November 2017 marked a major event in an increasingly instant world: the launch of the Single Euro Payments Area (SEPA) Instant Credit Transfer (SCT Inst), which enables credit transfers in ten seconds – or less – across the SEPA.

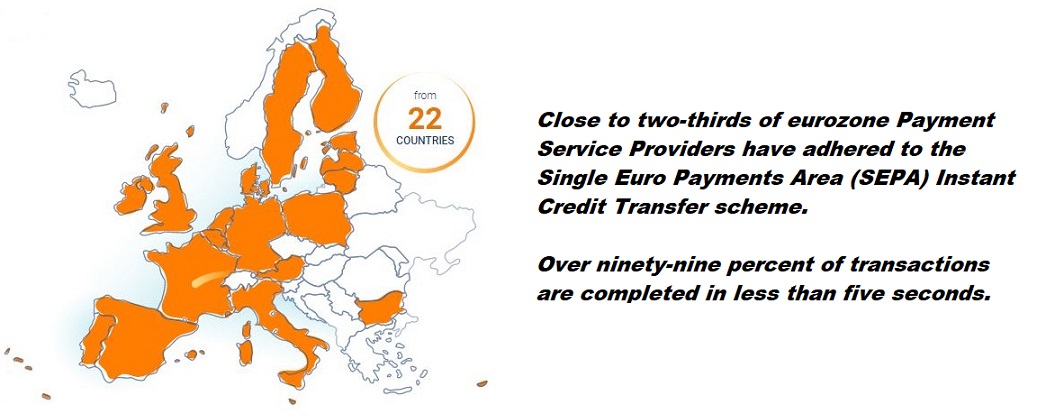

Since its launch, the SCT Inst scheme has kept on growing, and the latest Register of Scheme Participants, published in May 2020, reveals that „the scheme now includes 2,263 PSPs (fifty-six percent of the total) from 22 countries in Europe. These numbers will continue to grow over the coming year.”, according to a press release.

The countries with the largest numbers of registered PSPs are currently Germany (1,284), Austria (452), Italy (194) and France (128).

„The progress made since the end of 2017 is even more impressive when only the euro area is taken into consideration: close to two-thirds of eurozone PSPs have adhered to the SCT Inst scheme, and in eleven euro countries1 a vast majority of payment accounts can be used to send and receive SCT Inst transactions.”, the European Payments Council (EPC) said.

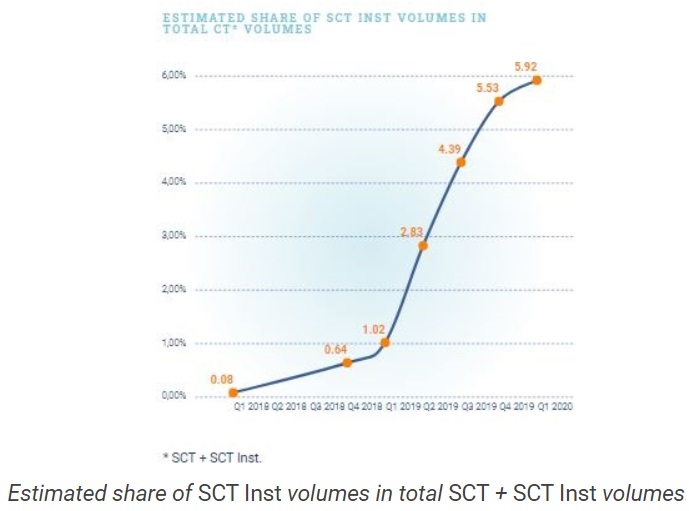

Furthermore, the estimated share of the SCT Inst volumes in total volumes of SEPA Credit Transfer (SCT plus SCT Inst) is growing rapidly and reached nearly six percent in the first quarter of 2020:

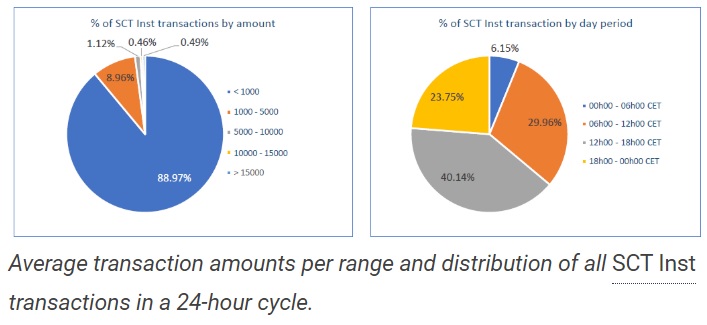

Additionally, it is worth noting that the overwhelming majority of the SCT Inst transactions are currently below one thousand euros, and most transactions (about seventy percent) are made during daytime (from 6:00 to 18:00 CET):

The PSPs that intend to join the SCT Inst scheme have to adapt their IT systems to make them real-time and available 24/7/365, as well as to establish back-up arrangements, to upgrade their operational and risk management processes such as fraud detection, their clearing and settlement arrangements, and to develop and to promote this new service to their customers.

Notwithstanding these challenges, the scheme has so far been deployed in line with expectations. Some progress is currently still needed to enable the achievement of full pan-European reachability in the most efficient manner. However, the PSP and Clearing and Settlement Mechanism (CSM) communities are addressing this issue, which is expected to be resolved this year.

The latest performance indicators are extremely positive: over ninety-nine percent of transactions are completed in less than five seconds, R-transaction2 rates have dramatically decreased – especially for intra-country transactions – and no significant fraud issue has been reported.

The EPC did not expect all PSPs from the 36 European countries to join immediately in November 2017 given the substantial investment and operational changes required. The SCT Inst scheme will progressively have an even broader geographical reach as it is implemented by PSPs from more and more SEPA countries.

Even though SCT Inst is limited to euro transactions, the scheme offers a tremendous opportunity for PSPs to satisfy new needs from their customers in the digital age as well as further harmonising euro payments in Europe, which could be a good example for other regions of the world. The EPC has already granted licences to some non-euro zone countries allowing them to use the building blocks of the SCT Inst scheme for non-euro transactions. This fosters harmonisation of real-time payments beyond the euro and throughout Europe.

Finally, the SCT Inst scheme still needs to evolve continually to meet market demand. Some new features have already been implemented, like the repayment functionality (effective since November 2019) and the maximum amount of one hundred thousand euros available from 1 July 2020, which will, in particular, facilitate business-to-business transactions.

Other features supporting real-time payments in Europe and complementing the SCT Inst scheme have been or are being developed in line with the EPC’s scheme management process which involves consulting all interested stakeholders.

In this context, it is worth highlighting the SEPA proxy look-up scheme launched at the beginning of 2019 (with the second release of its rulebook published at the end of March 2020) and the EPC’s on-going development in partnership with stakeholders of a Request to Pay scheme. The first rulebook for this new scheme is planned for publication in November 2020 following a three-month public consultation that starts at the beginning of June 2020.

###

1. Austria, Belgium, Estonia, Finland, France, Germany, Italy, Lithuania, Netherlands, Portugal and Spain

2. Some transactions require exception handling because one of the parties involved does not or cannot process the transaction in the normal way. This exception handling involves the sending of messages called R-transactions because their names all start with an R: Rejects, Recalls and Requests for Recall by the Originator (RFRO).

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: