Since the start of the pandemic, credit card debt in the US has declined significantly. According to the Federal Reserve’s report, consumer revolving debt plummeted by $9.4 billion in August 2020. The total debt, which mostly consists of credit card balances, dipped to $985.3 billion at the time.

Based on the research data analyzed and published by Stock Apps, credit card balances during the month dropped by 11.3% on an annualized basis. In July, the drop was less steep, at 0.3% while in June, it was 2.0%.

However, prior to that there were massive drops, 28.6% in May and a whopping 65% in April. In March, there was a 28.2% drop after a 4.2% increase in February. In May, revolving consumer debt sank below $1 trillion for the first time since May 2011, during the Great Recession.

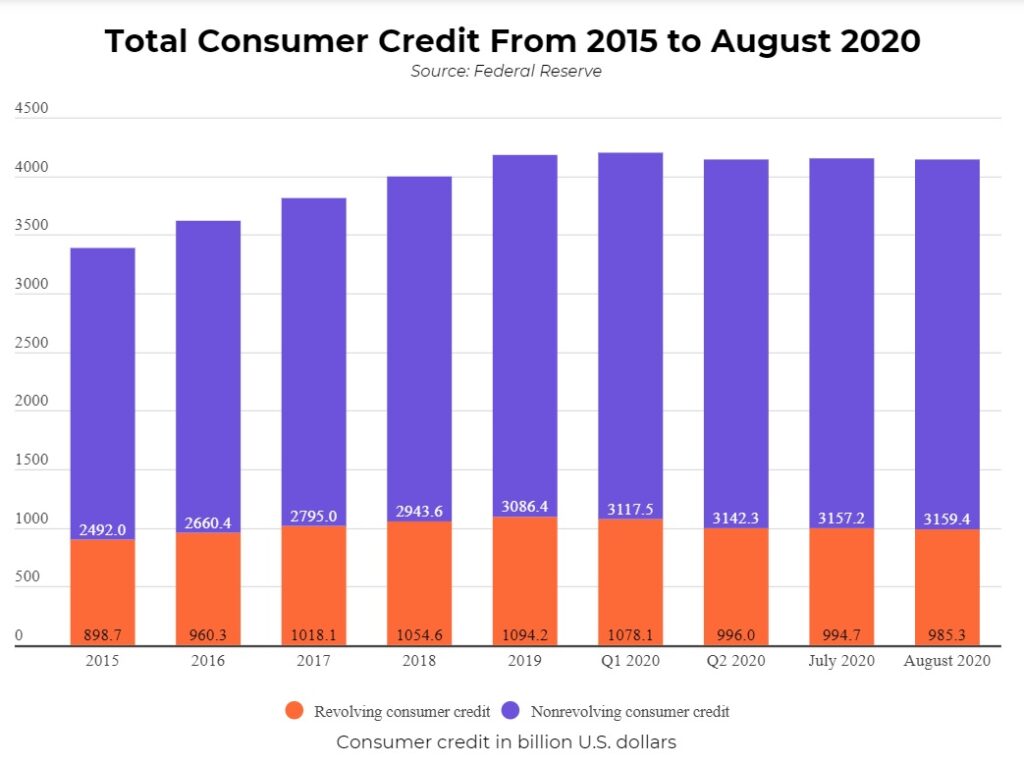

The Federal Reserve report revealed that the overall drop in consumer debt was 7.6% in Q1 2020, while in Q2 2020, it was 30.8%. In August, the total outstanding consumer debt (including auto and student loans and revolving debt), dropped by $7.2 billion to $4.14 trillion. That was a 2% decline on an annualized basis.

On the other hand, the average credit card interest was 14.58% in August, up from 14.52% in Q2 2020. For accounts with a credit card balance, the average interest rate in August was 16.43%, up from 15.78% in May.

It is noteworthy that since 2015, consumer revolving debt has always been on an uptrend. The percentage increase went from 5.7% in 2015 to 6.9% in 2016 and 6.0% in 2017. In 2018, it grew by 3.6% and for the whole of 2019, there was a 3.8% increase.

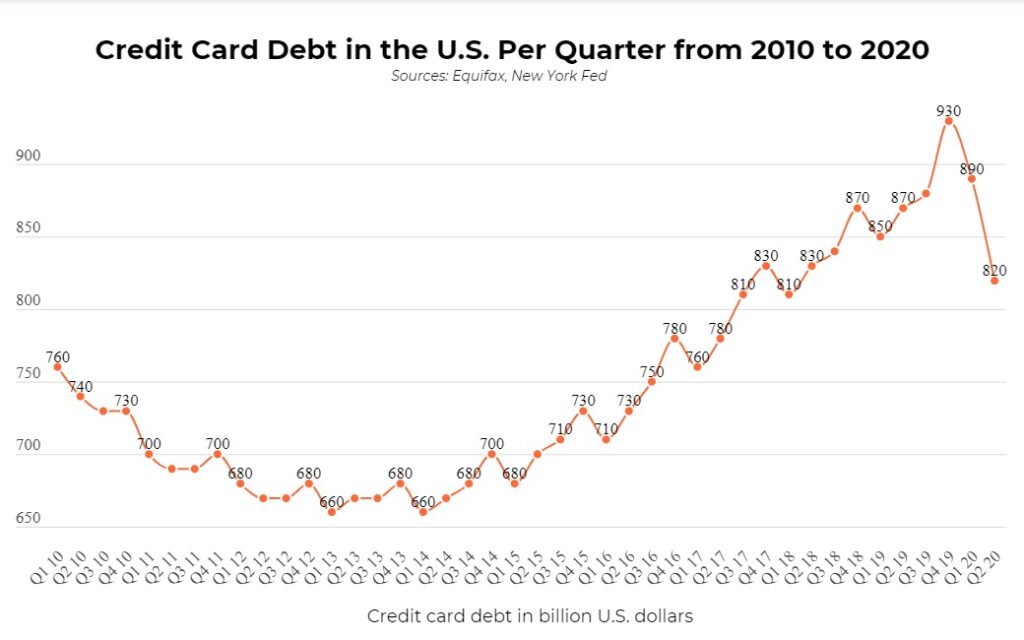

Similarly, according to data published by Equifax, there was no dramatic change to US credit card debt since 2014. It rose gradually from $660 billion in Q1 2014 to $930 billion in Q4 2019. But in Q1 2020, it plummeted to $890 billion, dropping further to around $820 billion in Q2 2020.

During Q2, the drop in credit card balances, which amounted to over $70 billion, was the steepest on record. According to New York Fed analysts, the only other time credit card debt fell during spring was during the Great Recession.

According to McKinsey, US credit card losses could reach $53 billion in 2020, up from $38 billion in 2019. The figure is expected to rise further to $59 billion in 2021, before dropping to $36 billion in 2022.

In the worst case scenario, it could go as high as $57 billion in 2020, more than doubling to $125 billion in 2021. That would see it drop to $72 billion in 2022.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: