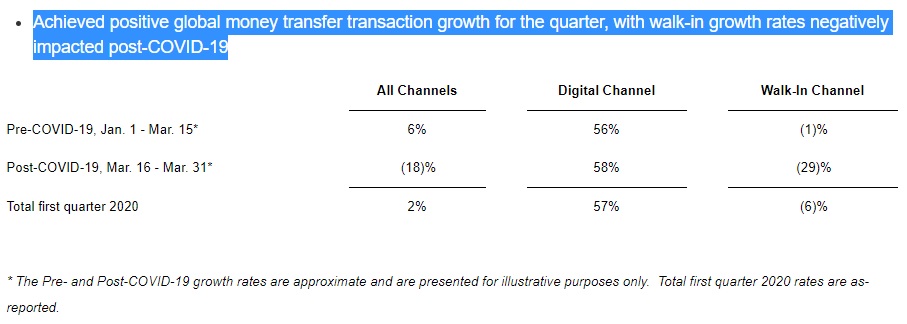

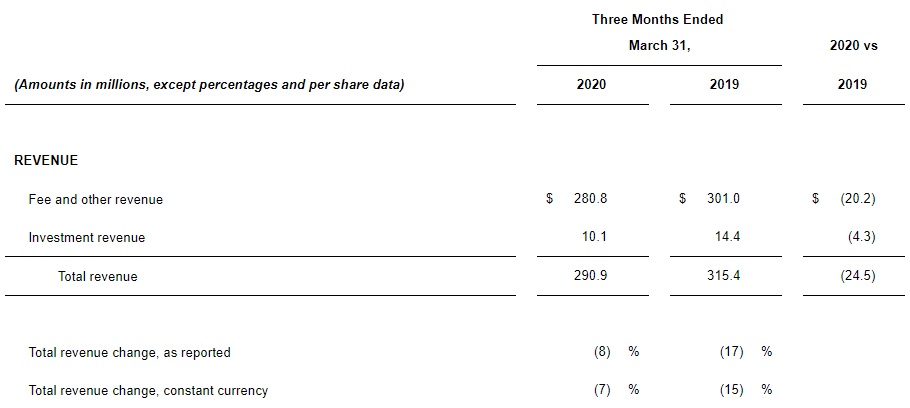

MoneyGram International reported financial results for its first quarter ending March 31, 2020. Total revenue was $290.9 million, a decline of 8% (or 7% on a constant currency basis), transfer revenue was $255.9 million, down 6% (or 5% on a constant currency basis) while the net loss was $ 21.5 million (compared to $ 13.5 million in the first quarter of 2019) , according to the press release.

„The pandemic caused sudden and significant global disruption and MoneyGram certainly was not immune. At the onset of COVID-19, our Walk-In Channel experienced a significant downturn, while in contrast, our Digital Channel continued its positive momentum as consumers increasingly value the ease and convenience of our leading offerings.”, said MoneyGram Chairman and CEO Alex Holmes.

First Quarter 2020 Highlights, Year Over Year

As the crisis unfolded, MoneyGram quickly shifted its marketing and operational focus to its online and digital capabilities to ensure customers were able to continue to seamlessly send and receive money from the safety of their own homes, in more than 70 countries.

Reported 57% digital transaction growth for the quarter, marking a continued acceleration from the fourth quarter 2019. „Performance was driven by market expansion, high customer retention rates, and strong demand for the MoneyGram app.”, the company said.

At quarter end, Digital transactions accounted for 18% of all money transfer transactions, and this percentage has grown significantly to 28% in the first 27 days of April

MoneyGram Online, comprising 73% of the Digital business, remained a key driver, with transaction growth of 60% for the quarter, and 66% in the post-COVID period, powered by:

. Triple-digit growth in both the U.S. Outbound and International markets

. App downloads increasing 46%

. App transaction growth exceeding 200%

MoneyGram also reports improvements in customer retention rates of 23%, and monthly active customers of 40%.

Transactions sent direct-to-account or wallet increased 80%, and in April these growth rates have improved further to more than triple digits.

As a result of the uncertainty created by the COVID-19 pandemic, the company is not providing a second quarter outlook.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: