The Report identifies topical issues including irresponsible lending, creditworthiness assessments, and digitalisation, which the EBA has very recently addressed, as well as others, such as selling practices and access to bank account, which it has recently started to work on. The Report also explains the measures the EBA has taken to mitigate the impact of the COVID-19 pandemic on consumers, according to the press release.

In this Report, the EBA observed that mortgages continue to have a big impact on consumers’ personal finances, representing 79% of loans to households. During the same period, the volume of consumer credit has increased by 14%, and that of deposits by 14.6%.

In both mortgages and consumer credit, the impact of the COVID-19 pandemic has led to a heightened engagement between lenders and borrowers with a focus on the use of moratoria and government guarantees. The EBA has supported such initiatives, with the aim of supporting the short-term operational and liquidity challenges faced by borrowers.

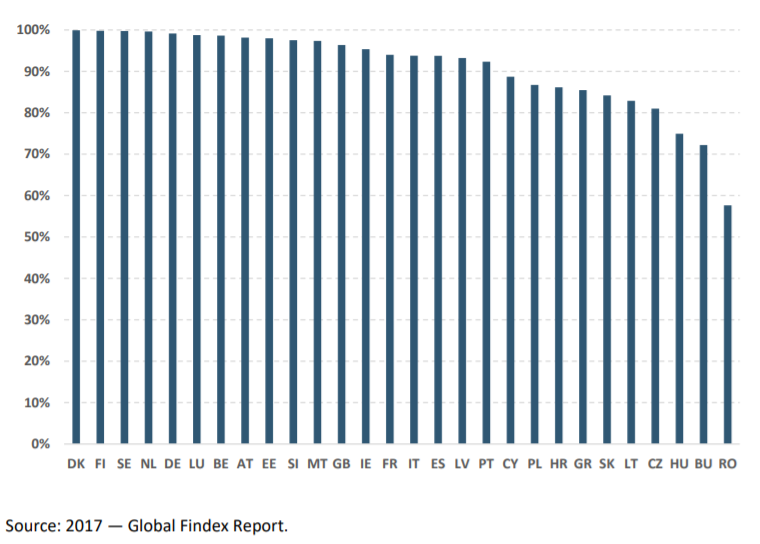

The Report also observes that the number of people holding a payment account within the EU has further increased and now covers a significant percentage of the EU population. However, issues have emerged regarding the impact of “de-risking” on customers who are denied access to such accounts.

Access to bank accounts appears as topical issue for the first time in the CTR 2020/21. It has been identified as relevant to consumers by a large number of stakeholders.

Percentage of the population aged 15 years or over holding a payment account in the EU (from 57% in Romania to 99% in Nordic countries)

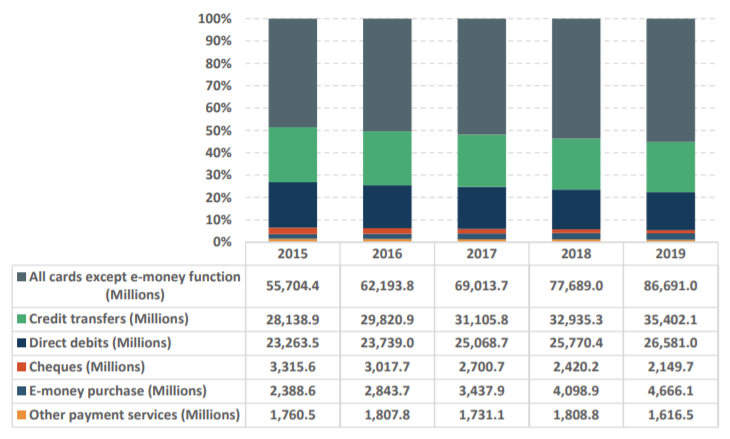

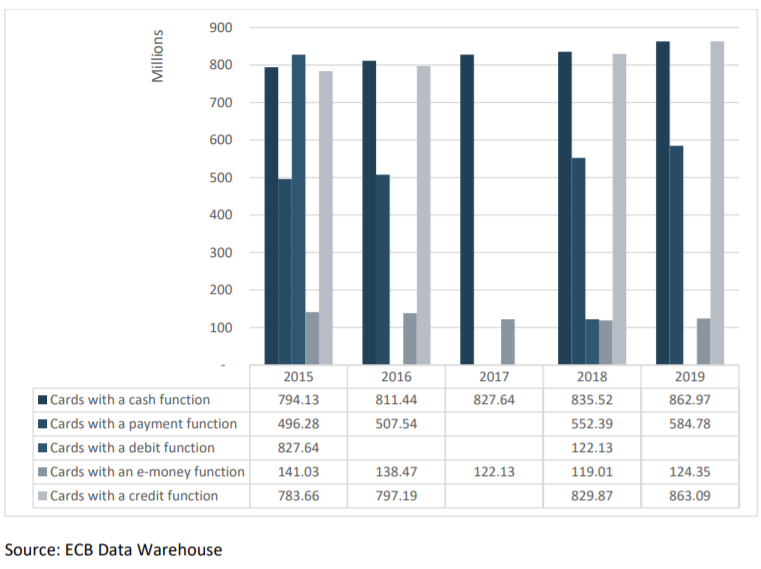

Regarding payment services, payment cards continue to be the most widely used payment instrument in the EU. The Report observes an increase in the use of contactless payments during the COVID-19 pandemic, which the EBA facilitated by calling on payment services providers to facilitate contactless payments, including by increasing the limit closer to the EUR50 threshold allowed under EU law.

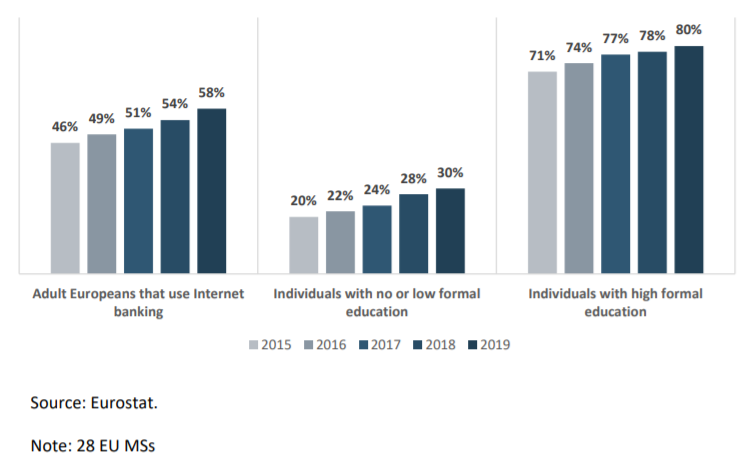

Percentage of Europeans that use internet banking, by type of individual

This Report is based on information provided by the national authorities of the 27 EU Member States, national and EU consumer associations, the members of the ‘Financial Dispute Resolution Network’ and EU industry associations. The Report also assesses quantitative data from the European Central Bank and the World Bank.

Total number of payments per type of payment service (millions)

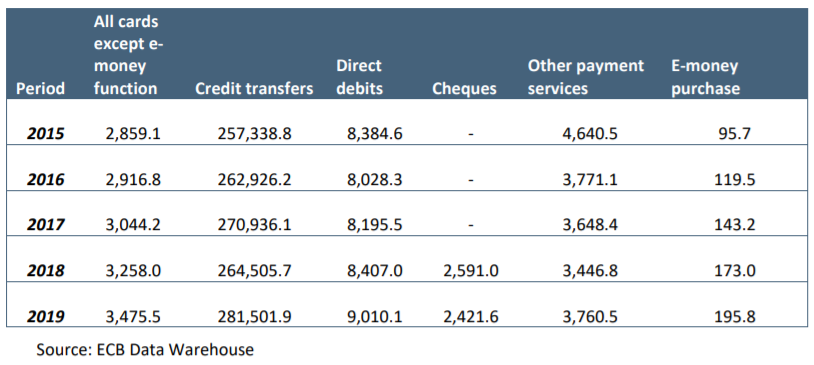

Total value of payments per type of payment instrument (billion Euro)

Number of cards issued by resident payment service provider

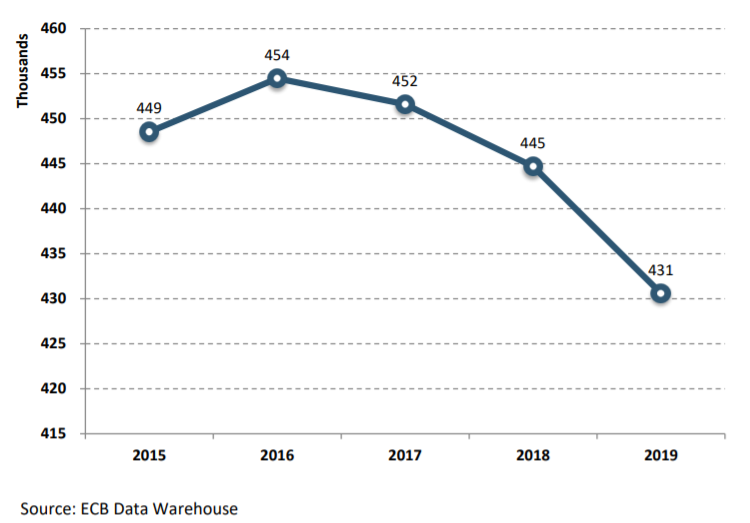

Total number of ATMs provided by resident PSPs

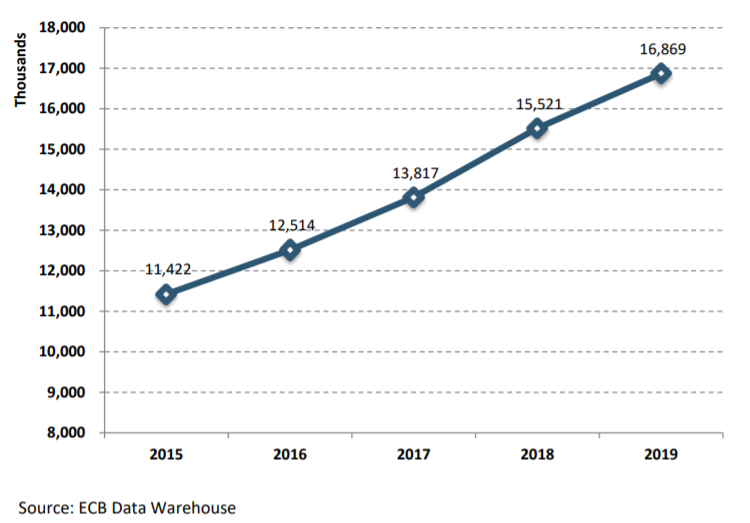

Total number of POS terminals provided by resident PSPs

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: