Visa Europe Report – high electronic payment usage goes to small shadow economy

Countries with high levels of electronic payment usage, such as UK and the Nordic countries, have smaller shadow economies than those with minimal level of electronic payments, such as Bulgaria, Romania and Greece, according to the latest Visa Europe Report. Professor Schneider’s research has found that increasing electronic payments by an average of 10 per cent annualy for at least four consecutive years can shrink the size of the shadow economy by up to 5 per cent.

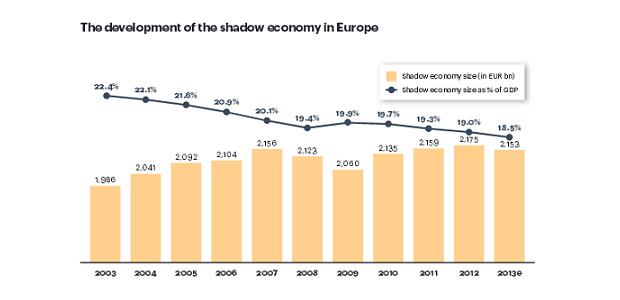

The Shadow Economy in Europe 2013 report estimates that ten percent (€200bn) of the shadow economy could be remedied through the use of electronic payments. In 2013, Europe’s shadow economy is set to be worth €2.1tr, or the equivalent of 18.5 percent of Europe’s economic activity. The scale of the shadow economy in Europe ranges from 8-10 percent of GDP in Switzerland, Austria, the Netherlands and the UK, through to nearly 30 percent of GDP in Bulgaria, Croatia, Romania and Estonia.

Poland and Sweden as an example

In 2010, a strategic initiative by the Visa Polska Executive Commitee aimed to double the size of Poland’s acceptance network. Financed by the Visa Polska’s members, the programme focused on expanding acceptance of both Visa and other systems’cards, along with terminal modernisation for medium-sized retailers in small towns and rural areas, where acceptance was limited. This „Visa cards accepted everywhere” initiative has been a huge success according to the author of the study. Since its start, more than 120,000 new terminals have been registered, most in predominantly cash-based industries with high sales underreporting, such as food and drink retailing, hotels, restaurants and catering.

Poland has also seens success in the growth of contactless payments, also attributed to the programmes’s implementation. The number of POS terminals capable of accepting payments by contactless cards and by smart phones with Visa payments applications is aproaching 40 per cent of all POS terminals in Poland and could top 50 per cent by the end of the year.

Poland is now second only to the UK in the number of contactless cards, which has transferred low-value payments from cash to cards. Since the launch of the „Visa cards accepted everywhwrw” programme, the shadow economy in Poland has dropped from 26% to 23,8% Undoubtedly, many factors are contributing to this decline, but the targeted effort to crack down on cash outside of large cities is certainly playing a significant role.

Meanwhile, Sweden – which introduced the world’s first banknotes in 1661 – has made significant move to abolish cash. Many bars do not accept cash; tickets are purchased with a text message or using contactless solutions, and a growing number of businesses only take cards. Of the 780 branches of the three leading banks, 530 no longer process or pay out in vcash.

Meanwhile, Sweden – which introduced the world’s first banknotes in 1661 – has made significant move to abolish cash. Many bars do not accept cash; tickets are purchased with a text message or using contactless solutions, and a growing number of businesses only take cards. Of the 780 branches of the three leading banks, 530 no longer process or pay out in vcash.

Since Sweden discontinued the 50 ore (Euro 0.06) coin in 2012 (having eliminated all lower denominations in previous years), the value of all cash and notes in Sweden has fallen below 3 per cent of GDP, well below the 7 per cent in the US, 10 per cent in Euro Zone, and 18.8 per cent in Japan.

Further more, the reduced amount of cash is making a dent in crime. According to the Swedish Bankers’ Association the number of bank robberies in Sweden plunged from 110 in 2008 to 16 in 2011, the lowest level since the association started keeping records 30 years ago; robberies of security vehicles have also dropped.

For more details download thew full report: The Shadow Economy in Europe 2013

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: