Italian payments giant SIA announced it has hired JP Morgan as financial advisor for all ‘extraordinary transactions’ – including a possible IPO. The firm, which is controlled by state lender CDP Equity, confirmed last month that it was beginning the listing process.

It said then that it could issue ordinary shares on the Mercato Telematico Azionario market by the summer, although a merger with another payments player was not ruled out.

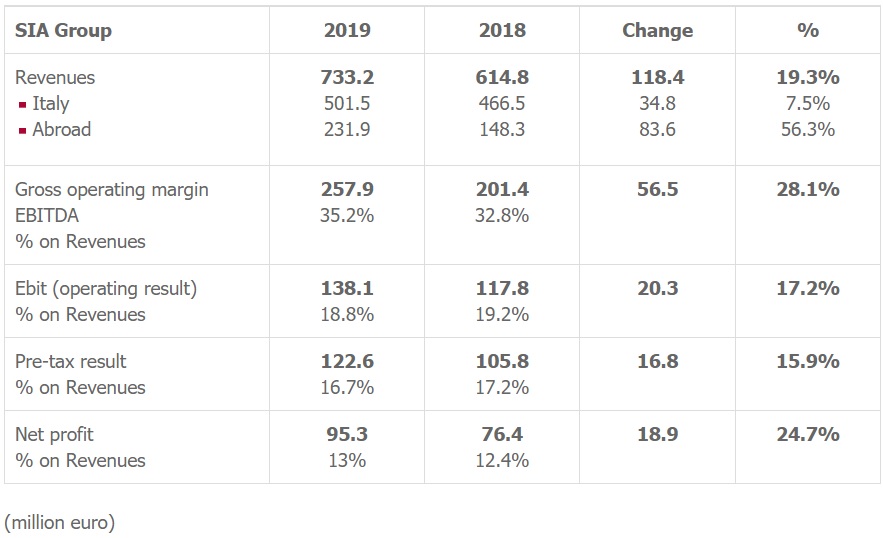

Reporting its 2019 results, SIA says consolidated revenues rose 19.3% to EUR733.2 million, with gross operating margin (Ebitda) up 28.1% to EUR257.9 million.

MAIN ECONOMIC-FINANCIAL RESULTS OF SIA GROUP

In 2019, SIA Group revenues rose to €733.2 million with a growth of €118.4 million (+19.3%) over 2018. Net of the commission expenses of subsidiary SIApay, reclassified net revenues reached €727.9 million.

The Card & Merchant Solutions segment with revenues of €490.5 million represents 67% of overall revenues, the Digital Payment Solutions segment with revenues of €150.8 million makes up 21% of the Group total, while the Capital Market & Network Solutions segment saw revenues of €92 million (12% of total revenues).

At geographic level, revenues in Italy totaled €501.3 million, up by €34.9 million (+7.5%) and representing 68% of total revenues (76% in 2018).

Revenues from abroad saw a sharp rise reaching €231.9 million, up by €83.6 million (+56.3%) and make up 32% of total revenues (24% in 2018) thanks to the strategy of internationalization carried out with success by the Group in past years.

„It should be said, in particular, that SIA has taken on the position of leading operator in Greece and other countries in central-south-eastern Europe including Croatia, Czech Republic, Hungary, Romania, Serbia and Slovakia, representing one of the most important and fastest growing areas in Europe in the electronic payments sector.”, according to the press release.

BUSINESS TREND

In 2019, SIA Group processed a total of 16.1 billion issuing and acquiring transactions in the Card & Merchant Solutions segment (+8.3% over 2018).

In the Digital Payment Solutions segment, 16.3 billion transactions were processed with a slight decrease (-2.2%) over the previous year due, in particular, to the rationalization of exchanges among German commercial banks.

In the Capital Market & Network Solutions segment, last year approximately 4.5 terabytes of data were carried on the 208,000 km of the SIAnet network, up by 28.7% over 2018, with total infrastructure availability and 100% service levels.

THE POSITIONING OF SIA GROUP IN DIGITAL PAYMENTS

In 2019, SIA Group confirmed its positioning as the leading hi-tech operator in the processing of digital payments and management of the European service infrastructures, in particular in the segments of Card & Merchant Solutions, Digital Payment Solutions, and Capital Market & Network Solutions. The geographic coverage of the services provided by SIA Group extends to over 50 countries in Europe, the Middle East, Africa and Oceania.

SIA Group operates in three distinct business sectors:

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: