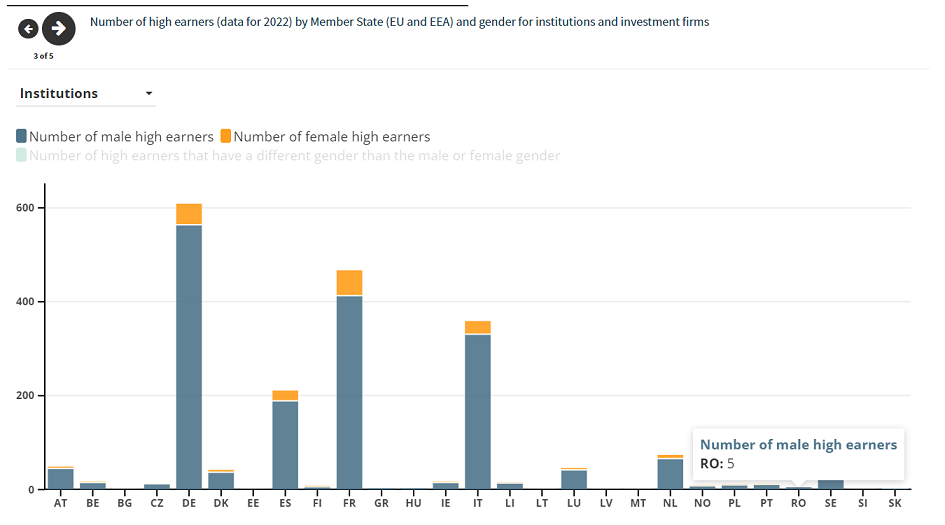

The EBA observes an increase of high earners working for EU banks (individuals who received a remuneration of +1 million euro) in the EU in 2022. Five of them are from Romania.

The European Banking Authority (EBA) published today its Report on high earners for 2022. The analysis reveals an increase of the number of individuals working for EU banks and investment firms who have received a remuneration of more than EUR 1 million. This increase is linked to the overall good performance of institutions, expansion of business and salaries adjusted for inflation.

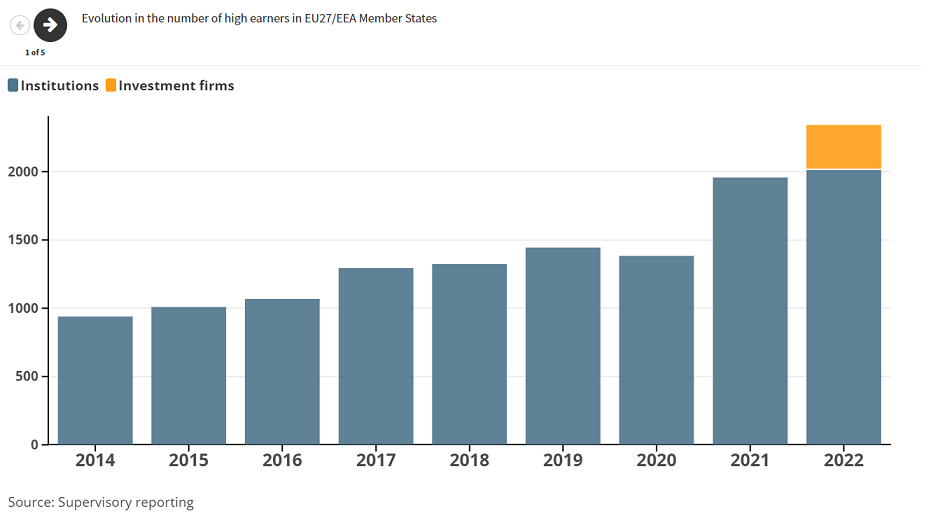

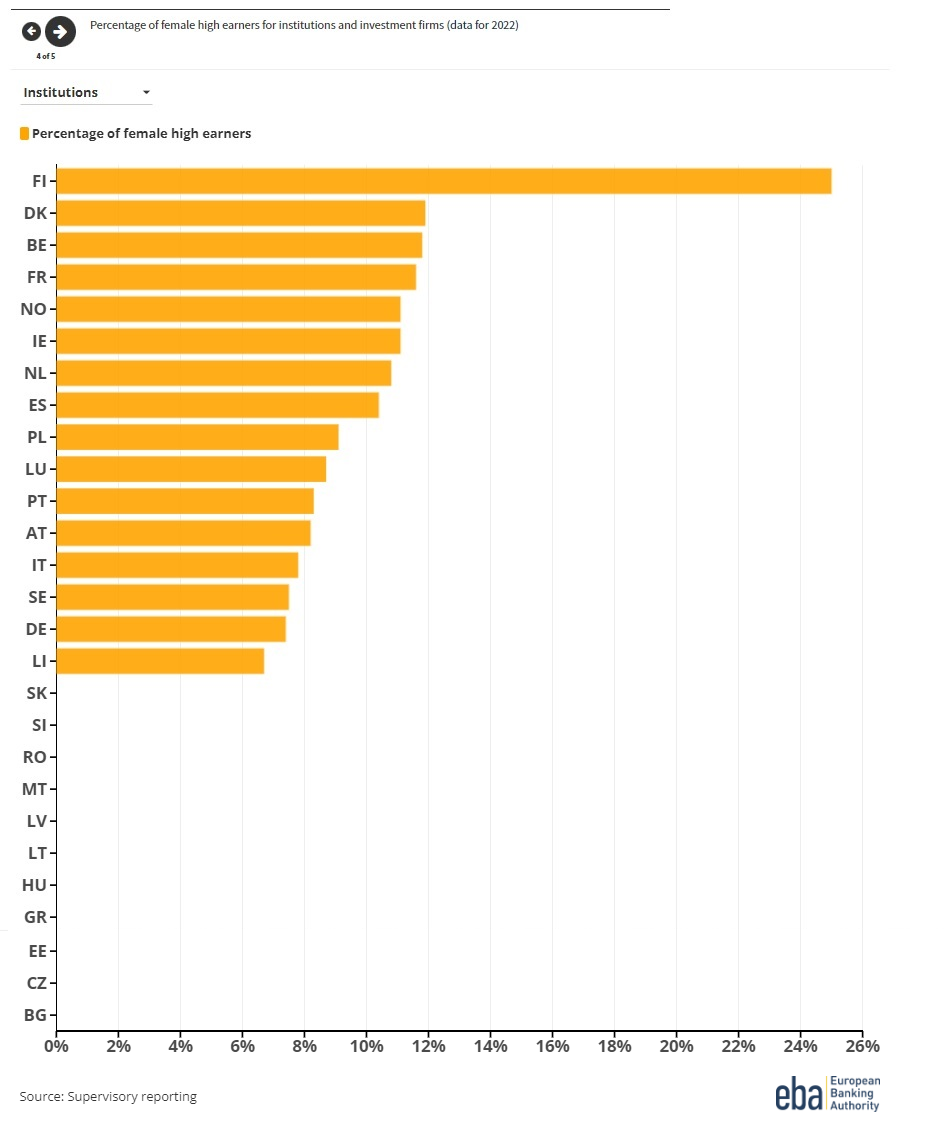

In 2022, the number of high earners receiving a remuneration of more than EUR 1 million increased by 19.7%, from 1 957 in 2021 to 2 342 in 2022. The EBA’s analysis also includes data on the gender distribution among high earners, highlighting a persistent gender imbalance within the financial sector, and particularly the highest paid positions.

The weighted average ratio of variable to fixed remuneration for all high earners of credit institutions stood at 85.3%, while it reached 489% for high earners of investment firms, for which the ratio between the variable and the fixed remuneration no longer applies as of 2021.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: