The German mobile bank backed by Peter Thiel is pressing ahead with its U.S. expansion, betting it can grab share from established lenders and credit-card providers with free accounts, fewer fees and phone alerts that nudge them toward better financial choices, according to Bloomberg.

“We have more than 110,000 customers on the wait list in the United States,’’ Valentin Stalf, the CEO and co-founder of Berlin-based N26, said in an interview in Salzburg, Austria. “Banking in the U.S. is much more un-transparent than in Europe, as you often have minimum fees, minimum balances and so on.’’

N26, whose name refers to the number of pieces in a Rubik’s Cube, is one of Europe’s most successful financial-technology startups, raising $470 million in its latest funding round. It says it’s adding 10,000 customers a day. It serves over 3.5 million customers four years after its launch, and operates in 24 countries, including Germany, France, the U.K. and Spain. Tech billionaire Thiel was among its first investors, putting in 10 million euros ($11.1 million) in 2015.

In the U.S., N26 has been open for about a month and is partnering with Axos Financial Inc., a San-Diego-based online-lending pioneer, and Visa Inc., which will operate N26’s debit cards. N26 has approval to operate in the U.S. already via the Axos partnership, Stalf says, and it’s doing credit and identity checks on Americans who have applied for accounts.

“Apps are less advanced than in Europe,’’ said Stalf, who said he wants N26 to become a global consumer brand comparable to Netflix or Spotify.

App-based banks see opportunity in the U.S. market. U.S. startups with a similar model include Chime, Empower and Varo, and other European are coming, too, notably Britain’s Monzo. They face incumbents like JPMorgan Chase & Co.’s Chase Bank, which are investing heavily in their mobile product, and offer basic checking accounts for free if a minimum balance or transaction level is hit.

Then, there’s the U.S. credit-card boom, which has seen a rush of providers woo consumers with air-mile and cash-back rewards for spending. Apple Inc. is planning a credit card venture with Goldman Sachs Group Inc., linked to its Apple Pay digital wallet.

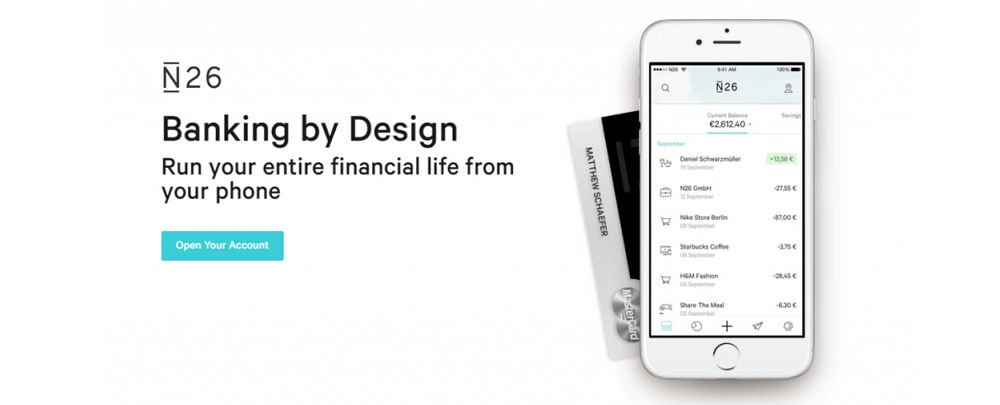

Stalf suggests that N26’s debit cards can win over Americans who have found their credit-card use has turned into an unhealthy spiral of carrying large balances and incurring fees. Any purchase using N26 is immediately accompanied by a push notification popping up on the phone, and it also functions as a basic personal-finance app, categorizing expenses and spending habits in real time. Customers can also instantly change their withdrawal and spending limits through the app, or disable the card’s online and foreign use.

N26 would earn revenue from the free accounts as Visa pays commissions when a customer uses the debit card multiple times. In Europe, the bank later typically adds fee-generating services such as credit cards, insurance or savings plans.

If clients graduate to a premium account in Germany, N26 charges as much as 16.90 euros a month and throws in worldwide no-fee cash withdrawals at ATMs, foreign medical insurance and discounts at hotels. Over a year, that’s not a dissimilar user fee, or perks, than those for premium U.S. credit cards or a higher-end Chase Bank account.

Within the last 12 months, N26 has tripled its workforce to more than 1,300 employees, including 70 in New York. It will likely employ about 2,000 people within 12 months, Stalf said.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: