When Nubank was born in 2013, reaching 1 million customers seemed far away for founders Cristina Junqueira, David Vélez and Edward Wible. This milestone arrived in 2016, two years after the launch of the first product, and materialized the possibility of going even further.

In May 2024, 11 years after being founded to challenge the way the financial system treats people, Nubank reached a total of 100 million customers in Brazil, Mexico and Colombia. In Brazil alone, there are more than 92 million people and companies who use Nubank to make their lives easier. In Mexico, there are 7 million customers and, in Colombia, 1 million.

„In 2013, we had set ourselves the ambitious goal to reach one million customers in five years, which seemed almost impossible at the time. In a decade, we have surpassed 100 million, which is a testament to the trust our customers place in us and to the power of a truly customer-centric business model. These 100 million customers have written their stories together with ours, and we want to honor them in a special way.” – said David Vélez, founder and CEO of Nubank.

To celebrate this milestone, Nubank placed customers at the center of the world: the faces of customers from the three markets where Nubank operates appeared on the Exosphere, the largest LED screen in the world and exterior of Sphere, in Las Vegas, in the United States.

For this campaign, the Exosphere activation shows 360 degrees of images of Nubank customers on the exterior of the venue – which is nearly 112 meters high and more than 157 meters wide. The faces are formed by purple particles, each of which represents one of Nubank’s 100 million customers. Together, they illustrate that Nubank is composed of all their individual stories. They will appear on the Exosphere between the 7th and 14th of May.

“Being customer-centric has been guiding us since the very beginning. Today, we want our customers to see themselves the way we see them: at the center of everything. In reaching this milestone, we want to focus on the real people and individual stories of empowerment and advance our mission to help improve people’s lives.” – said Cristina Junqueira, co-founder and Chief Growth Officer of Nubank.

Nubank was born from the pains of one of the founders, Colombian David Vélez. He came to Brazil in 2011 to work, and faced several bureaucracies to be able to open a bank account. Coming from a professional experience at Sequoia Capital, he knew the startup market in Latin America and perceived an opportunity to transform the experience that Brazilians had with the banking system.

To do this, he looked for partners who understood the Brazilian financial and technology markets, and found the ideal partners in Cristina Junqueira and Edward Wible.

It was in a small house, in Brooklin, São Paulo, that the work began, in May 2013. And from day one, the company already revealed its values: Nu came to show that it was possible to create financial services that treat customers well and are transparent, simple and bare of all the complexity that the banking system had for a long time.

Fighting complexity to empower people and give them back control over their financial lives was the mission, and continues to be, even 100 million customers later.

The first product was launched in 2014: the credit card Nubank (known as „roxinho”, purple), with no annual fees and fully controlled in the app. That year, Nu gained its first 6 thousand customers, and hasn’t stopped since.

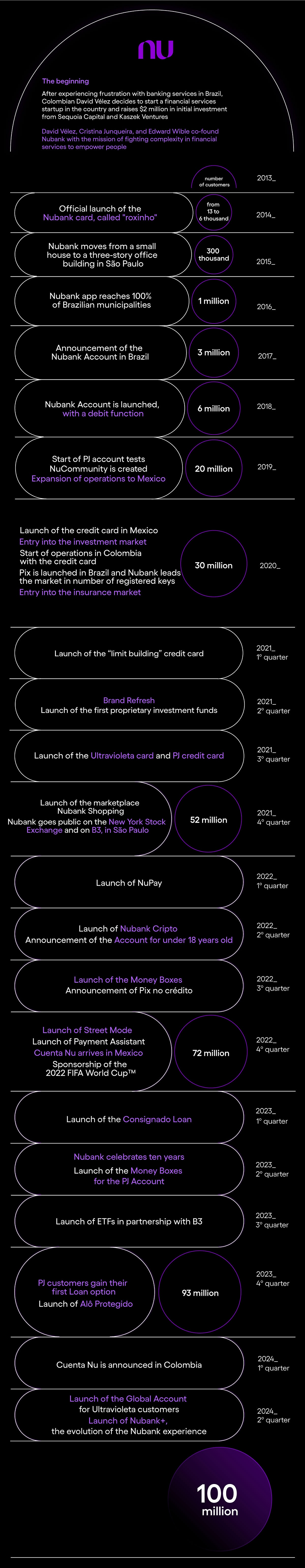

Check out, in the infographic below, the evolution of the number of Nubank customers with each step taken by the business.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: