by half.

When PNC closed its only branch in Jeromesville, Ohio, in 2015, the bank told regulators in a letter that it was “due to limited usage in a declining rural area.” In a letter to customers, PNC wrote that consumers were “using branches very differently today” and that they have “more service choices than ever.” While Jeromesville has no remaining bank branches, it still does have a PNC ATM.

“Limited usage is one of many criteria we look at when making the difficult, but necessary decision to close a branch,” PNC said. “Other criteria include community needs and the closest nearby branch.” PNC has a branch roughly 8 miles from Jeromesville.

Source: Wall Street Journal

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: