Visa, the Official Payment Technology Partner of FIFA, released spend data on Visa cards for all official FIFA World Cup™ venues from the start of tournament through group matches stage on December 2. According to the data, consumer spending (by value) at Qatar 2022™ is close to exceeding total spending for the entire FIFA World Cup 2018™ (89%) and has already exceeded total spending at FIFA World Cup 2014™ (192%). The data also revealed that 88% of Visa payments at official Qatar 2022™ venues have been contactless.

“For Qatar 2022™, Visa enabled more payment terminals in official venues than ever before and are trialing some innovative new ways to pay around Qatar, so paying for things can be less cumbersome and fans can stay in the moment and focus on the beautiful game.“ – said Dr. Saeeda Jaffar, Senior Vice President and Group Country Manager, Gulf Cooperation Council – Visa.

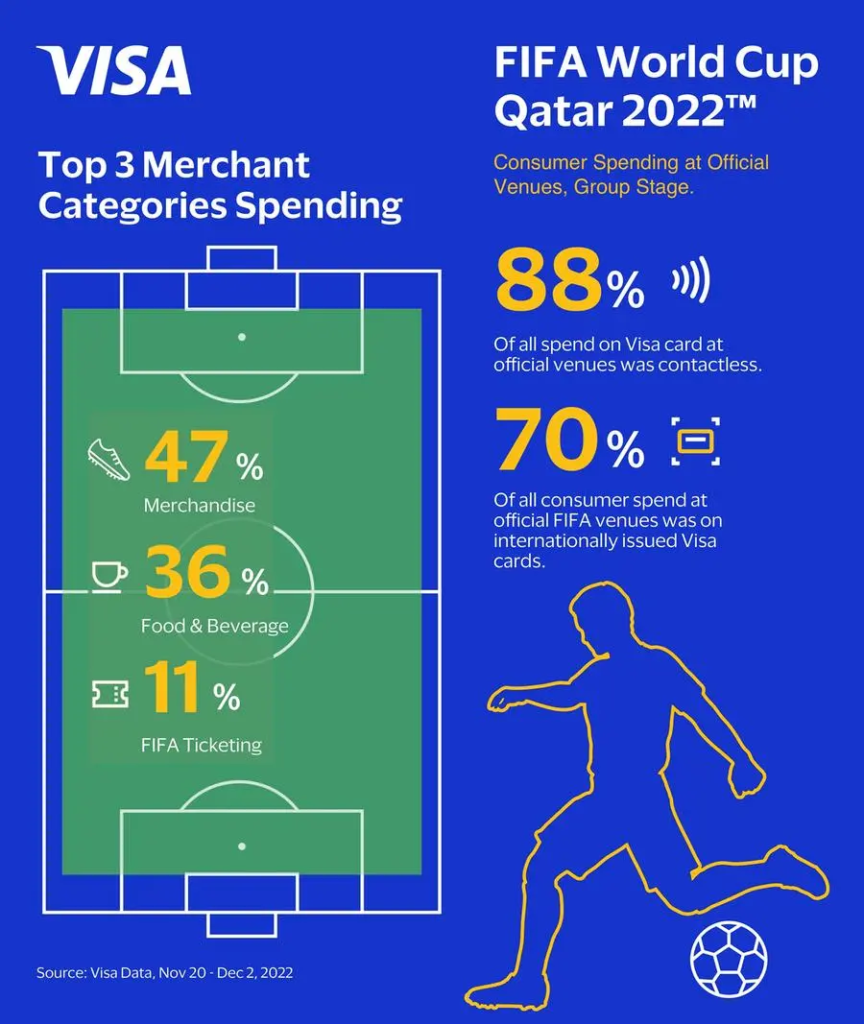

Official FIFA World Cup™ Spending Highlights for Group Stage:

Between kick-off on November 20 to the final group stage match on December 2, 70% of all consumer spend by value at official FIFA World Cup™ venues was on internationally issued Visa cards with the United States (18%) leading, followed by Mexico (9%) and KSA (8%).

In-stadium spend:

The average in-stadium transaction amount for all matches during the group stage of the tournament play was $23 USD. During all matches the top three spend categories were: Merchandise (47%), Food & Beverages (36%), and FIFA ticketing (11%).

Al Janoub stadium had the highest proportion of contactless payments (91%) and the match with the highest proportion of contactless payments was Poland vs KSA (96%).

Lusail Stadium led all stadiums for the total number of payment transactions during the group stage, with 22% of payment volume coming from Qatar-issued Visa cards vs 78% from international Visa cards.

Stadium 974 saw the highest average transaction amount ($25 USD), with $15 USD average total on food and beverage purchases, and $80 USD average on merchandise.

Per match spend:

Highest volume of in-stadium payment transactions was KSA vs Mexico match on November 30, followed by the Argentina vs Mexico match on November 26. Mexican cardholders spent almost four times more than Argentinian cardholders (29% and 8%, respectively) during the Argentina vs Mexico match.

The match with the highest average transaction amount was USA vs Iran on November 29 ($29 USD), with $14 USD average total on food and beverage purchases, and $89 USD average on merchandise.

Top 5 matches by spend:

KSA vs Mexico (Match 40; November 30): 5,1% from total spend

Argentina vs Mexico (Match 24; November 26): 4.7% from total spend

Cameroon vs Brazil (Match 48; December 2): 3,7% from total spend

Portugal vs Uruguay (Match 32; November 28): 3,6% from total spend

Qatar vs Ecuador (Match 1; November 20): 3,6% from total spend

For the FIFA World Cup Qatar 2022™ Visa is the exclusive payment technology partner in all stadiums where payment cards are accepted. At the more than 5,300 contactless payment terminals at FIFA’s official venues, fans can pay with Visa credit, debit or pre-loaded Visa gift cards available at any official Qatar 2022™ venue.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: