The pet insurance includes protection from high and unforeseeable vet costs and 24/7 free access to an online vet, further helping lowering the costs related to the pet ownership. Initially pet insurance will be available to UK customers and apply to cats and dogs only.

Revolut, the financial superapp with almost 4 million UK customers, recently announced the launch of Pet Insurance. The stand-alone product reinforces Revolut’s existing insurance offering including travel insurance, purchase protection and ticket- and missed event cover.

„Pet insurance is Revolut’s entrance into insurtech, and is the company’s first of many future standalone insurtech products,”according to the press release.

„Insurtech is one of the fastest growing business sectors in the world, and Revolut aims to become one of the leading insurtech players,” the company said.

The “COVID-effect” on pet ownership means that the pet insurance market in the UK and in Europe is expected to grow rapidly due to the increased number of people who became pet owners during the global pandemic.*

With Pet Insurance, Revolut wants to help pet-owning customers maintain their furry friends’ health. Initially pet insurance will be available to UK customers and apply to cats and dogs only. The insurance offers protection from high and unforeseeable vet costs, and provides 24/7 free access to an online vet.

Chiraayu Sethi, Product Manager for Pet Insurance at Revolut said:

“We are delighted to take the first step into yet another vertical, and launch our first standalone insurtech product. Insurtech is a fast growing sector, and Revolut aims to become one of the world’s leading insurtech players. We have listened to the feedback from over 150,000 customers on our platform, and we are looking forward to welcoming their pets as customers.”

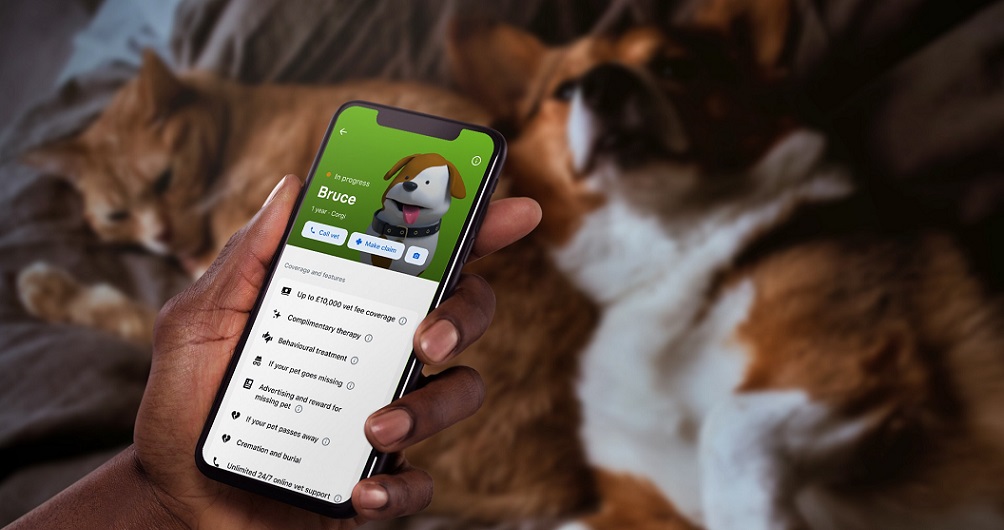

The in-app pet profile allows the customer to easily manage everything related to the insurance in one place, such as viewing policy documents, making a claim and accessing vet support.

Revolut Pet Insurance is a monthly subscription available in three plans, Bronze, Silver and Gold that offer up to £10,000 in annual vet fee cover. The plans are not price fixed, instead the monthly fee will depend on various factors such as age, breed, gender and location of the cat or dog. Customers can get a Pet Insurance quote and purchase it in the Revolut app.

Revolut’s Pet Insurance includes the following main features:

. Protection from high, unforeseeable vet costs up to £10,000 per year, per pet

. 24/7 free access to an online vet with FirstVet. Free for immediate help with non-emergency questions about the pet’s health

. Medical care when abroad and dental accidental injury cover

___________

*Report ‘Pet Ownership in the UK’, Statista, 2020 (data from 2019)

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: