Fines for anti-money laundering (AML) failings by regulated institutions were five times higher in 2020 than 2019, totalling $2.2 billion

The COVID-19 pandemic has not slowed regulators’ enforcement focus on anti-money laundering (AML) and sanctions failings, with the value of fines increasing considerably in 2020 from 2019, according to Kroll.

AML remains a key area of focus for regulatory enforcement action globally. It has on average consistently dominated both the number of fines and fine values for financial crime failures over the past five years.

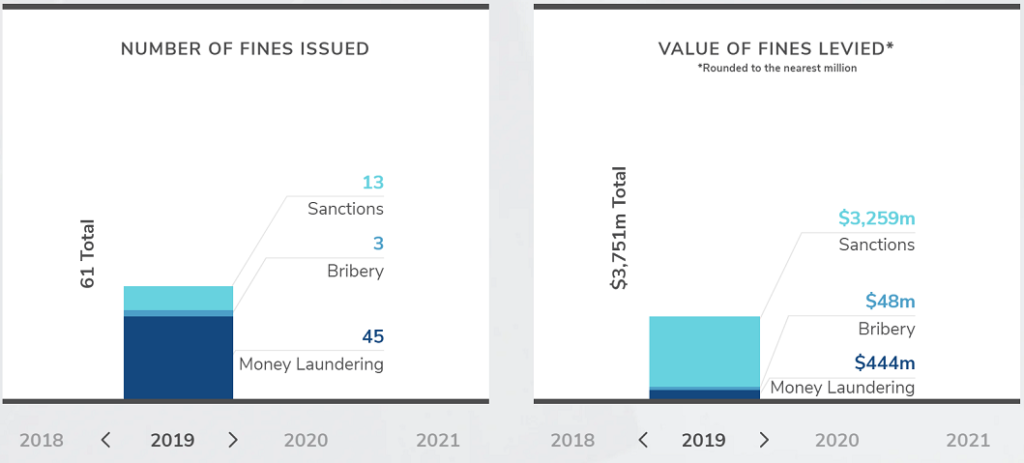

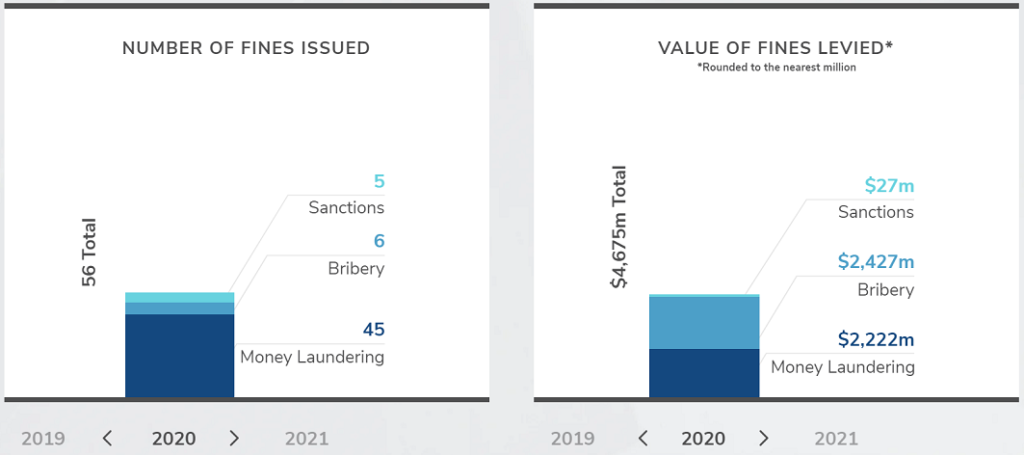

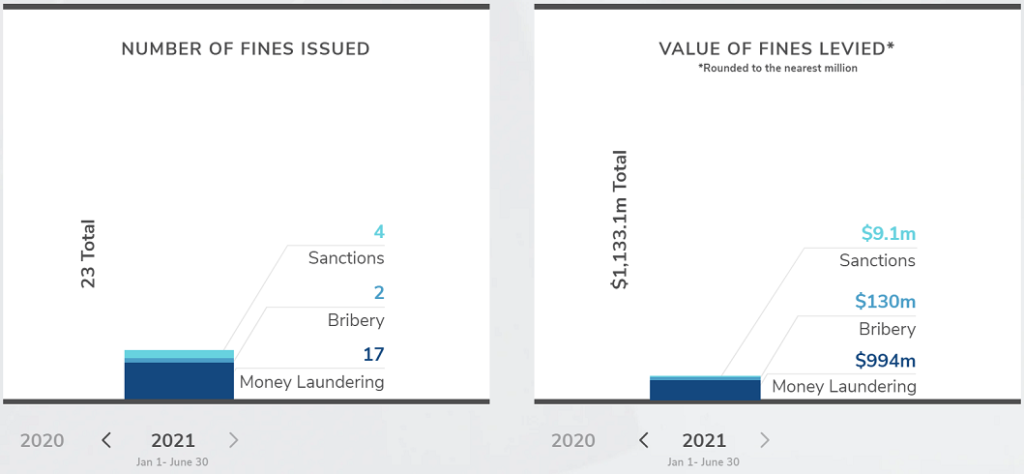

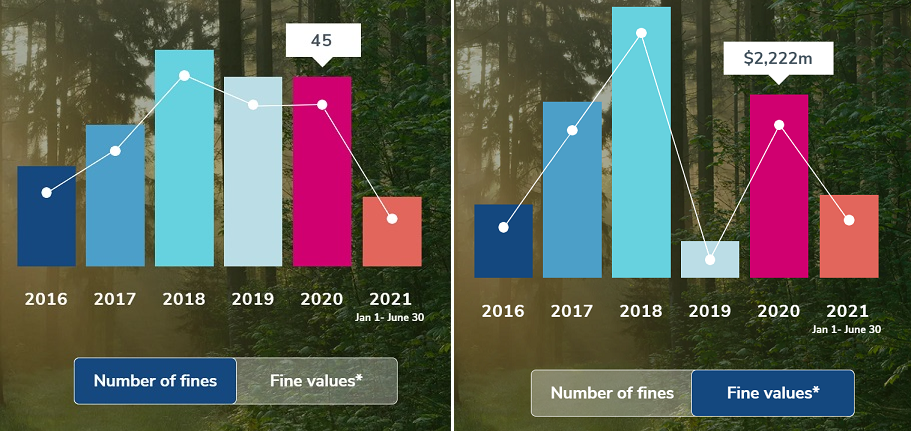

The company’s annual Global Enforcement Review 2021 shows that, globally, 45 fines for AML failures were issued in 2020, the same as in 2019. Moreover, the first half of 2021 seems to be following suit, with 17 fines issued between January and July, just under half of 2020’s year-end total.

Despite the consistency in the volume of fines issued, the total value of AML enforcement has rocketed, reaching USD 2.2 billion at the end of 2020, which is five times higher than in 2019 and over two-thirds of the record levels recorded in 2018 (USD 444 million and USD 3.3 billion, respectively). Similarly, the total value of AML fines as of June 2021 is nearly half of the 2020 total, standing at USD 994 million.

Kroll’s report also highlights the four key AML failings from 2016-2021 that regulators across the world have consistently identified through the fines they imposed: AML management (124 cases), suspicious activity monitoring (98 cases), customer due diligence (94 significant cases), and compliance monitoring and oversight (57 cases).

Globally, the number of fines issued in 2020 was at the same level as those in 2019, however the total value of AML enforcement fines is five times higher in 2020 following numerous substantial fines by Nordic regulators. Moreover, fine amounts in 2021 may reach similarly high levels as previous years, with the total value of AML fines as of June 2021 nearly half of the 2020 and 2017 totals.

AML management, suspicious activity monitoring, customer due diligence, and compliance oversight are the most frequently cited failings, a trend that is consistent across all regions globally. Firms should continue investing in these areas to minimize their financial crime risk and potential exposure to regulatory enforcement action.

______________

Kroll’s Global Enforcement Review 2021 provides insights on global enforcement trends with a focus on the financial services industry.

In compiling this research and analysis, Kroll has used the Corlytics’ extensive RiskFusion Global Enforcement database for the period January 1, 2016 to June 30, 2021. Corlytics is a world leader in determining of regulatory risk impact.

Corlytics prioritizes and selects penalties for inclusion in the database based on the following criteria:

. Enforcement penalties are from high priority financial services regulators and cover enforcement actions against both firms and individuals.

. Enforcement penalties greater than $1 million (mn) or equivalent across all selected regulators. For individuals, the $1 mn threshold does not apply.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: