EBA publishes the results of its 2023 EU-wide stress test

The European Banking Authority (EBA) published the results of its 2023 EU-wide stress test, which involved 70 banks from 16 EU and EEA countries, covering 75% of the EU banking sector assets. This stress test allows supervisors to assess the resilience of EU banks over a three-year horizon under both a baseline and an adverse scenario.

The adverse scenario is characterised by severe negative shocks to economic growth, higher unemployment combined with higher interest rates and credit spreads. In terms of GDP decline, the 2023 adverse scenario is the most severe used in the EU wide stress up to now. The individual bank results promote market discipline and are used as part of the EU supervisory decision-making process.

This year’s stress test includes some important enhancements compared to past stress test exercises. These enhancements include an increased sample with 20 more banks, the introduction of top-down elements for net fees and commission income (NFCI), and a detailed analysis on banks’ sectoral exposures.

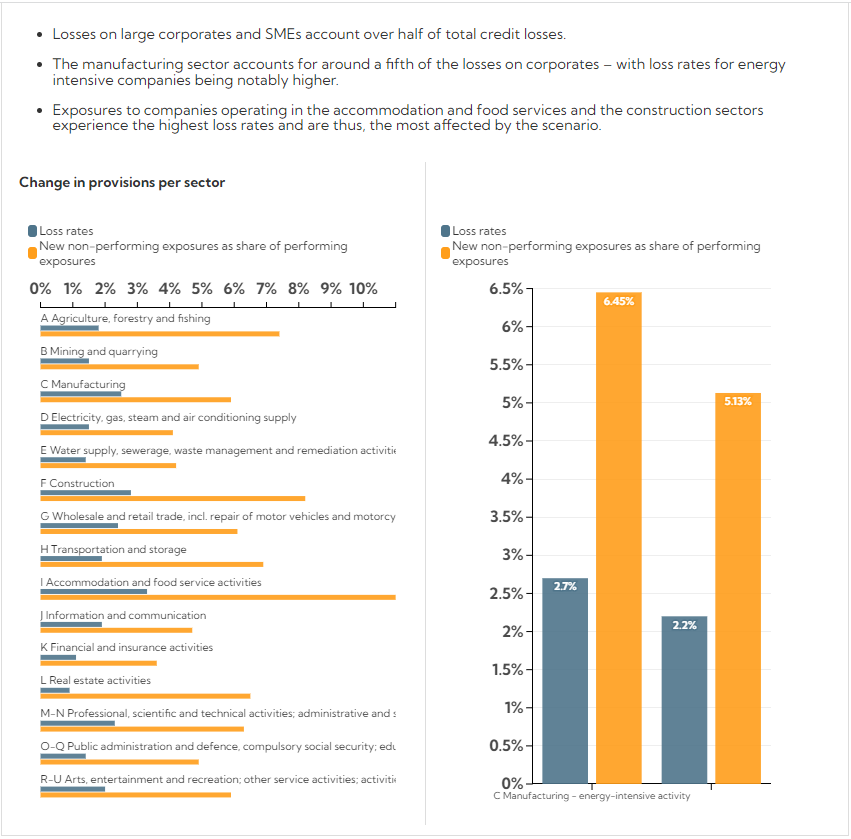

Heterogeneous impact of the scenario across economic sectors

Under the adverse scenario, banks project credit losses of EUR 347 bn

Key takeaways

The results of the 2023 EU-wide stress test show that European banks remain resilient under an adverse scenario which combines a severe EU and global recession, increasing interest rates and higher credit spreads.

This resilience of EU banks partly reflects a solid capital position at the start of the exercise, with an average fully-loaded CET1 ratio of 15% which allows banks to withstand the capital depletion under the adverse scenario.

The capital depletion under the adverse stress test scenario is 459 bps, resulting in a fully loaded CET1 ratio at the end of the scenario of 10.4%. Higher earnings and better asset quality at the beginning of the 2023 both help moderate capital depletion under the adverse scenario.

Despite combined losses of EUR 496bn, EU banks remain sufficiently capitalised to continue to support the economy also in times of severe stress.

The high current level of macroeconomic uncertainty shows however the importance of remaining vigilant and that both supervisors and banks should be prepared for a possible worsening of economic conditions.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: