ING international survey: „While people still prefer their own bank, the challengers are becoming better known – and more trusted”

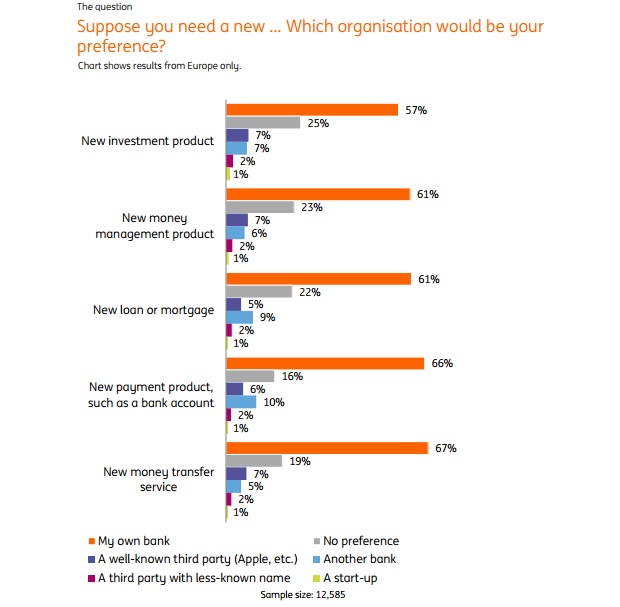

Emerging technologies are changing the banking scene for consumers. Yet, when asked which organisations they would prefer to go to for a range of new products, most people in Europe, the USA and Australia still reply: “My own bank”, according to the latest ING international survey recently published.

A quarter simply have no preference, whether the item is a new investment product, money management product, loan, payment product or account, or money transfer service.

It seems that trust in a brand or name is key. For example, the third most-favoured option is “another bank” or a “well-known third party”.

Less favoured are start-ups or “less-known” firms. This idea may be backed up by comparing these results with our Mobile Banking 2015 and 2016 survey findings.

In 2015 and 2016, we asked: “Of the following channels, which would you trust most?” The possible answers were “my bank”, “named groups (such as Google or Apple)”, “other suppliers”, “social media” or “other banks”.

In both years, more than three-quarters of respondents in Europe replied “my bank”. However, the share who selected third-party “named groups” as their answer doubled in a year − from five percent in 2015 to 11% in 2016. While people still prefer their own bank, the challengers are becoming better known – and more trusted.

About the ING International Survey

The ING International Survey aims to learn how retail customers– and potential customers – around the globe spend, save, invest and feel about money. It is conducted online several times a year, with reports hosted at www.ezonomics.com/iis.

Ipsos conducted this survey between 7 February and 27 February 2017. Sampling reflects gender ratios and age distribution, selecting from pools of possible respondents furnished by panel providers in each country. European consumer figures are an average, weighted to take country population into account. 15 countries are compared in this report and about 1,000 respondents were surveyed in each, apart from Luxembourg, with 500. 14692 is the total sample size of this report.

Source: www.ezonomics.com

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: