Consulting firm Strategy&, part of the PwC network, conducted a consumer survey across fifteen European countries to analyze the relevant changes in consumers’ payment behavior and derive impacts on the future of banking. With regard to a bank’s service offering, there are three key experience factors that are driving the banking experience and that banks are currently challenged with: free or low-priced cash withdrawals, a user-friendly mobile banking app, as well as a free current account. Also, the international survey found no post-Covid cash revival, but no acceleration of cash decline either.

When asked about their general preference for payments when shopping or paying for services, 37% of respondents named cash as preferred payment option – the same percentage we found in 2020 during a time with lockdowns in most countries.

In countries where cash has been less popular, the relevant proportion favoring cash bottoms out at around 20% – and even lower for the younger population. In countries which previously had a high level of cash preference, this continues to decline.

One in five consumers leave the house for shopping at least regularly without their purse, and an additional 15% rely at least rarely just on mobile payments which hands advantage to FinTechs and any kind of wallets.

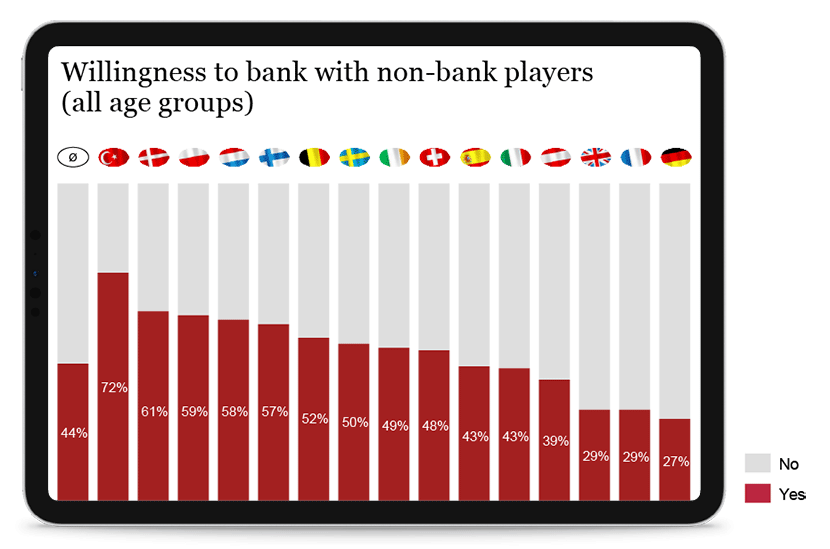

Only 20% of consumers are willing to share data in exchange for benefits. The same number of respondents named traditional banks and card issuers as most trusted providers for data sharing. In contrast to this, almost one in two people would still open a bank account with non-banks. However, the willingness to bank with non-bank players varies strongly by country:

Today’s Open Banking use cases are strongly focused on Account Information Services (AIS) and consumer use cases. Moving forward, the financial services industry should aim to establish further use cases beyond today’s focus on financial services. They should also include B2B use cases as a key lever for acceleration.

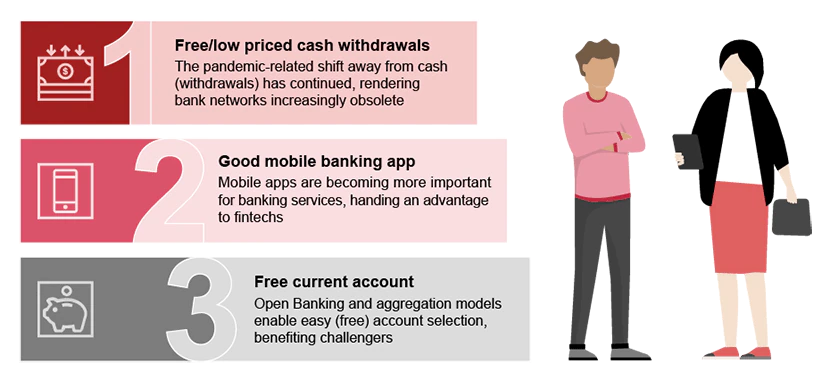

With regard to a bank’s service offering, there are three key factors that are driving the banking experience and that banks are currently challenged with:

The third edition of Strategy& analysis includes an online consumer survey of 5,750 participants across fifteen countries between September and October 2022. The report entitled „The calm before the storm – What subtle changes in consumer mindset tell us about the future of banking” can be downloaded here.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: