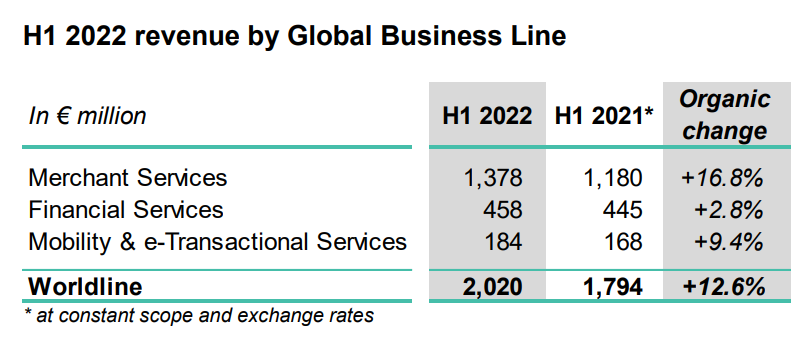

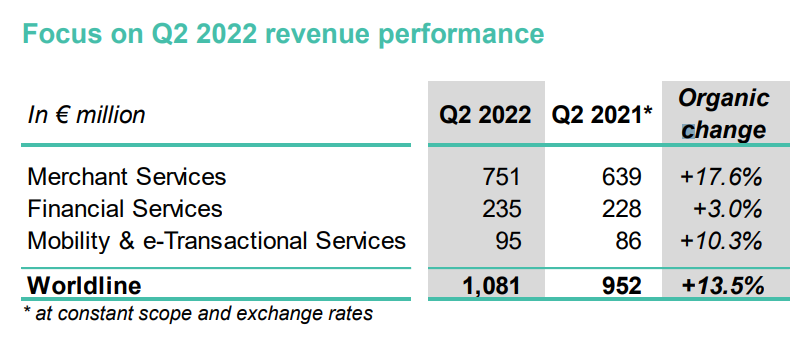

Worldline’s H1 2022 revenue reached € 2,020 million, representing a solid +12.6% revenue organic growth (of which +13.5% in Q2). „This achievement was reached thanks, in particular, to the continuous growth acceleration in Merchant Services reflecting the widespread and rapid shift towards digital payments as well as the Group’s strong positioning following the acquisition of Ingenico,” according to the press release.

Mobility & e-Transactional Services also contributed to growth acceleration, delivering a strong +10.3% organic growth in Q2 after having delivered +8.4% in Q1.

Worldline’s Q2 2022 revenue reached € 1,081 million, representing a strong +13.5% organic growth with all Global Business Lines contributing to growth acceleration.

Gilles Grapinet, Worldline’s CEO, said: “Worldline executed a very satisfactory first half of the year with a strong organic growth of 12.6%, accelerating again in Q2, confirming, 18 months after the start of the Ingenico integration, the power of our enhanced competitive positioning. This performance was, in particular, reached thanks to the very dynamic growth in Merchant Services with a steady expansion of acquiring volumes, a solid merchants count deployment, and numerous new large merchant wins and partnerships.

This strong business trends coupled with cost optimization plans, integration synergies and operating leverage, allowed the Group to deliver a 80 basis points margin expansion led, as planned, by a very significant improvement in Merchant Services profitability.

In parallel, we continued to execute our strategic initiatives during the semester with the closing of three acquisitions (Axepta Italy, ANZ commercial acquiring business in Australia, and Eurobank Merchant Acquiring in Greece) which will, from now on, significantly contribute to our Merchant Services success. The disposal process of TSS is fully on track, with closing confirmed for the second half of the year. This will provide Worldline with further financial flexibility to seize consolidation opportunities in our strong M&A pipeline.

Thanks to this very strong start of the year, we fully confirm our 2022 annual guidance, and reiterate our 2024 ambition to establish Worldline as a premium global Paytech at the heart of the European payment ecosystem.”

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: