Mastercard announced its plans to launch artificial intelligence (AI) bots that allow consumers to transact, manage finances, and shop via messaging platforms.

According to research firm Gartner, nearly $2 billion in online sales will be performed exclusively through mobile digital assistants by the end of 2016. Mastercard is developing bots for both its merchant and bank partners, which will use chat, messaging and natural language interfaces to communicate with consumers. With the Mastercard bots, partners can have a true dialogue with consumers and provide personalized service, seamless user experience and contextual offers and rewards.

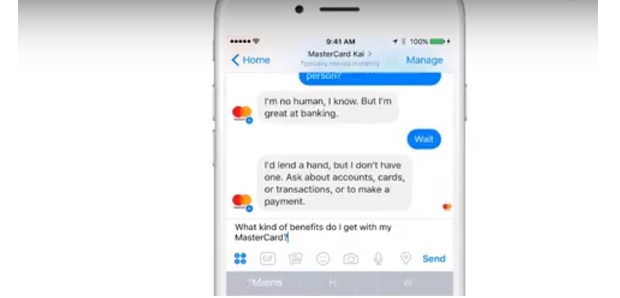

MasterCard account holders will soon be able to check on their accounts, track their spending, review past purchases and more right in Facebook Messenger. That’s right – MasterCard is the latest company to embrace Facebook’s chatbot platform as a new means of interacting with its customers in an automated, but A.I.-enhanced way.

The company announced its plans at the Money 20/20 conference this week. The bot itself is powered by Kasisto’s conversational A.I. platform KAI, a spin-off from SRI International. (SRI, as you may know, was also home to Siri before Apple acquired it.)

With the bot, customers will be able to ask a number of questions about their accounts, as well as set spending alerts, learn about their cardholder benefits, and receive offers through the MasterCard Priceless Experiences program – its local deals initiative.

The new bot is currently in pilot testing, but the company says it will roll out to all of Facebook Messenger’s 1 billion users, starting early next year, in the U.S. first.

Wath the video to see how it works

In addition, MasterCard also detailed its MasterCard bot for merchants, will allow online shoppers make purchases on messaging platforms, like Facebook Messenger. Later this year, merchant partners will be able to access MasterCard’s Bot Commerce API to start testing MasterCard integration in their own chatbots, says the company.

“At Mastercard, we believe that AI-driven conversations between companies and their customers can drive better customer experiences in places and platforms that consumers are already engaging in.,” said Kiki Del Valle, senior vice president, Commerce for Every Device, Mastercard. “Mastercard Labs has been testing integration of key Mastercard products and services within different messaging platforms and we’re thrilled to test Mastercard KAI on Messenger first. We will keep moving this test-and-learn approach to the next phase by developing chatbots that are naturally ingrained into a consumer’s daily life and helps our partners stimulate business interactions that are more conversational.”

MasterCard is not alone in embracing bot-based commerce. Though it’s unclear that consumers themselves have warmed to the idea of interacting with virtual assistants for online shopping and account management, that hasn’t seemed to slow companies down from developing for the various messaging platforms. For example, American Express debuted its own Facebook Messenger bot earlier this year, and yesterday, PayPal announced its own plans for further Messenger integrations.

Sursa: MasterCard

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: