UPS study: ”nearly three-quarters of European online shoppers buy from countries outside their own”

Online shoppers are more mobile, global and marketplace-driven: 71% bought from retailers outside their home country, 96% of online shoppers are purchasing on marketplaces and 43% of smartphone users purchased from their device, according to the 2017 UPS Europe Pulse of the Online Shopper™.

Seven in 10 European online shoppers bought items from retailers outside their home country, mainly because of better prices and the search for a specific brand or product. According to the 2017 UPS Europe Pulse of the Online Shopper™ study (1), this demonstrates not only opportunities for retailers that connect with customers in different geographies, but that retailers also need to provide a personalized, broad range of services to meet online shoppers’ expectations.

The study found that top considerations when purchasing from retailers in another country include: payment security (75 percent); clearly stating the total cost of the order including duties and fees (72 percent); a clear returns policy (63 percent); stating all prices in the shopper’s native currency (63 percent); and the speed of delivery (62 percent).

“The internet has made shopping truly global, enabling retailers to market and sell their products to customers worldwide. Our research shows that nearly three-quarters of European online shoppers buy from countries outside their own, so opportunity is rife for both small and large retailers looking to expand their businesses,” said Abhijit Saha, vice president of Marketing, UPS Europe. “At UPS, we’ve made it our mission to help them all do business across international borders just as easily as they do business across town.”

The UPS study also found that almost all European online shoppers (96 percent) bought on marketplaces, which are online platforms for third-party retailers. Of those, 67 percent cite better prices as a reason for purchasing on a marketplace instead of a retailer, and 43 percent cite a broader selection of products within any given category.

More than half (52 percent) of online shoppers in Europe consider the number of shipping options offered key when searching for and selecting products online, while 75 percent consider free return shipping important. Additionally, 63 percent of shoppers are interested in shipping to an alternative location with extended hours, if fees are less than shipping to their home.

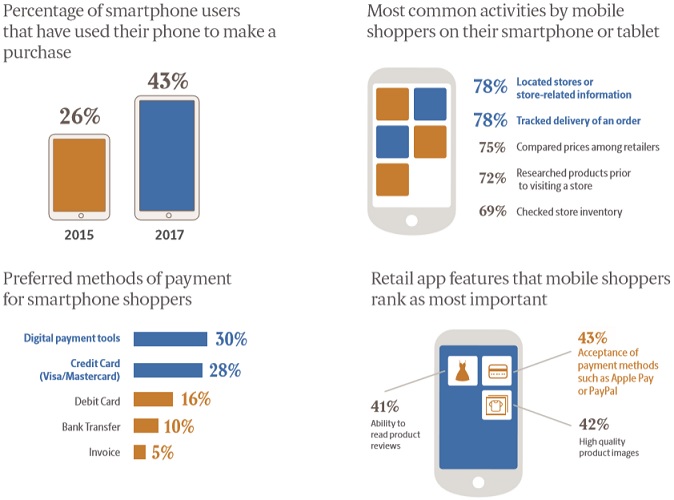

Retailers need to think “mobile first” as the use of smartphones for making purchases proliferates. According to the study, 43 percent of smartphone users purchased from their device. Shoppers use their mobile devices for a variety of other shopping-related tasks, including to locate stores or store-related information (78 percent), track orders (78 percent), and compare prices among retailers (75 percent).

(1) Based on a survey of more than 6,400 online shoppers in France, Germany, Italy, Poland, Spain, and the UK.

About the UPS Pulse of the Online Shopper™

The UPS Pulse of the Online Shopper Study evaluates consumer shopping habits from pre-purchase to post-delivery. The 2017 study is based on a comScore survey of more than 6,400 European online shoppers in six countries (France, Germany, Italy, Poland, Spain, and the UK).

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: