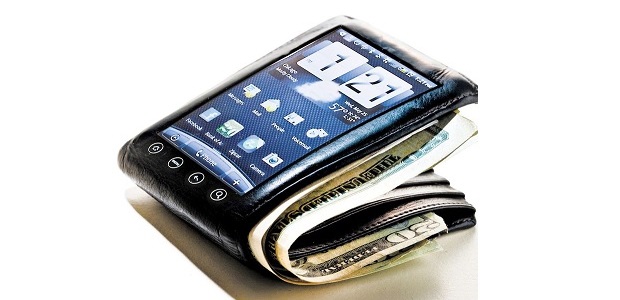

Global spend via mobile wallets is expected to rise by nearly 32% this year to $1.35 trillion, a new study from Juniper Research has found. The study – Mobile Wallets: Service Provider Analysis, Market Opportunities & Forecasts – found that spend is currently concentrated in the Far East & China, due primarily to the success of Alipay and WeChat. However, it claimed that moves by key players such as PayPal and Apple to offer wallets which can be used both instore and online means that wallets will increasingly become the default payment mechanism in other markets.

PayPal in Pole Position

The research, which forms „the most comprehensive report on the wallet industry available in the market”, highlighted PayPal’s decision to introduce an HCE (Host Card Emulation) NFC solution to enable POS payments as a key disruptive moment in the wallet wars. According to the research, this – allied to the burgeoning success of its social payments subsidiary Venmo – places PayPal in pole position to capitalise on the increased demand for mobile wallets.

Indeed, the company classified PayPal as the “Established Leader” within its Mobile Wallets Leaderboard, which provides a comparative assessment of wallet providers including Alipay, Apple, Mastercard, Paytm, Samsung and WeChat.

European Market to Benefit from Deregulation

Additionally, the research argued that the implementation of the PSD2 (Payment Services Directive 2) legislation should spur further competition within the European wallet space, with existing players poised to introduce additional services to complement their payment offerings.

However, it warned that outside emerging markets, remaining mobile network operator wallet ventures were unlikely to gain traction. According to research author Dr Windsor Holden, “Network operators remain wedded to offline payments based on an NFC SIM card, at a time when more agile competitors are deploying integrated HCE wallets that also enable online usage.”

Source: Juniper Research

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: