Multiple national banks, including the Bank of England and the European Central Bank (ECB), have declared that their central bank digital currencies (CBDC) won’t be ‘programmable money’. What about programmable CBDC payments? In a recent publication, Barclays posits that the best institution to house the programmability layer might be a financial market infrastructure (FMI). Why? Because it has the potential to improve the functionality of money, such as releasing money only upon receipt of goods or at a particular time.

Central banks are actively exploring central bank digital currencies (CBDCs) by conducting research, proofs of concept and pilots. However, „adoption of a retail CBDC can risk fragmenting both payments markets and retail deposits if the retail CBDC and commercial bank money do not have common operational characteristics”, according to Barclays.

In this paper, Barclays focuses on a potential UK retail CBDC, the ‘digital pound’, and the Bank of England’s ‘platform model’.

„We first explore how the concept of functional consistency could mitigate the risk of fragmentation. We next identify the common operational characteristics that are required to achieve functional consistency across all forms of regulated retail digital money.”

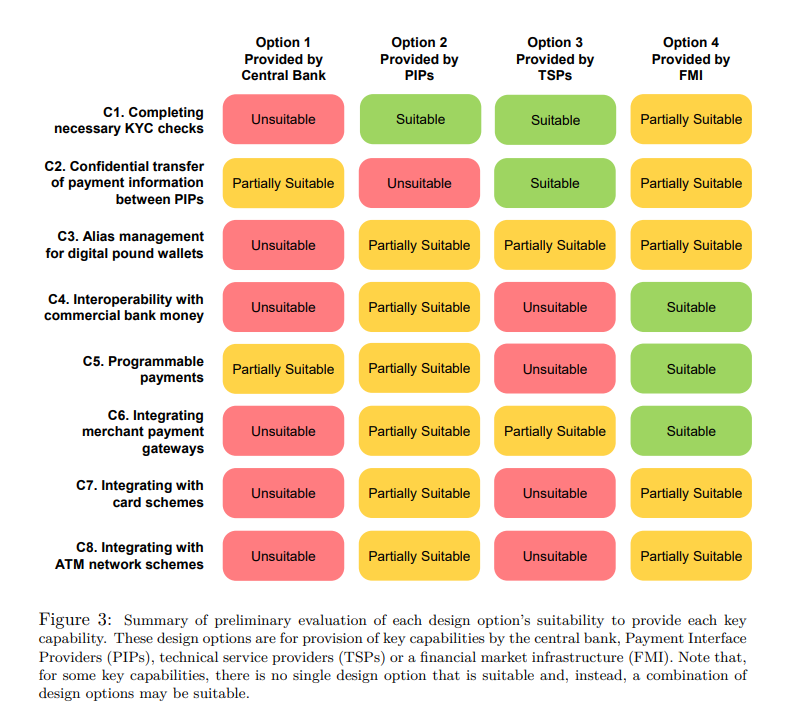

„We identify four design options based on the provision of these common operational characteristics by the central bank, payment interface providers (PIPs), technical service providers (TSPs) or a financial market infrastructure (FMI). We next identify architecturally-significant use cases and select key capabilities that support these use cases and the common operational characteristics. We evaluate the suitability of the design options to provide these key capabilities and draw insights.” according to the white paper.

Barclays concludes that no single design option could provide functional consistency across digital pounds and commercial bank money and, instead, a complete solution would need to combine the suitable design option(s) for each key capability and include common ecosystem services provided by an FMI and TSPs.

More details:

Functional Consistency across Retail Central Bank Digital Currency and Commercial Bank Money

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: