In 2022 Q2 alone, the number of merchants accepting payments via the Faster Payments System (FPS) increased by half. The amount of purchases paid for by people in the FPS doubled over this period. The FPS is a service that lets individuals make instant (24/7) interbank transfers to themselves or other persons using a mobile phone number.

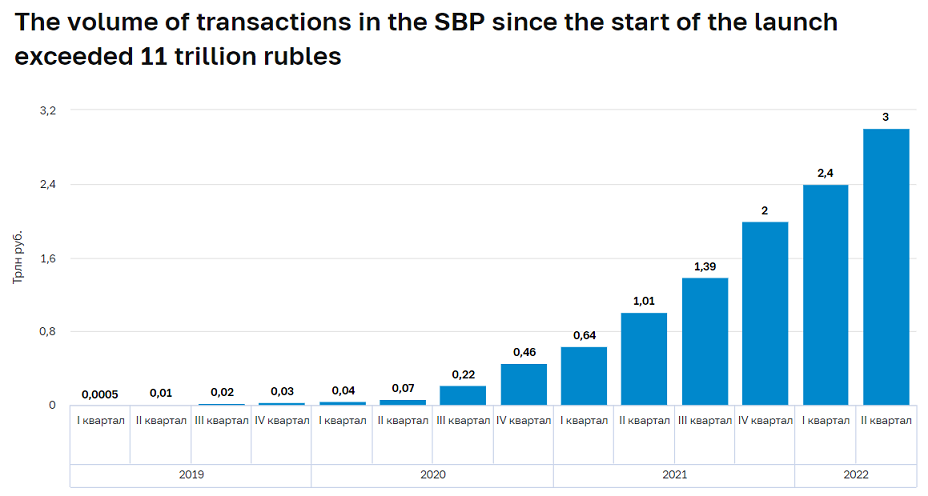

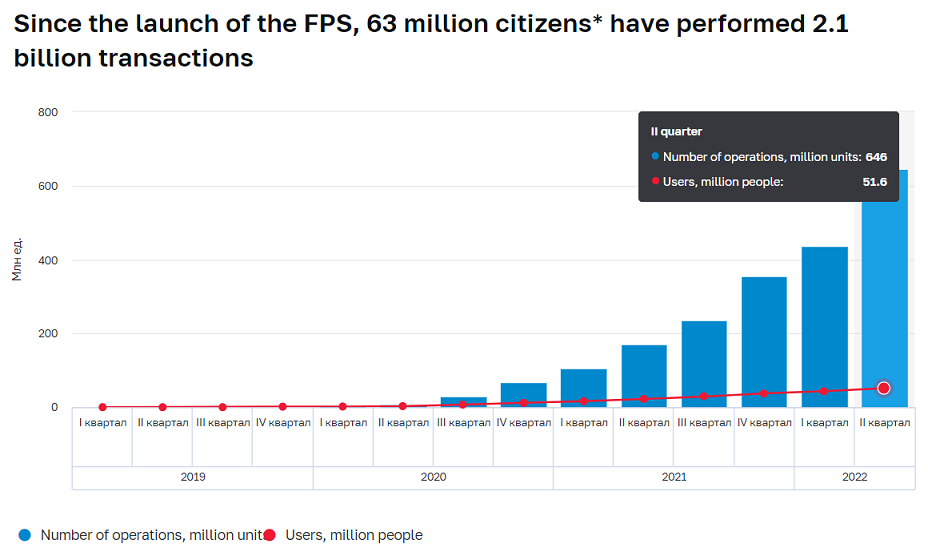

In the second quarter of 2022, citizens conducted transactions through the FPS for a total of 3 trillion rubles, which is 3 times higher than in the same period last year. At the same time, in the first half of 2022, more than 1 billion transactions worth 5.4 trillion rubles were completed in the FPS, which exceeds the same figures for the entire 2021. 211 banks are connected to the system.

On average, in the second quarter of 2022, one user made about 13 transactions in the FPS, while in the first quarter this figure was 10.

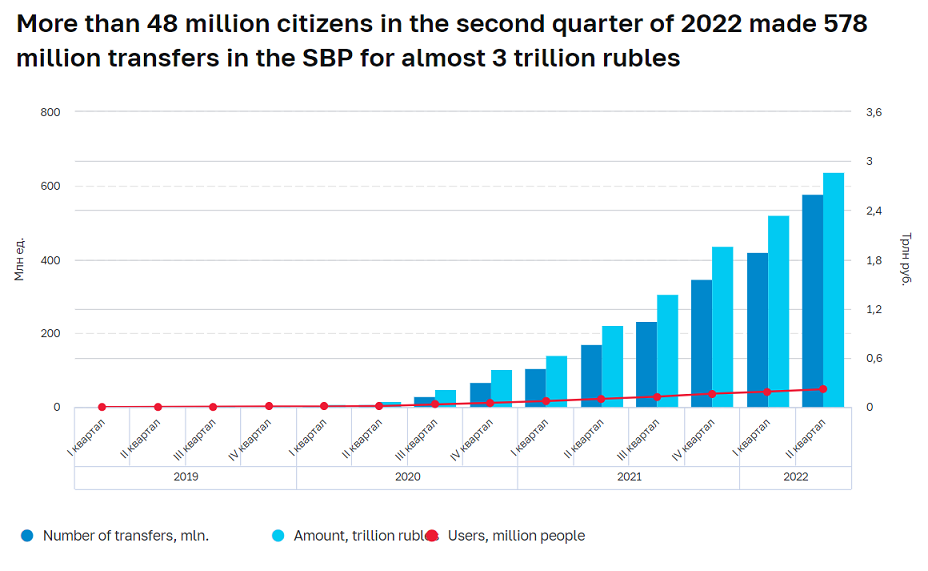

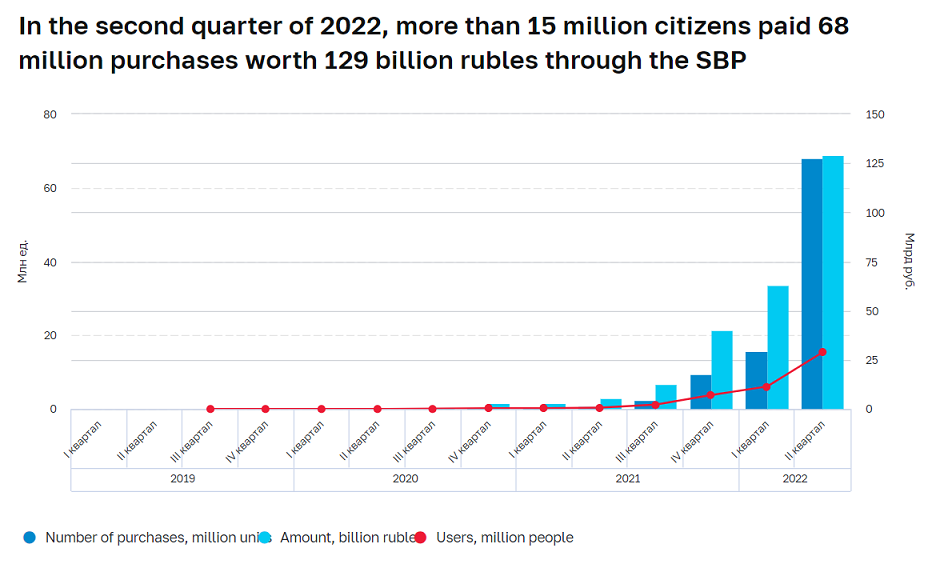

The number and amount of transfers made through the SBP by citizens in the second quarter of 2022 increased compared to the previous quarter by 38% and 23%, respectively.

During the reporting period, the number and amount of purchases of goods and services made in the SBP increased by 4 and 2 times compared to the previous quarter, respectively. On average, one buyer paid more than four purchases through the FPS, which is 2 times more than in previous periods.

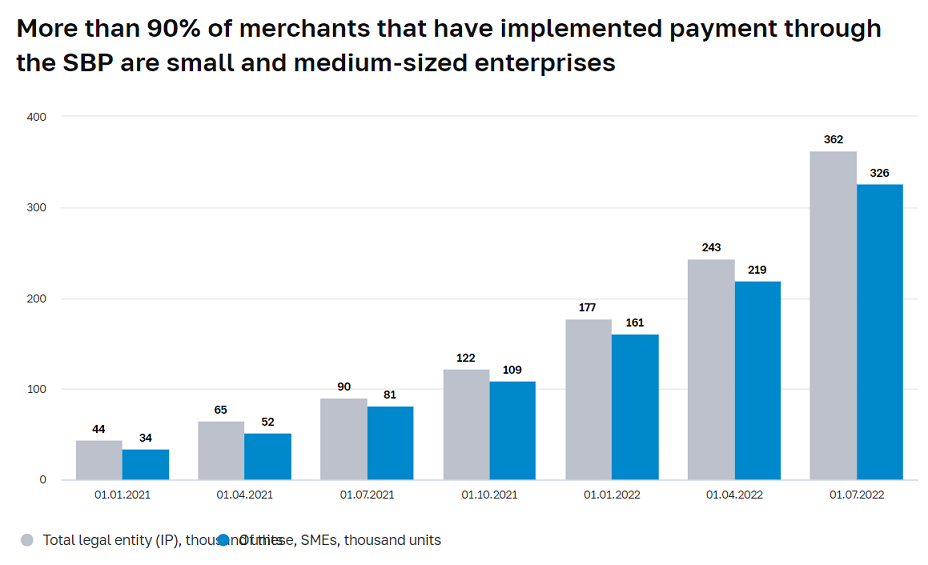

The number of trade and service enterprises (TSEs) accepting payment through the SBP increased almost 1.5 times compared to the previous quarter, to 362,000.

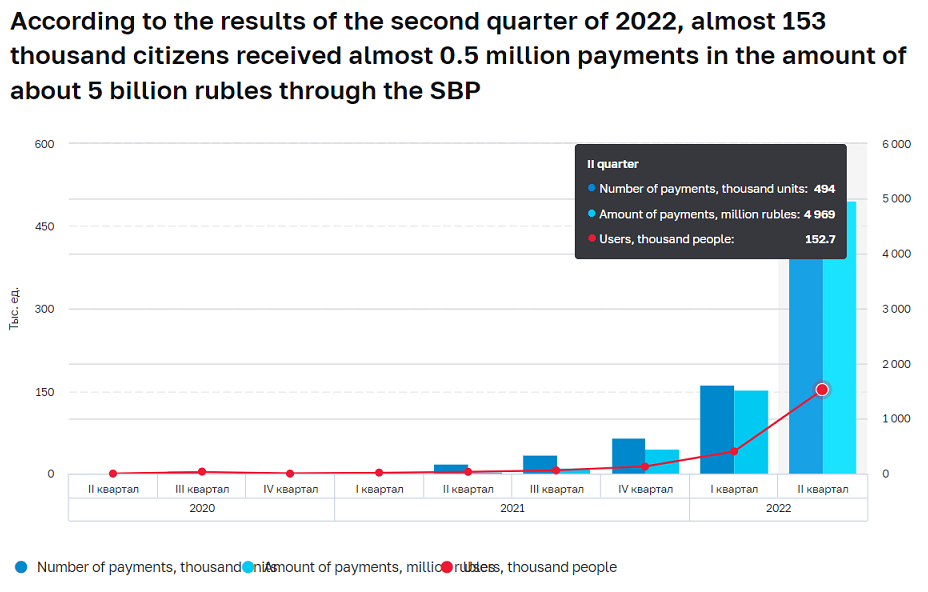

The demand for the service of transfers of legal entities to citizens continues to grow (for example, insurance payments, from brokers, and others). The number and amount of such payments in the SBP increased 3 times compared to the same indicators in the first quarter.

_____________

The Faster Payments System (FPS) is a service that lets individuals make instant (24/7) interbank transfers to themselves or other persons using a mobile phone number. The banks need to be connected to the FPS.

Customers can access the system via smartphone, tablet or PC using the mobile applications of banks connected to the FPS. In order to make an instant transfer, customers should select the account from which the payment will be made in the FPS Transfer section of their bank’s application and indicate the payee’s mobile phone number and the amount. After the payer has confirmed the transaction, funds are transferred and become available to the payee within seconds.

The Faster Payments System was jointly developed by the Bank of Russia and the National Payment Card System. It was launched and has been in commercial use since 28 January 2019.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: