The Bank of Korea (BOK) plans to push ahead with its ‘Coinless Society’ project to ease the inconvenience of using and carrying coins and to reduce the social costs incurred in their circulation and management.

As a first step towards its implementation, the BOK chose a feasibility study on introducing a coinless society as one of the key action plans for 2016 as indicated in its ‘Payment System Policy Roadmap – Vision 2020’, (published in January 2016).

Subsequently, a dedicated Task Force was formed to delve into this issue and develop a specific model to put the project into practice. In April 2016, the Bank of Korea formed a ‘coinless society working group’ to discuss ways to resolve any relevant technical and systemic issues, and to consider how to push ahead with a pilot program.

In the process of the efforts, a public survey was also performed to collect views of the general public. Its results showed that respondents are not much willing to reuse their changes due to the inconvenience of carrying coins. The majority view was in favor of a push for a coinless society (50.8% in favor, 23.7% opposed).

The plan, with the aims of enhancing the convenience to the general public and reducing social costs, will be carried forward in a way to decrease the circulation of coins, by effectively utilising a well-constructed digital payment infrastructure. However, it does not aim at eliminating coins completely.

A virtuous circle of declining use of coins will be pursued, creating a market mechanism supporting industry’s voluntary participation in the initiative.

A Model to Implement the Pilot program

In the first phase, a model to implement the pilot program will enable merchants to return retail consumers’ changes to their prepaid cards electronically. In the subsequent phase, an alternative way may be explored further so as for the merchants to return the changes to the consumers’ bank accounts directly.

Convenience stores are being considered as the first physical location for the operation serving as a testbed of the initiative as 1) these stores conduct large volumes of small value transactions at the forefront of retail network, and 2) they provide consumers with top-up services for their prepaid cards.

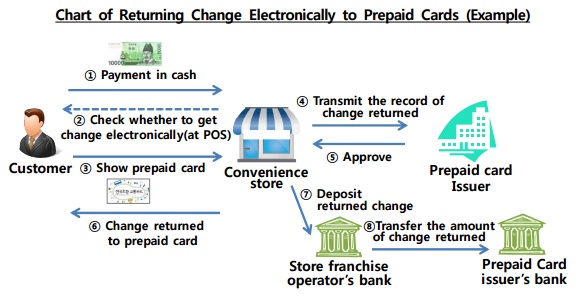

The chart below illustrates how a value equivalent to change will be returned to prepaid cards electronically when a consumer makes a physical cash payment at a convenience store. In lieu of returning physical change to a consumer, a merchant will add the equivalent amount to his/her prepaid card value through a prepaid card top-up terminal in the convenience store, followed by subsequent settlement between the store franchise operator and prepaid card issuer.

Under the model, system construction costs will be minimized by employing existing prepaid card top-up terminals operated in convenience stores. Furthermore, smooth transition of retailers and consumers to the initiative is expected given that the model is akin to the ways of current prepaid card top-up network.

Creating an Environment to Reduce Use of Coins

The BOK, by promoting the pilot program, will raise consumers‘ awareness of its benefits, thereby encouraging them to ask their change value to be deposited to prepaid cards instead of physical coins. In parallel, a business environment will be pursued in collaboration with relevant industries so as to create an incentive for them to develop and provide new variants of services for returning changes electronically to consumers. For instance, direct return of changes to consumers’ bank accounts or accrue his/her mobile or reward points etc.

Implementation Timeline

The pilot program will be conducted in 2017 for convenience stores and prepaid card issuers who join the project. In the first half, pertinent system revision will be completed and then the pilot program will go live. Over the course of the implementation, the BOK will assess the progress comprehensively and throughly review whether the project should be pushed forward in full swing.

The BOK will support the widespread development of models for returning changes based on electronic measures belonging to new breeds out of the pilot program, along with continuous promotion to raise public awareness of the initiative. Between 2018 ~ 2020, on the basis of successful placement of the models in previous phases, the project will expand its service territory by both attracting more service providers and diversifying the instruments for returning changes.

Results of Survey on ‘Coinless Society’

Overview The Bank of Korea performed public survey to 2,500 people (over age 19) from June to September in 2016.

Source: The Bank of Korea

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: