an article written by David G.W. Birch – Author, advisor and global commentator on digital financial services.

Today is a very important day for us payments nerds. It is the anniversary of the “Fresno Drop”, the birth of the modern credit card industry, a day that should be celebrated throughout the financial services sector (and every other sector as well, particularly management consultancy). On 18th September 1958, Bank of America officially launched its first 60,000 credit cards in Fresno, California.

No applications, no credit scoring, no approval mechanism. Bank of America simply sent almost every household a credit card. Something that the householders had never seen before. Each card had a credit limit of $500 (that’s around $5,000 adjusted for inflation). It was an astonishing and audacious experiment that changed the American way of borrowing, paying and budgeting. And, in time, changed everyone else’s way of doing those things too.

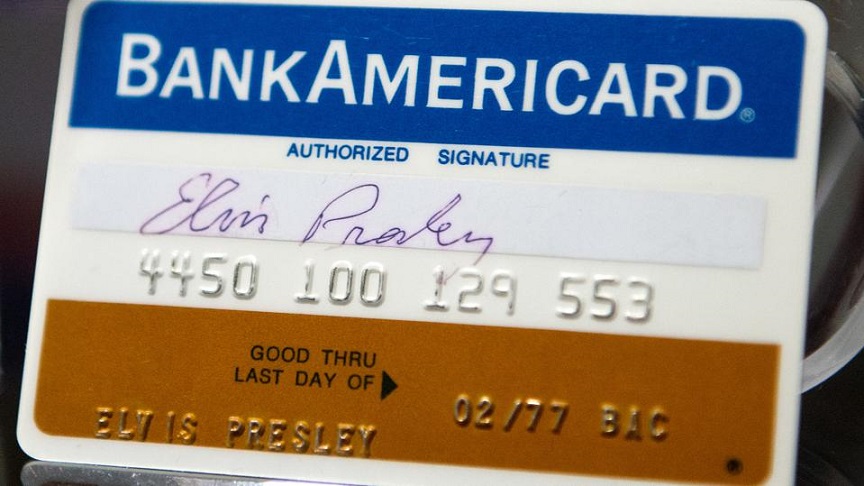

Photo: Elvis Presley’s Bank Americard, part of „Elvis at the O2 – Direct from Graceland” exhibition in London. Elvis at the O2 is the largest Elevis retrospective ever mounted in Europe – photo by Zak Hussein/Corbis via Getty images

Now is not the time to go over the whole story, and I am sure most of you are familiar with it anyway, but if you want a good introduction to the history of the credit card, from the Fresno Drop up to the Internet, I’d recommend Joe Nocera’s “A Piece of the Action“, which I read many years ago and still pick up from time to time. On the other hand, if you want to spend five minutes having a quick look at where the modern credit card business comes from, here’s the short version (courtesy of CNN Money): The most extraordinary episode in credit card history is the great Fresno Drop of 1958. The brainchild of a Bank of America middle manager named Joe Williams, he mailed out 60,000 credit cards, named BankAmericards, to nearly every household in Fresno [and] thousands of ordinary people suddenly found that thousands of dollars in credit had literally dropped into their laps…

There you go. Now you can go ahead and bore at least one person today with the story of the Fresno Drop. I know I will, because I covered the drop in my book Before Babylon, Beyond Bitcoin, where I pointed out that what is sometimes overlooked from our modern perspective: That the evolutionary trajectory of credit cards was not a simple, straight, onwards-and-upwards hockey-stick to glory and to gross margins that merchants can only dream of.

That baby credit card sector was a disaster. In year, Bank of America issued a couple of million cards but had massive bad debt (delinquencies over a fifth of the balances), a proposition merchants hated (a 6% commission) and out of control fraud. I’m sure that today it would have been canned by a bank’s innovation investment sustainability review subcommittee blue sky unit long before it ever got into public pockets.

In fact for more than the first decade or so, it was far from clear whether the credit card would continue to exist as a product at all, and as late as 1970 there were people predicting that banks would abandon the concept completely. Margins were thin and as Dee Hock (the visionary founder of the inter-bank organisation that became Visa wrote in his history of the industry, at that time fraud was still spiralling out of control and threatening to kill the industry stone dead. Blank cards were stolen from warehouses, personalised cards were stolen from the mail and organized crime was on the scene to exploit the weak signature-based security of the nascent industry.

What changed everything was a combination of regulation and technology: It was regulation that allowed banks to charge higher interest rates and it was the technology of the magnetic stripe and computer networks for online authorisation system that attacked fraud. This changed the customer experience, transformed risk management and cut costs dramatically while simultaneously allowing the banks to earn a good profit from the business.

(I can’t resist pointing out that it was the London transit system that pioneered the use of magnetic stripes on the backs of cards. The first transaction was at Stamford Brook subway station on 5th January 1964, well before BankAmericard introduced their first bank-issued magnetic stripe card ahead of the deployment of electronic authorisation in 1973.)

So where do these baby boomers go next? When cards went through middle age they bought the sports car of tokenisation and made some younger friends (Apple Pay and GooglePay). But now, as cards approach their golden years, who are the millennials set to inherit the (less profitable) Earth? Many years ago, I saw Anthony Jenkins (the former CEO of Barclays) give a terrific talk at a product launch in which he predicted that mobile phones were going to replace cards long before they replaced cash, a view echoed earlier this year by Deutsche Bank research in their future of payments study. I think they are right, of course, but what exactly will we use those mobile phones for? Instant credit transfers or digital currency? Request-to-pay and Libra transfer or WeChat message with digital Yuan inside? Bank credit transfers or Amazon AMZN -1.8% credit transfers?

Remember, it took more than a decade for the Fresno drop to turn into the mass market business, integral to the economy, that we know today. So I cannot resist asking you all what seemingly failing financial technology experiment of today will be of similar magnitude a decade because of a combination of future regulatory and technological change? DeFi or Digital ID? FacebookPay or the Lightning Network?

My guess is that will be something to do with digital asset token trading, but I’d be curious to hear yours.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: