Starling is among the UK’s fastest-growing banks. Since launching in 2017, it has opened more than two million accounts, including more than 300,000 small business accounts.

Starling, the leading UK digital bank, announces a £272 million Series D funding round led by Fidelity Management & Research Company (Fidelity), alongside Qatar Investment Authority (QIA), RPMI Railpen (Railpen), the investment manager for the £31 billion Railways Pension Scheme, and the global investment firm Millennium Management. The new investment values the company at £1.1 billion pre-money.

Starling’s total gross lending now exceeds £2 billion, while deposits top £5.4 billion. Starling was voted Best British Bank in 2018, 2019 and 2020 and topped the Which? customer satisfaction table for 2020.

The new funding announced today will support Starling’s continued rapid and now profitable growth. The capital will be deployed primarily to support a targeted expansion of Starling’s lending in the UK, as well as to launch Starling in Europe and for anticipated M&A.

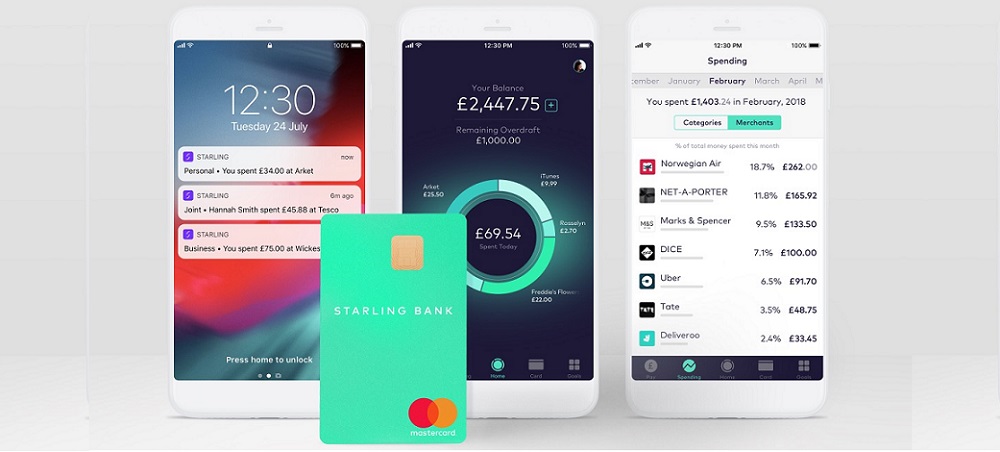

Anne Boden, founder and CEO of Starling Bank, said: “Digital banking has reached a tipping point. Customers now expect a fairer, smarter and more human alternative to the banks of the past and that is what we are giving them at Starling as we continue to grow and add new products and services. Our new investors will bring a wealth of experience as we enter the next stage of growth, while the continued support of our existing backers represents a huge vote of confidence.”

The announcement comes as Starling booked its fourth successive month in profit. Starling is on course to report its first full year in profit by the end of its next financial year-end.

January 2021 trading update

Starling generated a total revenue of £12 million in January 2021, which represents an annualised revenue run rate of c.£145 million and an increase of approximately 400% compared to January 2020.

Gross operating costs remain broadly flat with account numbers having almost doubled year-on-year to more than two million.

Starling generated a positive operating profit for a fourth consecutive month, with net income now exceeding £1.5 million per month.

Starling continues to see strong growth in customer deposits, with deposits now exceeding £5.4 billion and total gross lending exceeding £2 billion.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: