EPC launches public consultation for first pan-European scheme providing customers with Euro instant credit transfers

The European Payments Council (EPC) is today launching the public consultation on the Single Euro Payments Area (SEPA) Instant Credit Transfer (SCT Inst) scheme. „The proposed scheme is the first in the world to be interoperable in a region as large as SEPA and is a response to European customer needs for faster payments. It will be a turning point in making pan-European instant credit transfers in euro a reality.”, according to the press release.

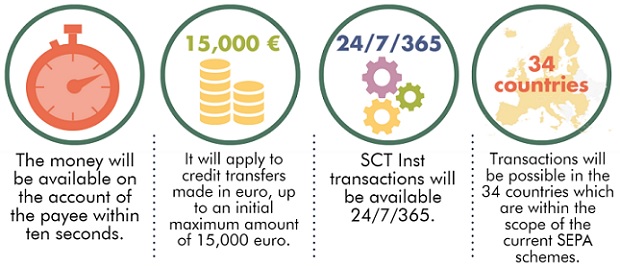

Set to launch in late 2017, the Sepa Instant Credit Transfer (SCT Inst) scheme promises to enable people to transfer up to EUR15,000 within 10 seconds, 24/7/365, across borders between accounts in any of 34 Sepa countries.

Javier Santamaría, chair, EPC, says: „The new scheme will be a turning point in making pan-European instant credit transfers in euro a reality. We look forward to the participation of all PSPs and technical players in the public consultation for this project, which will be the first of its kind in a region as large as Sepa.”

All payment stakeholders including Payment Service Providers (PSPs), as well as end users and technical players are encouraged to participate in the three-month public consultation, designed to ensure that the scheme reflects market needs.

The EPC says that SCT Inst transactions will be convenient for customers needing to send money across Europe quickly, and will further push cash to the edges, proving useful for things such as paying bills on the spot.

What are some of the convenient use cases of SCT Inst payments?

Key features of the optional SCT Inst scheme:

. The geographical scope of the scheme spans across the 34 countries which are within the scope of the current SEPA schemes.

. The scheme is based as much as possible on the existing SEPA Credit Transfer scheme and still includes many of its successful features. This has been designed to facilitate a faster and cheaper implementation for scheme participants.

. It applies to credit transfers made in euro, up to an initial maximum amount of 15,000 euro per transaction.

. The money will be available on the account of the payee within ten seconds.

. Individual scheme participants can agree bilaterally or multilaterally (e.g., within a specific SEPA country) on a lower maximum execution time and/or a higher maximum amount if they wish.

. All adhering scheme participants will have to be technically capable to process the SCT Inst transactions on a 24/7/365 basis.

The EPC will review the comments received during the public consultation, in close collaboration with stakeholder representatives.

The finalised scheme rulebook will be published by the EPC in November 2016 and will be implemented one year later. In November 2017, all live scheme participants will be ready to propose the first SCT Inst transaction solutions based on the finalised EPC SCT Inst scheme to their customers in Europe.

„The short period between the publication of the scheme and the first SCT Inst transactions demonstrates the payment industry’s confidence in PSPs to adapt well to customers’ needs, and quickly implement major changes.”, acording to the release.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: