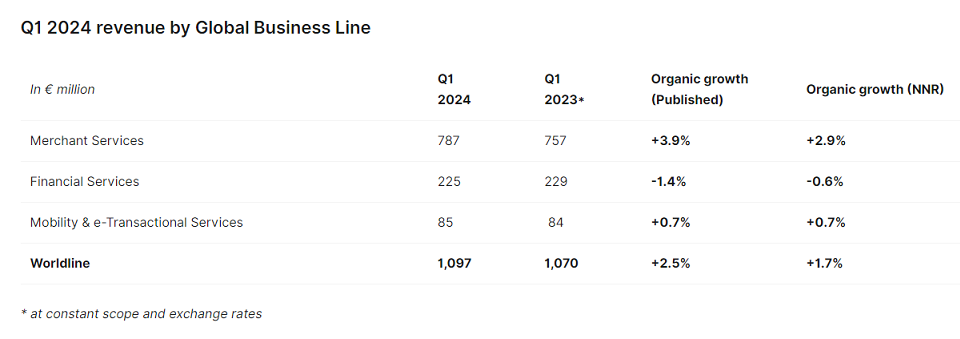

All 2024 objectives confirmed: organic revenue growth at least 3%, adjusted EBITDA at least €1.17bn, free cash-flow at least €230m. Worldline’s Q1 2024 revenue reached € 1,097 million, representing +2.5% organic growth, the company said in a press release.

Merchants Services division was resilient in the current macroeconomic context and termination of merchant contracts were slightly offset by the underlying growth of our acceptance activities, and the commercial momentum in Italy.

Financial Services division was impacted by low volumes in Account payments activity despite good underlying volumes in Acquiring and Issuing processing. Mobility & e-Transactional Services benefited from good dynamic in security and cryptographic solutions as well as ticketing volume increase.

Gilles Grapinet – CEO of Worldline, said: „Worldline is fully on track to meet its 2024 targets after posting 2.5% organic growth in the first quarter, supported by our Merchant Services activities posting a growth close to 4% despite a consumer spending context that remains soft. I am also satisfied by the solid and promising commercial developments achieved over the last months in terms of new contracts and partnerships, paving the way to our Merchant Services growth acceleration.

During the quarter, we continue to execute the immediate actions taken in 2023. Our Merchants’ termination process is now completed. Our accelerated transformation program Power24 is in full motion with reorganization already initiated in targeted countries, while social processes are progressing as per plan. It will reinforce Worldline competitiveness and structural mid-term profile, with full benefits expected in 2025.

We also reached significant milestones regarding our joint-venture with Crédit Agricole, after having received an unconditional agreement from the European Commission. We have now launched the JV, branded CAWL, headed by Meriem Echcherfi with a confirmed objective to go live early 2025. It is another key step in our strategic partnership with the Crédit Agricole in France, a highly promising market for Worldline.”

Merchant Services

Merchant Services’ revenue in Q1 2024 reached € 787 million, representing an organic growth of +3.9% (+6.5% excluding merchant termination). Despite good results achieved in the new markets addressed, such as Italy, the quarter was impacted by the continuously soft macro-economic context and the termination of some specific merchants’ contracts. The performance by division was the following:

. Commercial Acquiring: Soft growth impacted as expected by termination of merchant contracts, with a good underlying growth driven by commercial momentum in Italy and resilient activity in Switzerland.

. Payment Acceptance: Good performance led by Travel and Gaming transactional online volumes benefitting from the good ramp-up of contracts signed last year.

. Digital Services: Robust results thanks to sustained business in Germany and Türkiye.

Merchant Services growth profile should improve along the year with a progressive growth re-acceleration in the second half of the year due to a more normative comparison basis.

On the online cross-border, Worldline signed recently a strategic partnership with Lidio, one of Türkiye’s leading Fintech companies, to offer a direct access to local payment means, such as Troy cards, through domestic corridor. In addition, Worldline is the first online payment service provider authorized by the Turkish central for international payments. With this authorization and with the partnership with Lidio, Worldline will help global online businesses to gain competitive advantage in the $72bn Turkish expanding e-commerce market.

On the distribution side, Worldline reinforced its footprint in the fast-food industry with Tabesto, the order-taking and payment specialist. This ISV partnership will take place in 36 countries and will promote SoftPos Worldline Tap on Mobile technology to enhance ordering and payment kiosk experience.

During the first quarter, commercial activity in Merchant Services has been dynamic with many contracts signed, in particular in the EV charging industry, such as Electra, Road, Kempower, as well as in the Hospitality vertical (Preferred Hotels & Resorts), and in the Retail sector with ASDA.

Financial Services

Q1 2024 revenue reached € 225 million, implying -1.4% organic growth, despite a good dynamic in acquiring and issuing processing. The performance by division was the following:

. Card-based payment processing activities (Issuing Processing and Acquiring Processing): Good level of performance fueled by project activity, in particular with ING, and improved volumes in Belgium and the Netherlands.

. Digital Banking: Stable overall despite higher customer demand for Sanctions Securities and Monitoring solutions in Belgium and the Luxembourg.

. Account Payments: Activity was impacted by lower volumes in Germany and Italy, which were not offset by deliveries on EPC projects.

After a stabilization of the activity in H1, Financial Services should slow down in the second half with lower volumes on existing contracts and some re-insourcing processes, partially offset by improving commercial dynamics on fertilization projects.

On the commercial front, following the completed migration of Consorsbank’s Visa Card Portfolio and as a testament to the success of the migration, Financial Services signed several contracts extension with Consorsbank, a German brand of BNP Paribas, for Worldline’s issuing processing solution.

Mobility & e-Transactional Services

Mobility & e-Transactional Services revenue reached € 85 million, up +0.7% organically, driven by a good dynamic on our security and cryptographic solution as well as ticketing volume increase. The performance by division was the following:

. Trusted Services*: Good momentum driven by new sales of security hardware, additional licenses and business with our cryptographic solution for e-health in Germany.

. Transport & Mobility*: Significant performance led by project activity in rail industry and increased volumes on e-ticketing in the UK.

. Finally, Omnichannel interactions*: Solid pipeline but impacted by projects delivery delays in France.

Mobility & e-Transactional Services growth is expected to improve throughout the year.

In terms of business, Worldline secured a five-year contract renewal in the UK and Ireland with a large customer to continue to deliver data and customer information systems and application support services in the rail industry.

„We also continued to expand our full offering covering billing, invoicing and card management solution with a major integrated energy company. Meanwhile, in Germany, we signed an agreement with Secunet virtualizing and simplifying access to digital medicine and health services for doctors, nurses, pharmacists and all health professional in Germany through our Telematics Infrastructure Gateway.” the company added.

*New Go-to-Market organization

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: