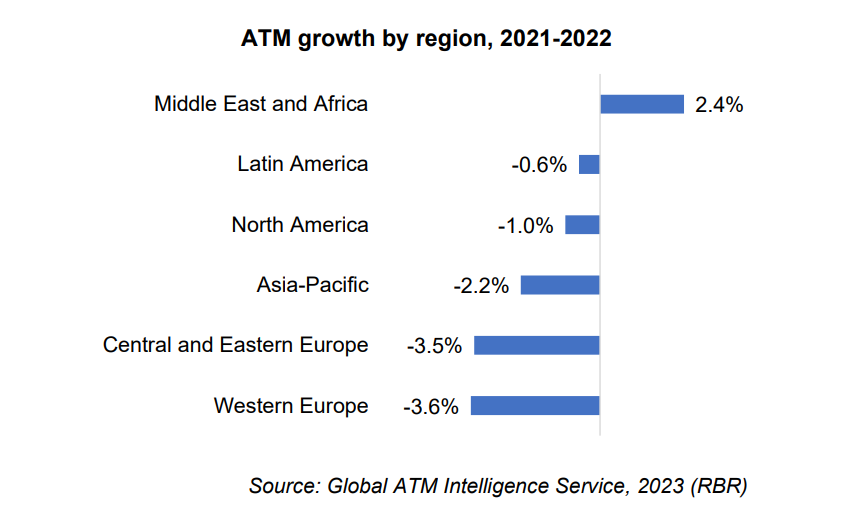

Reduction in ATM deployment worldwide disguises more positive outlook in majority of markets.

New research from RBR’s Global ATM Intelligence Service shows that the number of ATMs installed

worldwide fell by 2% in 2022 to stand at 3.0 million. The comprehensive market report and database

reveals that the rate of decline has gradually decreased since 2020, as the impact of COVID-19 has

receded. 2022 marked a return to relative normality, with the last pandemic restrictions typically being lifted in countries where they had remained in place.

Under these more favourable conditions, the ATM market grew in more than half of the 180 countries analysed in the research, with many seeing growth either return or accelerate. As a result, the number of ATMs has now reached or surpassed pre-pandemic levels in the majority of markets.

In the Middle East and Africa (MEA), the expansion of certain markets was enough to offset the decline in others, and the regional total grew by over 5,000 terminals. Particularly high growth was observed in Egypt, where the government has capitalised on the post-pandemic situation by launching several financial inclusion initiatives, with increased ATM provision being a top priority.

Bank branch closures drive market contraction

With banks worldwide promoting alternative channels, and customers demonstrating a growing preference for digital banking, branches are being shuttered increasingly rapidly, and ATMs in these locations usually removed. While the number of off-site ATMs increased slightly in 2022, over 65,000 machines were withdrawn from bank branches.

Asia-Pacific accounted for well over half of this fall, with the decline in branch ATMs being driven by China, the region’s largest market. The country’s ‘Big Five’ banks have been investing heavily in selfservice and digital channels, while closing low-footfall branches and removing associated ATMs.

Financial inclusion efforts to underpin new deployment

RBR forecasts that global ATM numbers will continue to fall until end-2028, leaving around 2.9 million machines. Amid ongoing bank branch closures and uptake of cashless payment methods, many markets around the world are expected to see their ATM provision decrease, with Asia-Pacific continuing to see the highest number of machines removed.

The rate of decline is forecast to continue slowing, however, and in two regions, ATM numbers will increase. Latin America is expected to experience modest growth, but it is MEA that is projected to contribute the majority of new ATMs. Most of the region’s markets are forecast to expand, with increased deployment often perceived as a key tool in efforts to widen financial inclusion and improve access to banking services.

Mandy Eagle, who led RBR’s research, remarked: “While ATM usage is down on a global level, the decline is by no means universal, with a significant number of markets expected to continue growing. There are segments of the population for which access to cash remains vital, and this is sustaining the demand for ATMs in many parts of the world”.

____________

These figures and insights are based on the 2023 market report and database from RBR’s Global ATM Intelligence Service. RBR is a strategic research and consulting firm with three decades of experience in banking and retail technology, cards and payments.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: