Klarna, a leading global retail bank, payments, and shopping service, today announced its plans for the international expansion of two of Klarna’s fastest-growing products across nine of its key growth markets.

Klarna’s rewards program will soon be available in the UK, Ireland, France, Italy, Spain, Portugal, Poland, Canada & New Zealand.

Pay Now, which launched in the US and UK in 2021, will soon be accessible in Australia, Ireland, France, Italy, Spain, Portugal, Poland, Canada & New Zealand.

Both products will become available across all Klarna markets over the course of 2022.

With the global growth of Klarna’s rewards program and the payment method Pay Now, which enables consumers to pay immediately and in full, „Klarna will become the go-to for any type of purchase whilst also rewarding consumers for every payment”, according to the company.

The further expansion of these products enables the company to serve a wide range of fast-growing verticals whilst driving consumer loyalty and engagement. Consumers in these markets will now be able to manage all of their payments, redeem their rewards and access a wide range of services and content in the Klarna App.

Sebastian Siemiatkowski, CEO and co-founder of Klarna, said: “With the introduction of Pay Now, Klarna will offer consumers in more markets the choice to pay immediately and in full, alongside our sustainable, interest-free Pay Later services. From large purchases to everyday essentials like mobility services and entertainment, Klarna provides consumers with maximal choice, control and flexibility in how they pay for every single purchase and rewards them for every payment they make on time.”

“With our rewards program, we help consumers get more out of every dollar they spend and actively encourage consumers to pay for their purchases on time, making money management fun and engaging.” said Camilla Giesecke, Chief Expansion Officer at Klarna. “Members of the rewards program have a 50% higher engagement with the Klarna App than non-members, demonstrating its effectiveness to build long-term loyalty and strengthening the Klarna App as a growth channel for our retailers.”

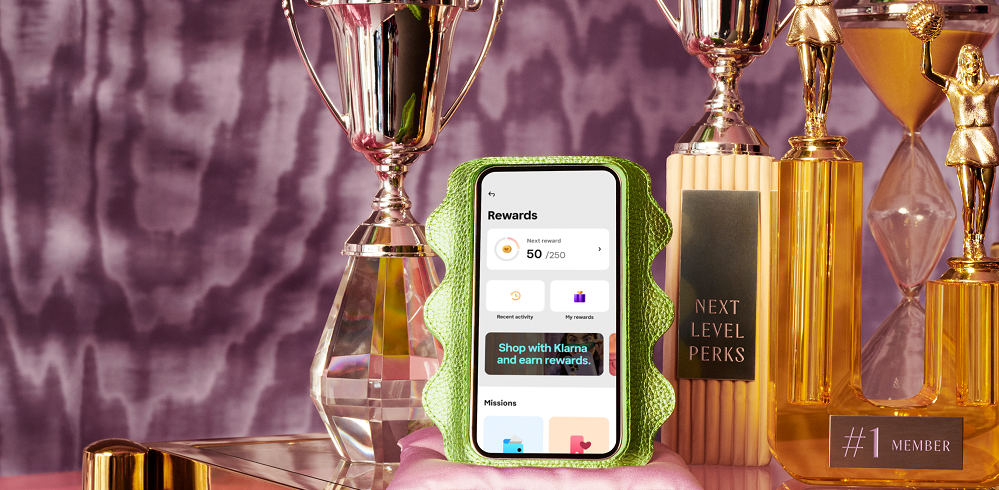

How Klarna’s rewards program works

Since its launch in September 2020, Klarna’s rewards program has gained over 4 million members in the US and Australia, with 1 million members joining in the last quarter alone. Now, it is expanding to nine further Klarna growth markets.

Members of the rewards program earn “points” for every payment they make on time with Klarna, no matter whether they pay now, pay later or pay over time. The points can be redeemed in the Klarna App for rewards at world-class brands including H&M, Amazon, Walmart, Footlocker and many more.

Members of the program also benefit from exclusive deals and gain early access to product drops from hand-picked merchants. As part of the international expansion of the rewards program, Klarna is also introducing “Missions”. Missions are small, engaging tasks that consumers can complete to earn points, aimed at encouraging consumers to discover different features in the Klarna App and take control of their finances.

How Pay Now works

Hand in hand with the international expansion of Klarna’s rewards program, Klarna is also launching its popular payment method “Pay Now” in nine Klarna markets as part of an entirely redesigned “one-click” checkout flow, enabling consumers to pay immediately and in full wherever Klarna is available. Consumers simply connect their existing card to their Klarna account and safely pay in full with just one click at every Klarna retailer.

The introduction of Pay Now comes as part of a new Klarna checkout flow, which will be implemented across all Klarna retailers resulting in a consistent, recognizable experience for consumers every time they select Klarna at checkout. At the heart of the new flow lies the review screen, which gives consumers a quick and transparent overview of their order, their payment schedule and chosen funding source. The consumer’s billing details will be pre-filled and their preferred payment option will be set as a default, enabling a one-click experience that saves time at every checkout.

The product expansion follows closely on the heels of the launch of the company’s all-in-one shopping app across 17 markets, which empowers consumers to shop with Klarna at any online store and is used by over 45 million consumers worldwide. These product developments are accelerating Klarna’s growth in new markets both on the consumer and the retailer side. Klarna has now surpassed the milestone of 1 million consumers in Italy, Spain and France since the launch in Summer and Autumn 2020, where leading brands such as Lacoste, ba&sh, Samsung, Diesel, and H&M are among the most recent retailers to integrate Klarna’s technology.

______________

Since 2005 Klarna has been on a mission to revolutionize the retail banking industry. The company has over 100 million global active users, more than 250,000 global retail partners and 2 million transactions per day.

With over 5,000 employees, Klarna is active in 20 markets and is one of the most highly-valued private fintechs globally, with a valuation of $45.6 billion.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: