The registration for the SEPA Instant Credit Transfer scheme is now open

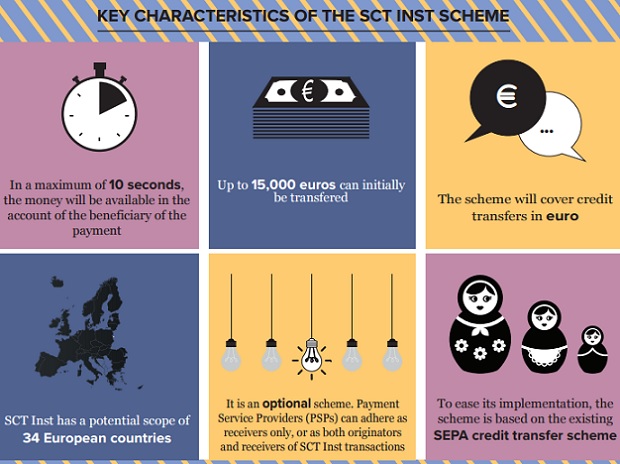

Starting with 19.01.2017, Payment Service Providers (PSPs) can apply for adherence to the SEPA Instant Credit Transfer (SCT Inst) scheme, which will become effective in November 2017.

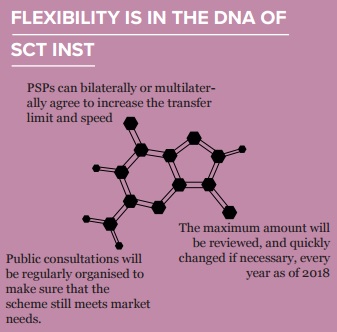

The SCT Inst scheme (published in November last year) will enable the transfer of initially up to 15,000 euro per single transaction in less than ten seconds, any time and any day, and in an international area that will progressively span over 34 European countries.

Payments will become increasingly faster, easier, and more accessible through the development of mobile and digital devices. The EPC encourages all PSPs to rapidly board the instant payments train, and to adhere to the SCT Inst scheme as soon as possible.

If you wish to learn more about the SCT Inst scheme, view this short video

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: