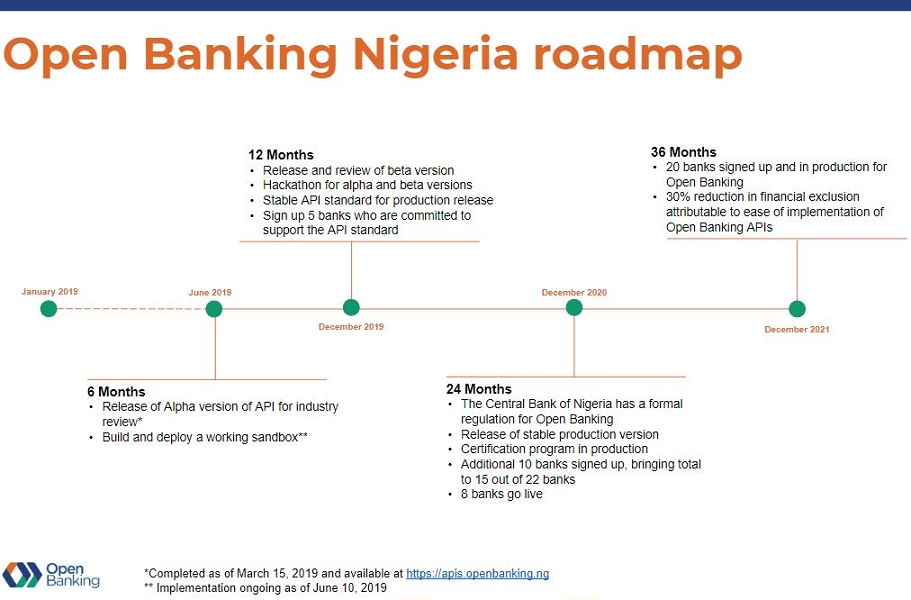

The Open Banking Foundation has facilitated the drafting the alpha version of the API standard and is on course to deliver a sandbox by Q3 of 2019.

Nigeria has signified a strong desire to become the first country in Africa and the second in EMEA—after Bahrain—to officially adopt an Open Banking standard, which defines how financial data is created, shared and accessed – a system which also provides users with a network of financial institutions’ data through the use of a standard Application Programming Interface (API).

Nigeria’s Central Bank recently made this indication as it made public a Request for Information into its Payment Systems Vision (PSV) 2030, which would “define the strategic agenda for the Payments System for the next ten years.” It comes on the heels of its hugely successful Payments System Vision PSV 2020 that wraps up at the end of this year.

If Nigeria scales through in good time with the implementation of PSV 2030, central to which is Open Banking now being considered by the country’s highest banking regulator as one of the top global trends and new practices in payments, the country would enact policies to ensure the speedy adoption of Open Banking across its financial services industry.

„With this, Nigeria would join other countries like Canada, Australia, and New Zealand, among others, that have followed the footsteps of the United Kingdom in developing and adopting a single API standard, for their respective financial ecosystems.”, according to a press release.

According to Nigeria’s Central Bank, PSV 2030 is necessary because of the importance of having a strategy that is relevant for the Nigerian market domestically and for regional and global markets where Nigeria plays a role in international flows.

“Our goal is a payments system that is not only nationally utilized but also internationally recognized- one that promotes efficiency supports innovation while also anticipates and manages the risks from the adoption of new technologies,” Aisha Ahmad, Deputy Governor, Central Bank of Nigeria said recently.

The Central Bank’s Request for Information stated that: “Most countries with mature banking infrastructure are opening access to new entrants and challenger banks to encourage innovation and competition.” It referred Europe’s PSD/2 that has created different levels of service provision, from pure payment initiation and balance reporting (but not account holding) through to full-service account and credit provision.

“Such structures must support new entrants while not undermining the resilience of banking and payment services,” the Central Bank concluded.

For a while, advocacy for Open Banking in Nigeria has been led by the Open Technology Foundation, also known as Open Banking Nigeria, a non-profit founded by payment industry veteran and open banking evangelist, Adedeji Olowe. Open Technology Foundation has high caliber partners such as Ernst & Young, KPMG Nigeria, and PwC Nigeria. It also has some of Africa’s top fintechs including Africa’s Talking, Flutterwave, Paystack, and Teamapt.

Already, through its advocacy, the Open Banking Foundation has facilitated the drafting the alpha version of the API standard and is on course to deliver a sandbox by Q3 of 2019.

For its payment vision for the next decade, along with Open Banking, Nigeria is also considering other payment trends such as digital access, distributed ledger technology, payment methods, big data and artificial intelligence, cyber-security, digital identity, and machine learning and robotics process automation.

With the Central Bank of Nigeria ready to set the pace for the African continent, it is likely that—with the country serving a reference point—more countries in Africa would take active steps towards adopting Open Banking Standards as might be applicable for their respective economies and ecosystems.

Increasingly, the financial climate across Africa in the next decade would be driven by rapid changes driven by advances in digital technology, customer expectations and new business models which includes Fintech, much more than they did in the last decade.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: