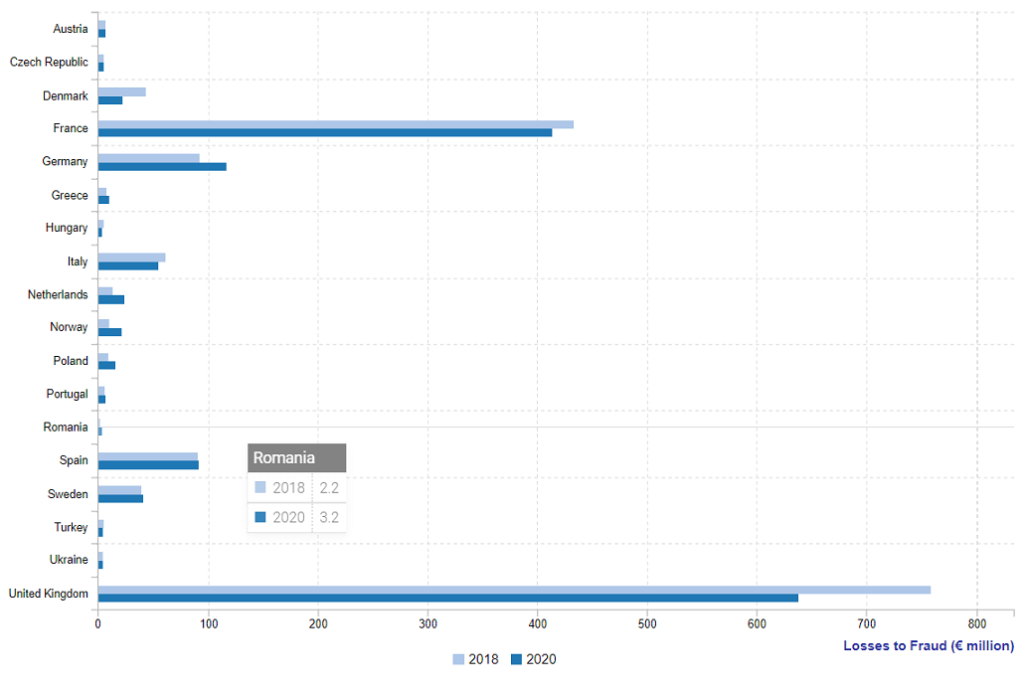

Romania recorded increasing losses generated by card fraud in 2020. The total value lost to fraud amounted to 15,1 million lei (3,1 mil. Euros), according to FICO data. Out of this value, Card Not Present stands for 13,9 million lei (over 92%).

New data from FICO’s updated European Fraud Map shows that the UK achieved the greatest fall in card fraud monetary losses, dropping 7 percent and £46 million year-on-year. However, other nations among the 18 European countries studied did not fare as well. Overall, card fraud losses in these countries was reduced by €62M.

Romania – „A continued challenge of increasing losses”

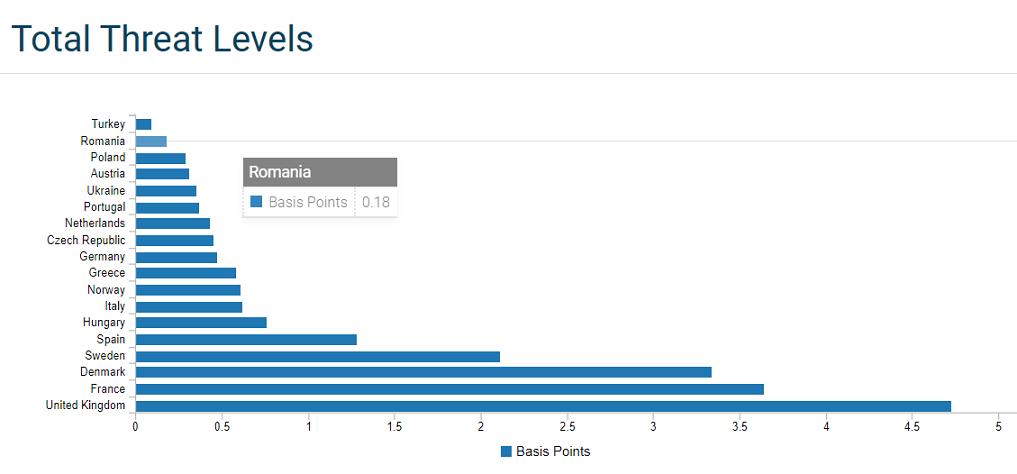

Romania has reported the fifth largest increase in the report, „which clearly indicates that more needs to be done by the remaining banks to follow suit of the leaders,” FICO says.

UK led European fraud reduction

While Europe enjoyed a sizable £54M drop in fraud loss for 2020, this was primarily driven by two countries, accounting for a reduction of £78 million between them. The United Kingdom achieved a £46M reduction (7 percent year-on-year).

The UK is not alone in reporting strong reductions in fraud, with Denmark also achieving a €21M relative reduction (21%). Hungary also made significant progress. It achieved the third best reduction in fraud loss of the studied countries, reducing fraud levels by €2M (39 percent).

However, of the 18 countries contained within the study, 12 have posted an increase in value lost to fraud in the past year, which adds up to an additional €32M of value lost. The fraudsters continued to enjoy a steady increase in success in both France and Germany, but Norway lead the increases for this year, seeing a return to its highest loss levels since 2016.

“In an incredibly challenging year, only five of the 18 countries analysed by FICO achieved a reduction in card fraud,” noted Toby Carlin, a senior director of fraud consulting at FICO.

Norway sees massive rise from phishing attacks

Unfortunately, fraud losses continued their increases in France (€6M higher than 2019), Poland (€4M higher) and Germany (€3M higher). There was also a major attack in Norway, which led to an increase in fraud losses from around €8 in 2019 to around €22 in 2020, a rise of 172 percent, the largest rise of all the countries studied.

“An impressive multi-industry response to tackle this new attack is already showing positive signs of improvement,” added Carlin. “Much has been done in the region to combat this threat, both by our banking partners and the mobile phone operators, with real success. The worrying sign here is that the fraudsters have found a hybrid attack vector for the historically ‘digital savvy’ market.”

The Norway attacks centre around large-scale phishing and smishing efforts, designed to introduce a scam which ultimately ends in fraudulent Card Not Present (CNP) transactions.

For more information, visit https://www.fico.com/europeanfraud

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: