Will the war on cash ever stop?

an article written by Chris Skinner, one of the most influential people in technology and a best-selling author

I’ve been writing about the war on cash for years. It’s a constant theme that comes up at conferences like SIBOS, and the first time I think I heard the phrase was a Visa presentation back in the 2000s. Back in 2012, I wrote about a Pew report that surveyed a range of experts about mobile wallets in 2020.

A majority of respondents supported the scenario that by 2020 most people will have embraced and fully adopted the use of smart-device swiping for purchases they make, nearly eliminating the need for cash or credit cards.

Nope.

After all, the war on cash is created by banks as cash is inefficient. It is paper-based, has to have huge logistics about its movements between corporations, institutions and banks, and is a pain in the ass compared to a quick digital swipe … for the provider.

For the user, cash is pretty good. It is immediate, trusted and holds its value. More specifically, it is anonymous and can be passed between people with immediacy. That’s why users – people – don’t want to lose access to cash.

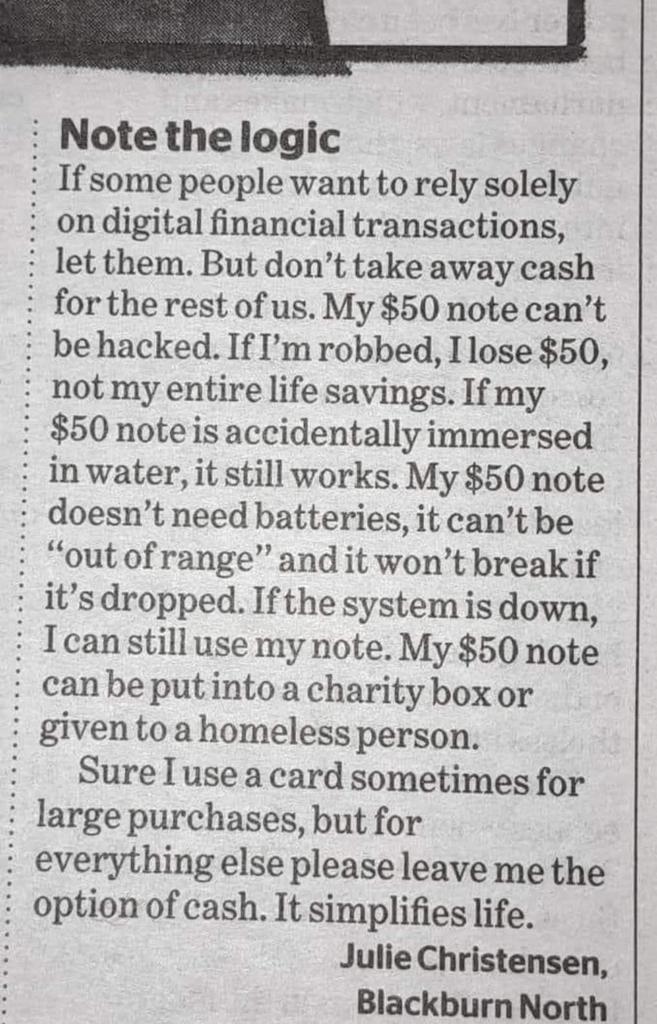

There are various stories about this, many appearing in my inbox in the last few weeks. For example, Julie from Blackburn sent a point of view to one of the national newspapers explaining why cash works best?

Her math is slightly out but, even so, you get the idea.

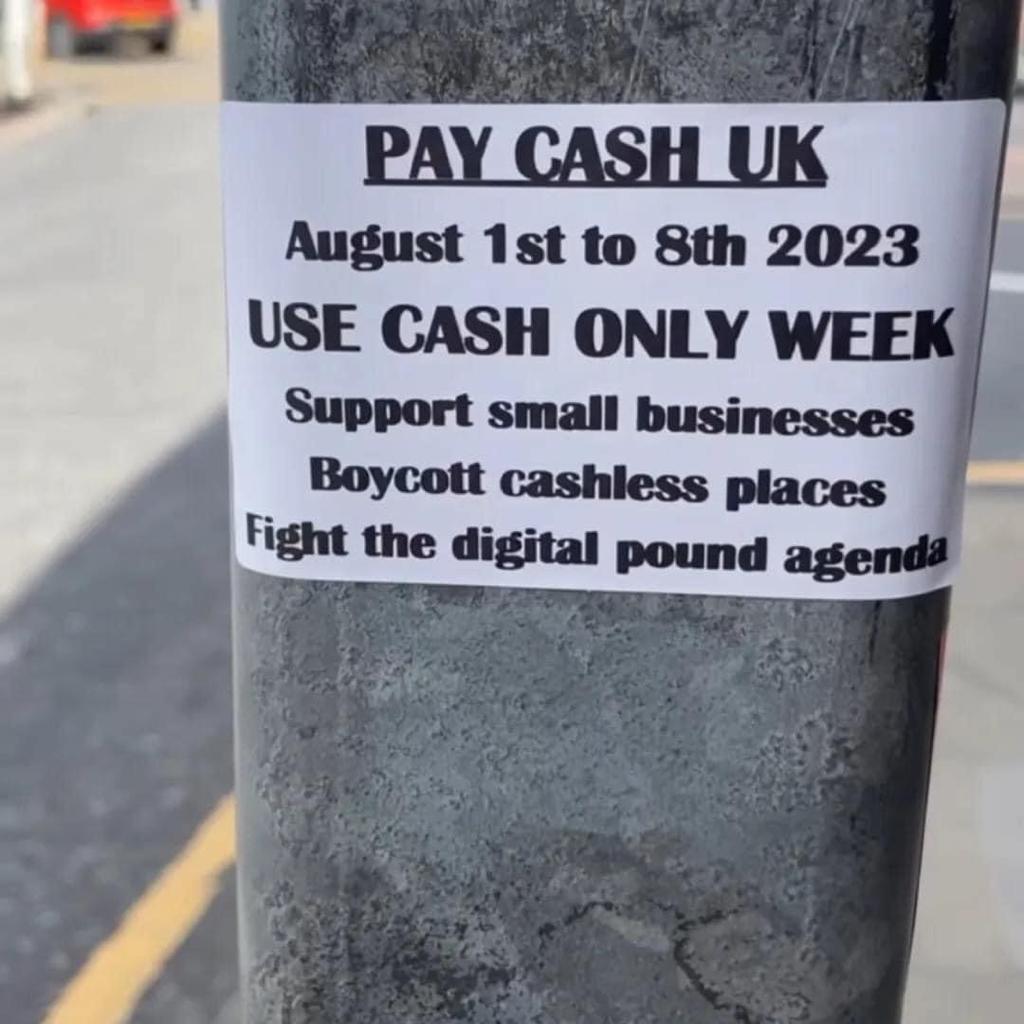

Then, whilst on a walkabout, I discovered that this week is being promoted as a national Cash Only Week.

It’s not been widely promoted – not a single news programme mentioned it – but it’s interested that consumers want to fight the digital pound agenda.

In fact, I then heard about a bank that tried to ban cash in their branches. They rolled out a test where only ATMs were available. No cash deposits or withdrawals allowed. During the three-month test, they had massive customer complaints and thousands of account closures. More importantly, staff did not support the idea and told customers that they should close their accounts if they were unhappy.

Unsurprisingly, the bank reversed the policy after the three-month test, and cash is still used wide and deep across the economy. I guess the question always comes back to: why? The answer is simple: there is no cash equivalent replacement.

Read the article in full here

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: