FICO report: card fraud in Europe are going up – Romania has the highest level of security and the lowest fraud level

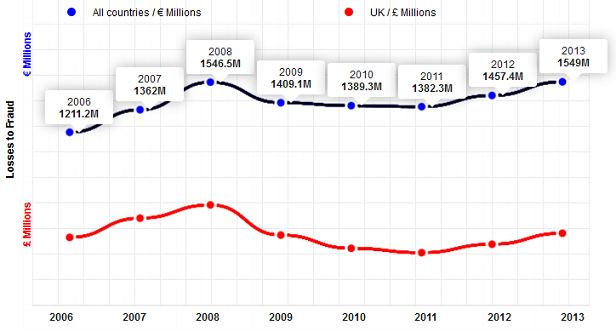

That is made clear by FICO’s latest map of card fraud in Europe, which shows card fraud losses in 2013 for 19 European countries reached €1.55 billion, slightly more than the previous peak in 2008. The UK and France suffered 62 percent of the total fraud losses for the 19 countries in the fraud map, reflecting their higher rates of card usage, which make them targets for criminals. „When we add Germany, Russian and Spain, you arrive at 80% of the total losses”, according to FICO report.

Ten of the countries saw a rise in fraud compared to 2012, while nine stayed the same or saw reduced losses.

While Visa Europe representatives say that growth in Visa contactless payments is accelerating in the UK market „at a phenomenal pace”, the FICO report show that the very same market has the highest level of card fraud in Europe.

Consumers made almost 20 million (19.7 million) contactless transactions across the UK in May 2014, an 18% increase on April 2014 alone. More than 37.8 million contactless cards have now been issued by UK banks, a 35% increase on the same period last year, acording tofigures released by Visa Europe today. Data provided by the Euromonitor International present another image where we can see how card fraud losses goes up 32% in UK, for the last two years, reaching £ 535 mil.

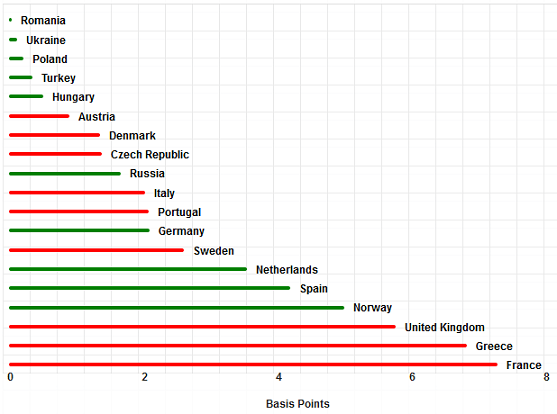

While the UK had the highest losses, mainly fuelled by card not present (CNP) fraud, France and Greece both had higher ratios of fraud losses to card sales, at 7 basis points (.07 percent). And fraud grew fastest in Russia, jumping nearly 28%. Romania seems to be the safest country with the lowest level of the card fraud losses and the highest security level out of all 19 analysed countries.

The card industry often measures fraud losses in terms of „basis points” – 100 basis points = 1 percent of card sales. A basis points level of 5 or less reflects a relatively low threat level from card fraud. As we can see below, Romania is 0,0 basic points.

Fraud threat levels – fraud security levels

„Fraud is like a ballon – squeeze it in one place and it bulges somewhere else.”, said Martin Warwick, a principal fraud consultant at FICO in EMEA, who provided the commentary for the map. „This is why it’s vital to be as strong as your European neighbours at fighting fraud, to be able to <adjust the dials> on fraud prevention while ensuring a good positive experience.”

FICO predicts these losses will start a new wave of initiaves by regional bodies and card issuers which will cause new fraud migration patterns. That’s what happened after previous peak, in 2008.

„These losses are a wake-up call that should start a new wave of anti-fraud initiatives by regional bodies and card issuers. After the previous peak, in 2008, this led to new fraud migration patterns. Unfortunately, many organisations do not maintain continuous investment in fraud prevention systems and staff — they invest only when the problem grows. The companies and countries that aren’t investing this year will be the new targets for criminal activity.” considers Martin.

For more details download the FICO report – Evolution of card fraud in Europe 2013

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: