Wirecard enables integration of click and collect omnichannel payments – merchants who introduced the service reported a growth in online sales of up to 30%

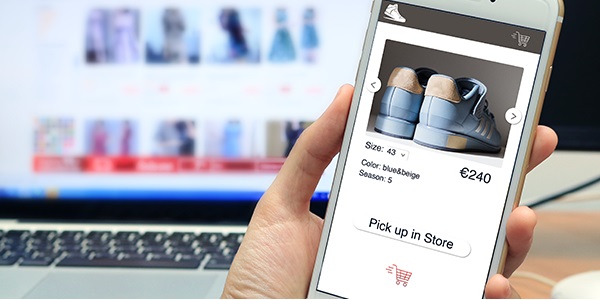

Wirecard, the global innovation leader in digital financial technology, today announced that it is making it even easier for merchants to take advantage of customer demand for true omnichannel purchase experiences by enabling click and collect via the Wirecard platform. Wirecard is thus expanding its ecosystem of real-time value added services around innovative digital payments and as a result helping retailers to significantly increase their average sales figures. Merchants who introduced click and collect services reported a growth in online sales of up to 30%.

The new click and collect solution aligns with current market trends. According to a recent UPS Global Pulse of the Online Shopper survey, 66% of consumers made an additional purchase when returning an item in-store.

“Retailers are having to use significantly more channels than in the past in order to meet their customers wherever they decide to make a purchase, whether that be via an e-commerce site, a mobile app or in-store,” said Sreelekha Sankar, EVP of Payment & Risk at Wirecard. “The Wirecard platform enables merchants to be able to support omnichannel use cases like click and collect. This means that retailers can provide a positive and seamless customer experience, a key factor for customer retention.”

While consumers have come to expect a seamless, unified purchasing experience regardless of the chosen location and method, it has been a challenge for merchants to merge the various channels behind the scenes. The Wirecard digital platform bridges this gap by channeling transactions from all entry channels to a single platform. This means that each transaction is assigned a unique reference ID so that retailers are able to accept payment on one channel and fulfill the purchase via another if the customer so chooses.

Wirecard recently outlined its Vision 2025, focusing on two key areas: firstly, accelerating convergence and enabling omnichannel commerce via one platform and secondly, developing innovative data-led value-added services, which are built around Wirecard Digital Payment Ecosystem and which lead to an improvement in the conversion rate.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: