Mastercard launches Global Cybersecurity Alliance Program – an ambitious effort to help businesses manage their cyber risks

Mastercard Incorporated has announced the launch of its Global Cybersecurity Alliance Program to help organizations secure their digital ecosystems from increasing third- and Nth-party cyber risk – projected to account for 60% of cybersecurity incidents in 2022.

Organizations are under continuous pressure to efficiently monitor and secure their ever-growing and evolving online footprint, including external business and supply chain relationships. Recent data from RiskRecon and the Cyentia Institute highlights that multi-party cyber breaches can cause 26 times more financial damage, compared to an attack that affects only one target.

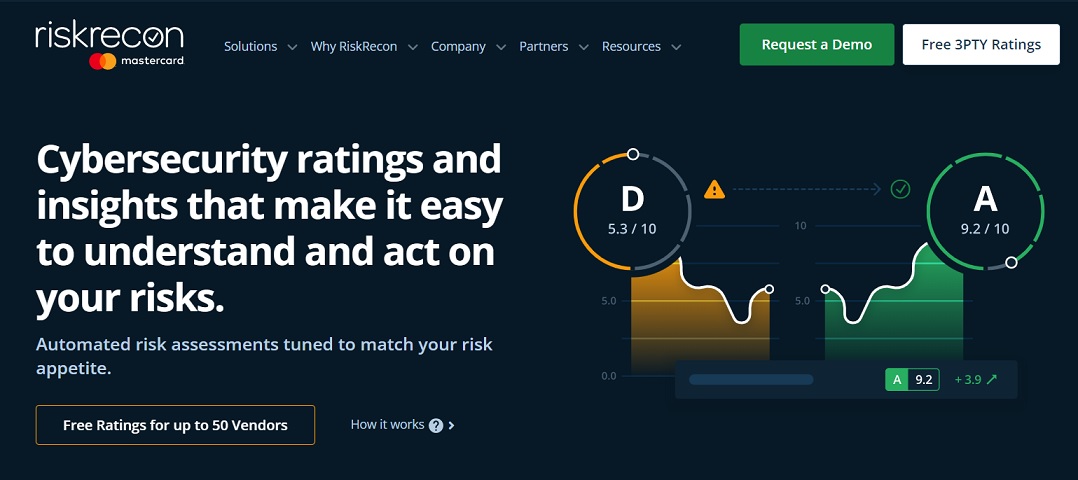

Mastercard’s Global Cybersecurity Alliance Program provides user-friendly APIs to extend cyber risk monitoring and scoring to partners’ customers. These insights can then be used to build a scalable, third-party risk reduction program.

„The goal of the program is simple: help businesses improve the security of their third parties, thereby helping enhance the security of the digital ecosystem,” Mastercard said.

“As the digital landscape evolves, it is becoming more interconnected. Businesses of all shapes and sizes are now working with more companies than ever before to access the services and support they need – and protecting these complex ecosystems can be extremely challenging,” said Johan Gerber, Executive Vice President of Security and Cyber Innovation, Mastercard. “Mastercard is investing in new technologies and programs to help our customers manage cyber risk across their extended ecosystems. The Global Cybersecurity Alliances Program is designed to help more organizations arm their customers with the cyber risk intelligence they need to confidently make better and faster risk decisions.”

“Our Third-Party Risk as a Service offering leverages leading risk data sources. Mastercard’s cybersecurity ratings bolster our services, allowing our customers to identify, prioritize, and act on cyber risk quickly, efficiently and based on their unique risk appetite,” said Matthew Moog, Principal, EY.

Since its inception, the Global Cybersecurity Alliance Program has quickly gained market momentum and expanded its alliance partners to include Aravo, Archer, Argos Risk, ComplyScore, CyberGRX, Deloitte, EY, HSB / Munich Re, Interos, Kroll, LogicGate, OneTrust, Privva, ProcessUnity, Standard Fusion, TealBook, Tech Mahindra, Venminder, Whistic, Wipro and other organizations across the most highly regulated industries.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: