European study of business adoption: 10% of all transactions will be contactless within the next three years

Gemalto spoke to 240 banking, retail, telecoms and transport business-decision makers across Spain, Germany and the UK about their attitudes to contactless technology, both now and in the future. They found out that nine in 10 businesses are now running contactless projects.

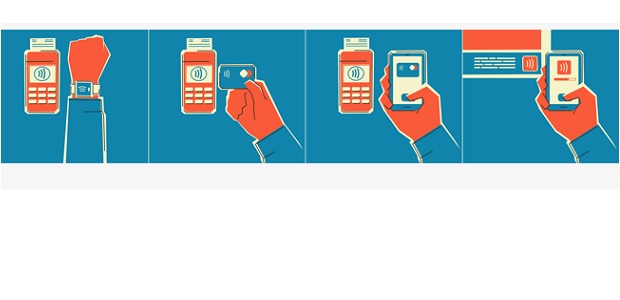

Although there is not yet a clear dominant payment option favoured among respondents, with contactless payment cards (52%), mobile (50%), wearable devices (43%) and contactless store/loyalty cards (42%) being the current leading choices, the business leaders interviewed expect that 10% of all transactions will be contactless within the next three years, according to the press release.

The top three drivers for adopting contactless solutions identified by the study are faster payments (74%), being seen to innovate (43%) and cost-effectiveness (42%). Reputational benefits are also important — 38% believe it helps them to be seen as market leaders and 33% think that it differentiates them from competitors.

In order to overcome the technical aspects of the deployment stage, half of respondents believe they will need to outsource this to a trusted partner, with 12% saying they will outsource the entire process. 30% of participants are set to launch a contactless solution through their own brand and 33% plan to “partner with someone launching under their brand”.

“Our survey indicates that businesses are going all in on investing in contactless, which is reflective of today’s consumer demand for convenience, speed and choice,” says Howard Berg, senior vice president of Gemalto UK and Ireland. “To get to a point in a few short years where businesses predict that 10% of all their payments being made via such a new channel is remarkable. This is testament to the benefits that businesses are already experiencing in terms of operational efficiency and reputational advantage.”

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: