Financial Institutions are set to miss out on an additional 42% of payments-related revenue and legacy cost savings of up to 21% annually if they fail to migrate to future-ready paytech platforms.

According to a new study by IDC Financial Insights sponsored by Episode Six (E6), a global provider of enterprise-grade payment processing and digital ledger infrastructure, spending on legacy paytech is rising rapidly and damaging the growth prospects of banks around the world. Global financial institution (FI) spend on outdated payment systems is expected to climb to $57.1 billion in 2028 from $36.7 billion in 2022, with an average annual growth rate of 7.8%.

The IDC InfoBrief ‘Future Ready Payments Platforms Enabling the Next Phase of Growth for Banks’ also reveals the hidden costs of legacy paytech, which renders banks unable to compete for new payments-related income. FIs are set to miss out on an additional 42% of payments-related revenue and legacy cost savings of up to 21% annually if they fail to migrate to future-ready paytech platforms.

IDC found that these revenue boosts are derived from the additional capabilities delivered by future-ready paytech. These include new product creation, such as deferred payments or digital wallet platforms (22%), Banking-as-a-Service (BaaS) and Payments-as-a-Service (PaaS) revenue (12%) and data monetization (8%). The annual savings come from retiring unneeded legacy technology (8%), orchestration cost benefits (5%), downtime reduction (4%) and development cost reductions (4%).

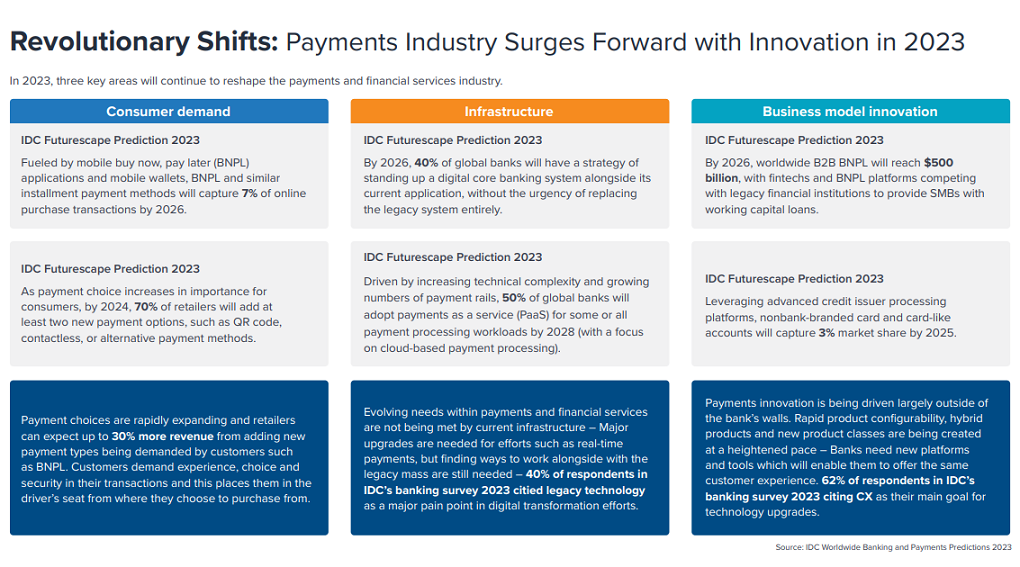

40% of respondents in IDC’s 2023 banking survey cited legacy technology as a major pain point in their digital transformation efforts. Because of this, banks and FIs around the world are actively looking for future-ready payments technology to enable their next phase of growth and innovation. Driving this change are three major forces:

Consumer demand: As payment choice increases in importance for consumers, by 2024, 70% of retailers will add at least two new payment options, such as QR codes, contactless, or alternative payment methods.

Infrastructure: Driven by increasing technical complexity and growing numbers of payment rails, 50% of global banks will adopt PaaS for some or all payment processing workloads by 2028, with a focus on cloud-based payment processing.

Business model innovation: By 2026, worldwide B2B BNPL will reach $500 billion, with BNPL platforms competing with legacy FIs to provide small- and medium-sized businesses with working capital loans.

While the forces behind the payment landscape are similar globally, each region has a different focus when it comes to payments transformation:

North America: Bank payments remain dominant in the U.S. and other parts of the Americas, where credit cards have been the primary method of digital payments. New options are emerging as merchants seek alternative ways to improve customer experience, leverage data and reduce fees. IDC predicts that by 2028 non-bank digital payments like deferred payments, card-like schemes and mobile wallets will overtake digital bank payments in growth, reaching $24.8 trillion by 2028. For banks to compete they’ll need a future-ready paytech platform to enable payments anywhere and everywhere.

Europe: Home to the open banking movement, the region is starting to benefit. By 2028 the European PaaS market is set to reach $59.7 billion in value. Due to the complex regulatory requirements of PSD2 there has been a rise in specialist PaaS service providers. Several European banks have already established partnerships with providers to handle their payment processing. This trend is expected to grow as more providers emerge and expand their PaaS capabilities. These providers already have the future-ready paytech required, this can then connect to the banks’ core systems and execute payments on their behalf.

Asia Pacific: While Europe sees growth with PaaS, the APAC region is maximizing the opportunity for BaaS. Asia Pacific banks have smaller IT budgets than in North America and Europe, creating opportunities for BaaS. As a result, APAC banking estimated revenue from BaaS partners is set to represent 30% of all banking revenue by 2028. Banks wanting to benefit from BaaS opportunities will need best-in-class scalability and open, future-ready platforms to support these innovations.

Based on IDC’s analysis, moving to new future-ready paytech platforms delivers new product and service innovation for banks and financial institutions. Currently, only 5% of global FIs have future-ready paytech, meaning there’s significant room for improvement.

„Maintaining legacy payment technology systems creates a ‘lose-lose’ scenario for banks. On the one hand, they’re spending more and more money to maintain outdated payment systems, constraining technology budgets urgently required to digitally transform their businesses. On the other, they’re missing out on substantial, long-term revenue opportunities to emerging competitors. But, given the business-critical role that paytech plays in banks, most will not be able to ‘rip-and-replace’ legacy systems,” said John Mitchell – CEO of Episode Six.

„A progressive modernization approach defines a faster path to transform mature banks into truly digital banks. By progressively modernizing specific parts of their payments stack, banks benefit from the new capabilities of modern future-ready platforms, reduce costs and technical debt, while at the same time minimizing disruption from full switchovers to new platforms.„

„Payments innovation is being driven largely outside of the banks’ walls. For banks and FIs that wish to be competitive in the next phase of payments, a future-ready payments platform will provide the core capabilities required, including quickly integrating a modern payments technosphere,” said Michael Yeo, Associate Research Director at IDC Financial Insights.

„As this Infobrief also reveals, migration methodologies have become optimized and provide easier and less risky options to move away from legacy to truly embrace digital transformation by leveraging cloud infrastructure’s specific properties.„

The IDC InfoBrief sponsored by Episode Six ‘Future Ready Payments Platforms Enabling the Next Phase of Growth for Banks’, document #AP241432IB, June 2023, can be downloaded free of charge here.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: