The world’s central banks are stepping up efforts to prepare the ground for central bank digital currencies (CBDCs) either as digital cash (retail) or tokenised reserves (wholesale). This report shows how the BIS Innovation Hub is helping central banks on their CBDC journeys and discusses the lessons learnt so far.

The Innovation Hub has conducted 12 CBDC projects that cover retail and wholesale, both in a domestic and cross-border context. For domestic use cases, two projects investigate wholesale CBDC (wCBDC) and five look at retail CBDC (rCBDC). Across borders, four experiments look at wCBDC and one looks at rCBDC. For each category, the key insights and lessons learnt are presented from the perspectives of desirability, feasibility and viability.

For the different types of CBDC the report finds:

Wholesale CBDCs will be driven by the public and private sector’s quest to shape the future of trading and settlement.

A retail CBDC is a complex undertaking, and not only for the central banks. The Hub’s projects focus on individual aspects to shed light on these complexities. In particular, they are experimenting with (i) the most promising CBDC model, a two-tier model with public-private partnership; (ii) the most fundamental feature, privacy, and (iii) the greatest challenge, cyber security.

Cross-border CBDC arrangements are novel territory, and more complicated than their domestic counterparts. Common platforms are likely to have more upside and bring potential operational efficiencies compared with current arrangements but hub-and-spoke designs provide more flexibility for domestic systems and are thus easier to contemplate at least in the short run. By leveraging new technologies, central banks can provide new solutions to many „old” operational challenges and policy questions.

Overview of experiments

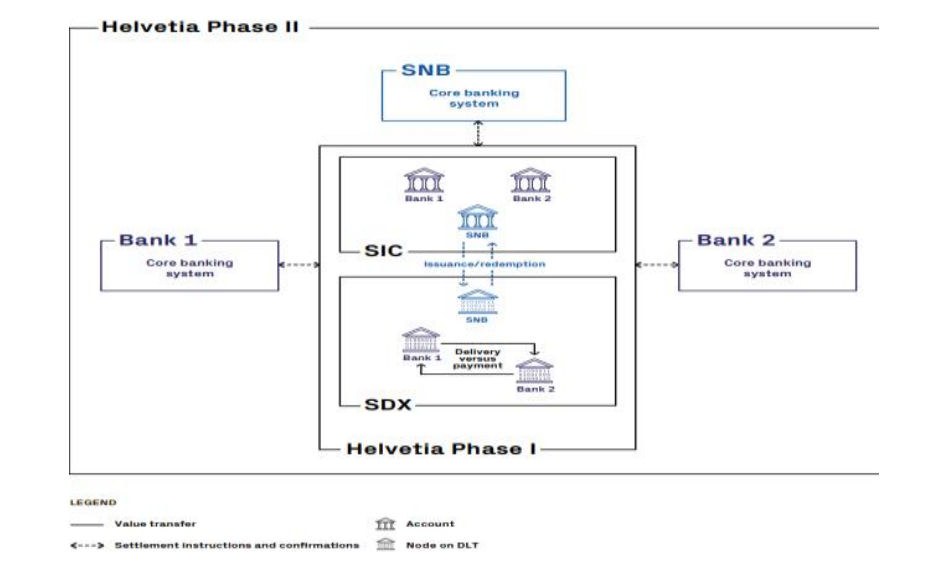

Project Helvetia, together with the BIS Innovation Hub Swiss Centre, the Swiss National Bank and the financial infrastructure operator SIX, explored how central banks could offer settlement in central bank money with more tokenised financial assets based on DLT, focusing on operational, legal and policy questions in two phases. Phase I built on the test environments of the Swiss real-time gross settlement system and SIX Digital Exchange (SDX), a platform for the trading and settlement of tokenised assets. Phase II expanded on the work carried out in Phase I by (i) adding commercial banks to the experiment; (ii) integrating wholesale CBDC into the core banking systems of the central bank and commercial banks; and (iii) running transactions from end to end.

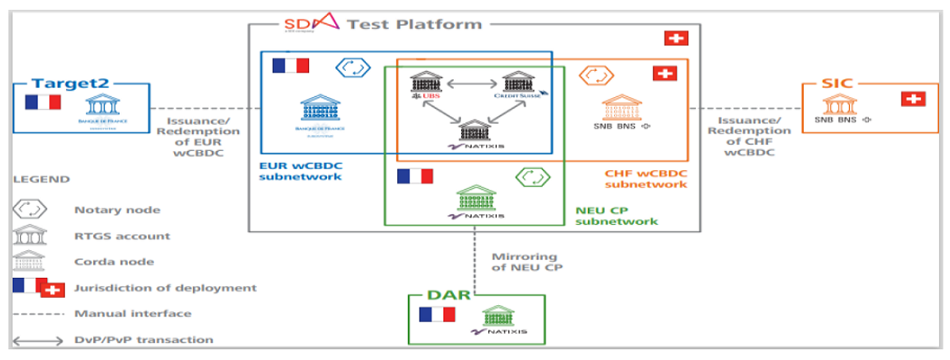

Project Jura, together with the BIS Innovation Hub Swiss Centre, the Bank of France, the Swiss National Bank and a private sector consortium, including the SIX Digital Exchange (SDX), explored how to use wholesale CBDC for cross-border payment and settlement of tokenised financial instruments using a common multi-CBDC platform with separate subnetworks. Project Jura explored the direct transfer of euro and Swiss franc wholesale CBDCs between French and Swiss commercial banks on a single DLT platform operated by a third party. Tokenised asset and FX trades were settled using PvP and delivery-versus-payment (DvP) mechanisms. The Jura experiment was conducted in a near real setting, using real-value transactions and complying with current regulatory requirements.

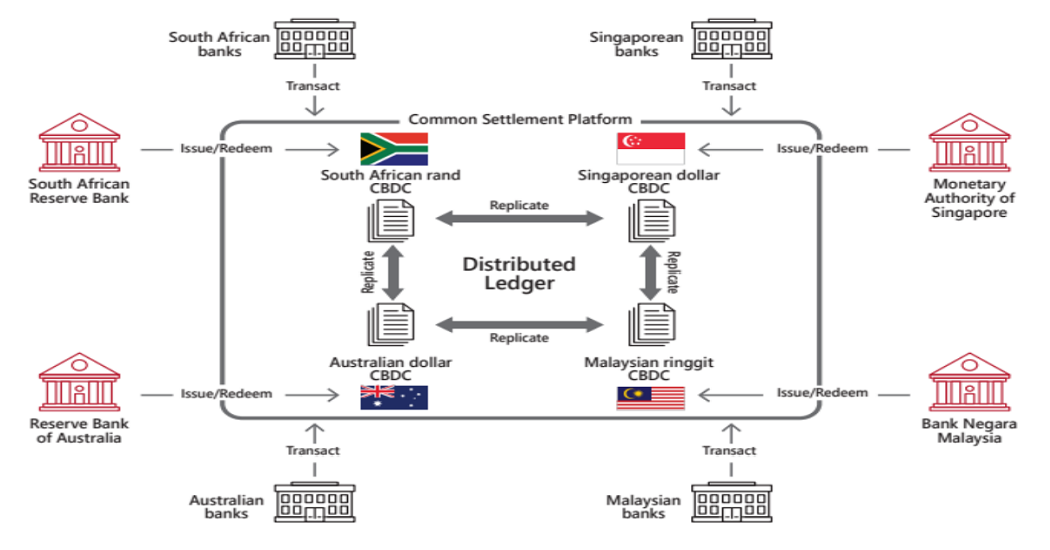

Project Dunbar, in collaboration with the BIS Innovation Hub Singapore Centre, the Reserve Bank of Australia, Central Bank of Malaysia, Monetary Authority of Singapore and the South African Reserve Bank, explored how a common platform for multi-CBDCs could enable cheaper, faster and safer cross-border payments. It identified the challenges of implementing a multi-CBDC platform shared across central banks and proposed practical design approaches to address them. These approaches were validated

through the successful development of technical prototypes on Corda and Quorum, proving that the concept of multi-CBDCs was technically viable.

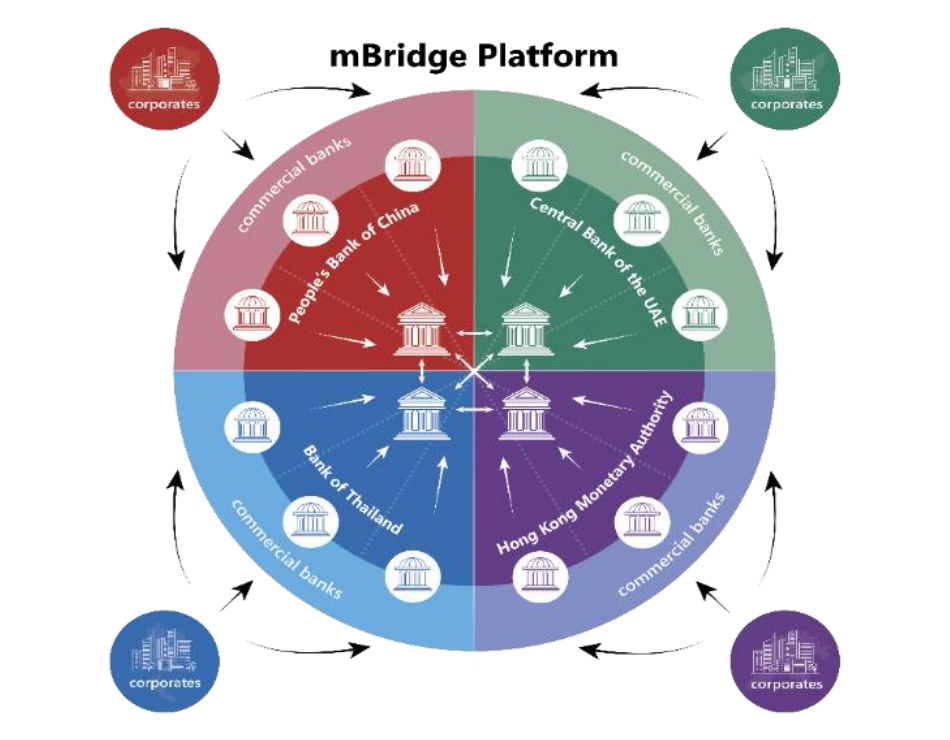

Project mBridge is being developed by the BIS Innovation Hub Hong Kong Centre, the Hong Kong Monetary Authority, the Bank of Thailand, the Digital Currency Institute of the People’s Bank of China and the Central Bank of the United Arab Emirates. It explores how wholesale CBDCs can be used for cross-border payments using a common multi-CBDC platform.

The mBridge platform is built in a modular “Lego bricks” approach to enable flexibility of implementation and the inclusion of features that apply across participating members. Focus areas in the current phase

include further work on the technology stack, and deeper dives into legal and governance aspects. mBridge demonstrates that it is realistic to aim for a tailored multi-CBDC platform solution to tackle the limitations of today’s cross-border payment systems.

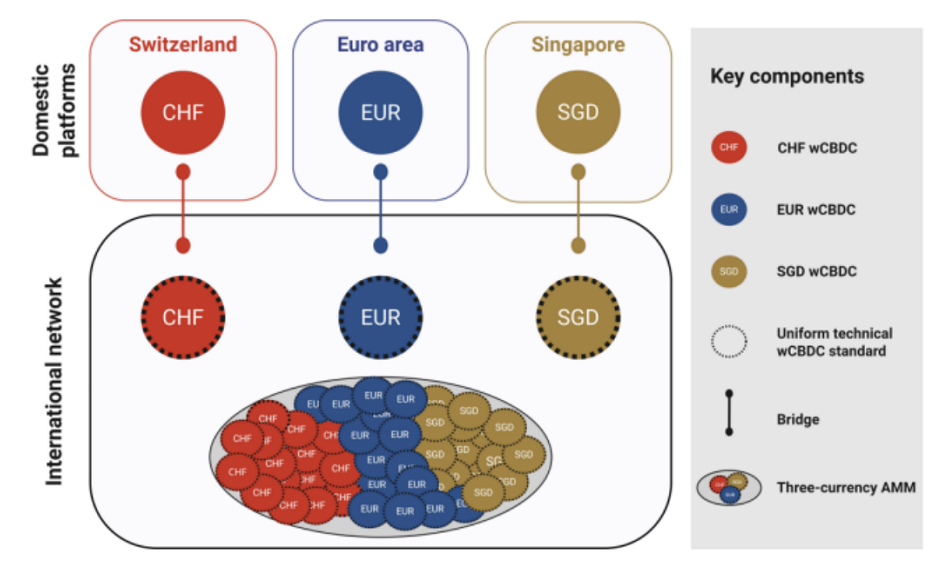

Project Mariana is a joint proof of concept between the Switzerland, Singapore and Eurosystem BIS Innovation Hub Centres, the Bank of France, the Monetary Authority of Singapore and the Swiss National Bank.

The project expands on previous wCBDC experiments by the BISIH, exploring concepts developed in decentralised finance (DeFi) applications. It set out to investigate whether so-called automated

market-makers (AMMs) using wCBDCs could improve the effectiveness, safety and transparency of FX trading and settlement, eliminating some of their associated risks in FX markets. The project also examined crossborder interoperability using wCBDC based on a uniform technical standard, as a way to future-proof CBDC developments.

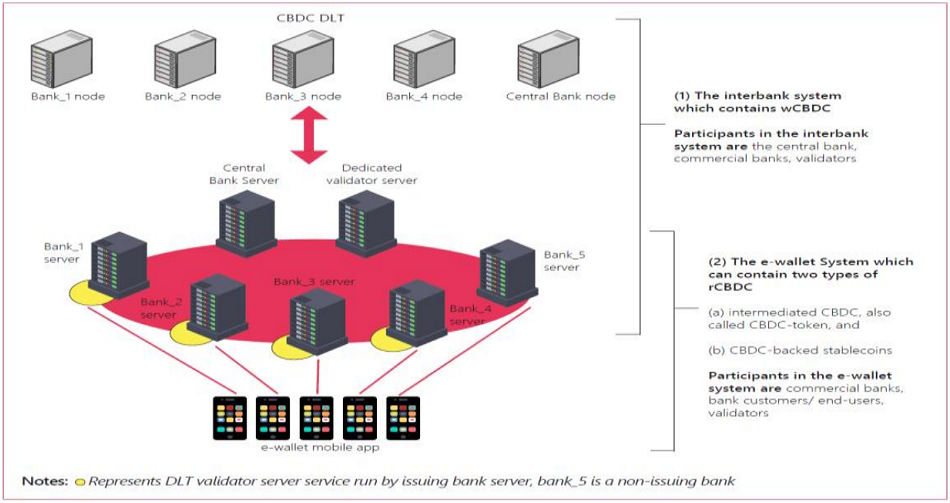

Project Aurum, in partnership with the BIS Innovation Hub Hong Kong Centre, Hong Kong Monetary Authority and the Hong Kong Applied Science and Technology Research Institute, explored how tiered

architectures can be used for the distribution of retail CBDC. It is a fullstack (front-end and back-end) CBDC system comprising a wholesale interbank system and a retail e-wallet system. The aim was to bring to life two very different types of token in the interbank system: intermediated CBDC and stablecoins backed by CBDC.

The Project Aurum prototype is designed to prevent over-issuance and to be flexible for different CBDC

models. The technical manuals together with the source code are accessible to all BIS member central banks on BIS Open Tech.

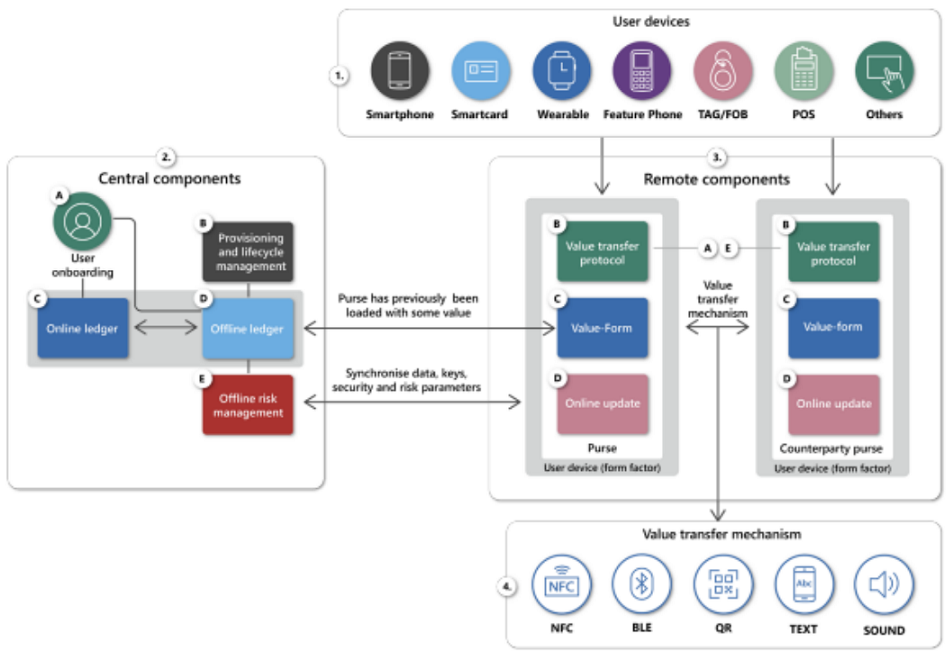

Project Polaris, launched by the BIS Innovation Hub Nordic Centre, explores how to implement and operate end-to-end secure and resilient CBDC platforms, including provisions for offline functionality. A key focus of the project is on the provision of offline payments functionality for CBDC, which could address requirements for resilience, crisis robustness, financial inclusion, cash resemblance, accessibility and other desiderata.

Another key focus area is on the practical aspects of security and resilience, taking a risk-based approach, to build a security and resilience playbook to inform the work of central banks. This would build on existing industry frameworks and apply them to CBDCs, incorporating state-of-the art practices to put together a set of fundamental capabilities and associated processes for a central bank to consider when implementing a secure and resilient CBDC system.

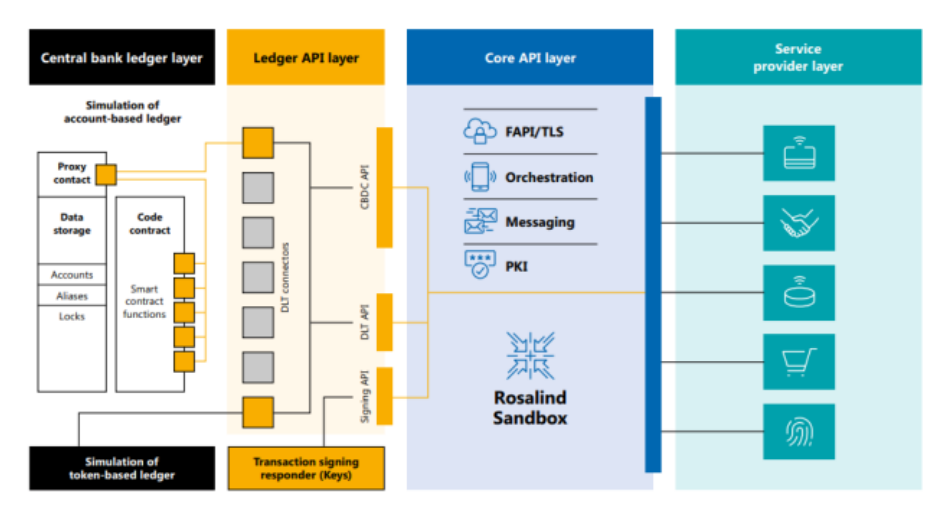

Project Rosalind, a joint experiment with the BIS Innovation Hub’s London Centre and the Bank of England, investigated how to use API) functions to distribute and settle retail CBDC payments. Based on a twotier distribution model, the project explored how this interface could best enable a central bank ledger to interact with private sector agents to safely provide retail payments. It also explored some of the functionalities required to enable a diverse and innovative set of use cases to be developed by the private sector.

Project Rosalind demonstrated a set of API functionalities that could enable a close collaboration between the public and private sector in developing a retail CBDC system as well as supporting a robust ecosystem to spur innovation. Project Rosalind completed a TechSprint in April 2023.

Project Sela, in partnership with the BIS Innovation Hub Hong Kong Centre, the Hong Kong Monetary Authority and the Bank of Israel, explores how to ensure cyber-secure two-tiered retail CBDC architecture.

The focus of the project is investigating the cyber security and technical feasibility of a two-tier retail CBDC architecture that allows intermediaries, such as commercial banks, payment service providers and financial technology firms, to provide CBDC services without any related financial exposure. If reducing financial exposure for retail CBDC intermediaries proves feasible, this could lead to a more accessible CBDC system. With this wider access, however, comes heightened concerns surrounding preventative cyber security. Project Sela will therefore evaluate how cyber security can be enhanced while providing wider system access.

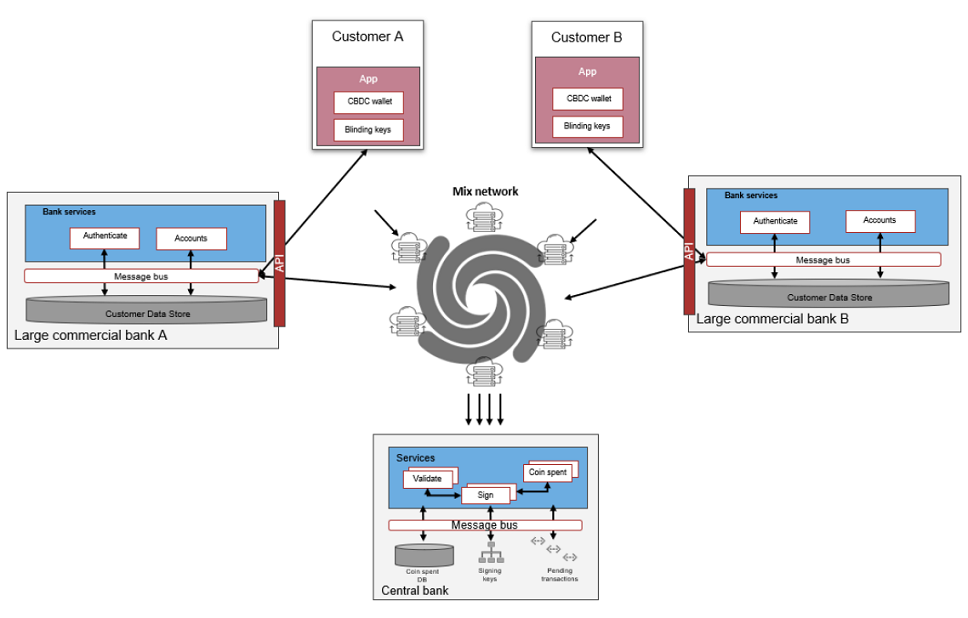

Project Tourbillon, launched by the BIS Innovation Hub’s Swiss Centre, investigates how to develop a CBDC system that preserves transaction privacy, is resilient to quantum computer attacks and can handle large transaction volumes. Central banks have identified cyber resiliency, scalability and privacy as core features of CBDCs. However, designing them involves complex trade-offs between these three elements.

Project Tourbillon aims to reconcile these trade-offs by combining proven technologies such as blind signatures and mixed networks with the latest research on cryptography and CBDC design. The conclusions of this project will be relevant for both wholesale and retail CBDC systems.

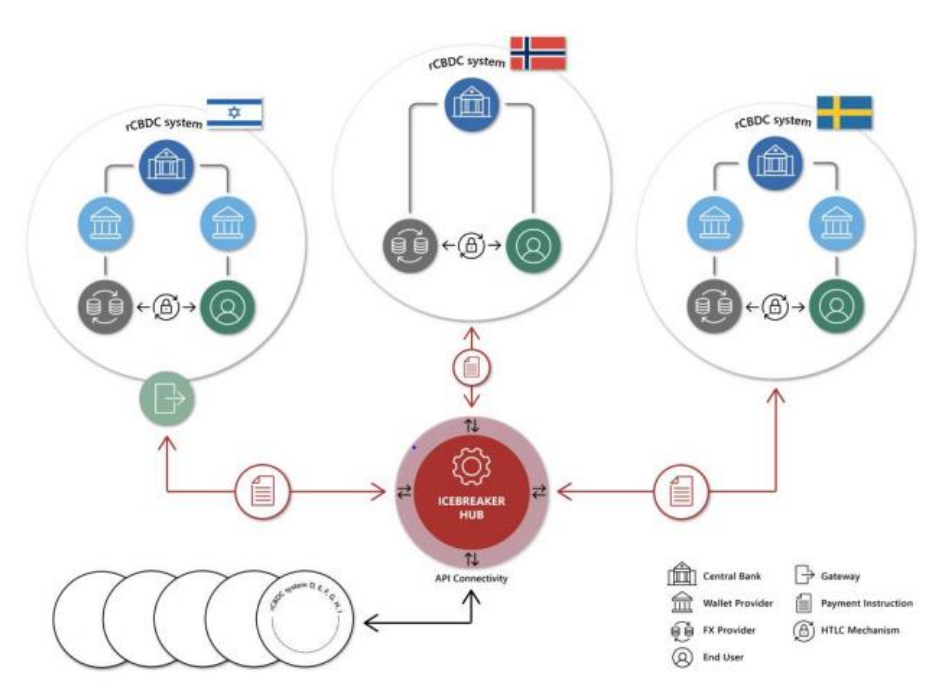

Project Icebreaker, a collaboration with the BIS Innovation Hub Nordic Centre and the central banks of Israel, Norway and Sweden, studied how retail CBDCs can be used for international retail and remittance payments using a hub-and-spoke model as a way to interlink domestic systems.

Additional features promoted simplicity and interoperability, reduce settlement risk, and foster competition and transparency for cross-border retail CBDC payments. The project tested the technical feasibility of conducting cross-border and cross-currency transactions between different experimental retail CBDC systems. It shows that central banks can have almost full autonomy when designing their domestic retail CBDC system while still being able to participate in a formalised interlinking arrangement to enable cross-border payments.

____________

BIS Innovation Hub work on central bank digital currency (CBDC)

Using CBDCs across borders: lessons from practical experiments

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: