European Commission: billions are lost because of the challenges we face in taxing digital companies

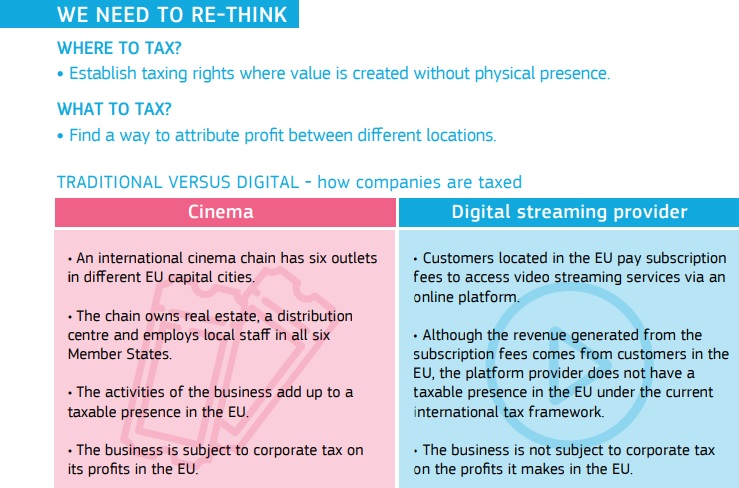

Recent reports and studies suggest that billions are lost because of the challenges we face in taxing digital companies. On 21 September 2017, the European Commission put forward its plan for the way ahead.

„The EU needs to agree an ambitious approach on taxing the digital economy by spring next year, ahead of a Commission legislative proposal. It needs to be fair, effective and competitive, mindful of future developments. If we stand still, it’s our revenues and our budgets that will suffer. It’s time to act on #FairTaxation for the digital economy.”, according to European Commission.

The European Commission set itself the challenge of finding a formula that will satisfy leaders both like France’s Emmanuel Macron, who’s demanding giant tech companies pay more taxes, as well as those concerned about driving their business away.

Commission President Jean-Claude Juncker said his officials will propose a new set of rules for taxing tech companies next year after a day of discussions at a European Union summit in Tallinn, Estonia.

Macron is leading a group of 10 countries also including Germany, Italy and Spain that want to find a way to stop companies like Google, Facebook and Apple shifting their profits to low tax jurisdictions such as Ireland or the Netherlands. Officials in Dublin, engaged in a legal fight with the commission to avoid receiving a 6 billion-euro ($7.1 billion) tax windfall from Apple, are trying to block the initiative.

“Internet giants are not contributing to funding the common good,” Macron said at a press conference after the summit on Friday. “Some Internet giants are not playing a fair. They are using their dominant position to block other players, and we’re calling for an ambitious reform on that.”

Romanian President Klaus Iohannis was among those advocating a more cautious approach to levies on Internet-based services.

“There’s a need to find an adequate method, a fair method, to tax these services because we’re facing a danger here in Europe,” Iohannis told reporters as he met fellow EU leaders in Tallinn, according to Bloomberg. “If we overdo this tax, I don’t think it will solve the problem. We’re in fierce competition with the U.S., with Asia, so if the taxation level is too high, then companies would move elsewhere and we wouldn’t gain a thing.”

Source: European Commission

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: