More than two thirds of UK consumers (67%) who use contactless payments would prefer the function to be added to something they already own or wear, rather than purchase a brand new wearable payment device, research released by Barclaycard reveals.

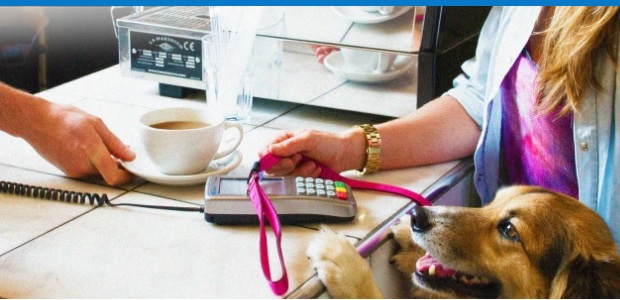

Watches top the list of items that British consumers would most like to adapt for contactless payments with 62%, followed by inherited jewelry (21%) and wedding rings (19%). The top ten is rounded out by dog leashes, sweaters, sunglasses, hats, cufflinks, handbags and grandad’s pocket watch.

42% of contactless payment users are put off by the expense of wearable devices, and 39% are dissuaded if it is too bulky, 35% if it is too large. A quarter of the 1,200 surveyed favor wearables that suit or can be adapted to their personal style.

The findings come as consumer demand for a discreet wearable payment option that can be added to wearables they already own – in particular watches and fitness bands – has led Barclaycard to develop and launch bPay loop, a small chip holder that can be used to turn certain items into a contactless way to pay, without the need to carry a wallet.

The research suggests that a new trend of retrofitting items we wear with new functionality is emerging. The poll shows that almost half of Brits (49 per cent) would like to give current possessions a 21st century revamp. A quarter (25 per cent) also said they would wear their vintage items and family heirlooms more if they could customise them with contactless technology.

Contactless spending is quickly becoming the payment method of choice, with the latest figures from The UK Cards Association showing that spending is up by 247 per cent year-on-year to £1.9bn a month. Nearly a fifth (18 per cent) of all card purchases are now made using contactless technology, which is up from just less than one in ten (7 per cent) in May 2015.

Tami Hargreaves, Commercial Director, Digital Consumer Payments at Barclaycard, said:

“Consumers have taken contactless payments to their heart and they are now making seven million transactions a day using it. Whether it’s your watch, bracelet, dog lead or pair of sunglasses, paying using your favourite item isn’t as far-fetched as it seems, as bPay loop can help turn everyday items into a quick, easy and secure way to pay.”

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: