Cashless society still far away for most European markets

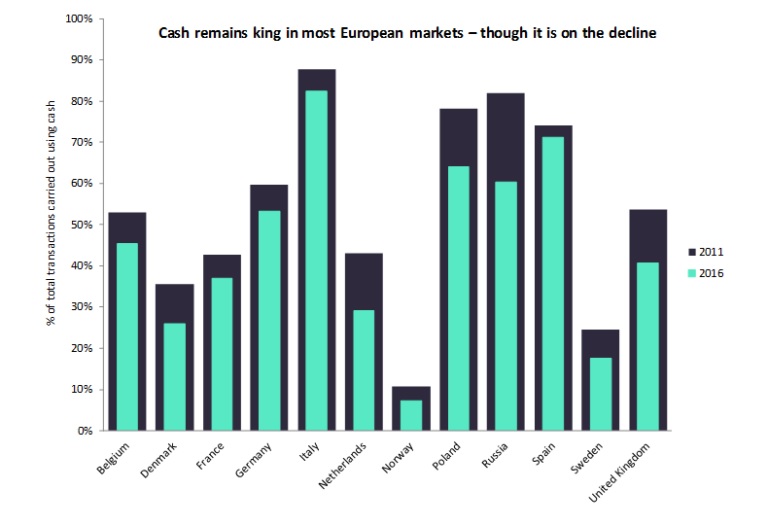

As per our Payment Instrument Analytics, cash is still king in Europe, with over half of all payment transactions made using cash in Germany, Italy, Russia, Poland, and Spain in 2016. „Overall the cashless society remains a distant prospect for most of Europe, despite the decline in cash usage across the region in the past five years.”, according to a Global Data report.

The closest market to the cashless ideal is Norway, where cash accounted for only 7% of all transactions in 2016 (down from 11% in 2011). The Scandinavian markets generally are the least reliant on cash in the region, with cash accounting for 18% of all transactions in Sweden in 2016, and 26% in Denmark. High levels of card penetration combined with extensive and highly developed POS terminal networks in these markets make it easy for consumers to use cards, and emerging tools such as mobile wallets are beginning to gain market share in these countries – all at the expense of cash.

The most cash-dependent market in Europe is Italy, where cash accounted for 82% of all transactions in the market in 2016 (down from 88% in 2011). Italian consumers are heavily reliant on cash at the POS, to the point that the government has legislated to reduce cash use on two separate occasions. In 2012 it banned cash payments of over €1,000 ($1,185), and in 2014 it mandated that all businesses must offer card terminals for transactions above €30 ($36). These measures have been of limited effect, as shown in the above chart. In markets such as Italy, Germany, and Spain, where the culture heavily favours cash use at the POS, change will be slow even with engagement from the government and the payments industry.

Contactless cards have proven to be an effective way of reducing cash usage in European markets. For example, in the UK the introduction of contactless card acceptance on London’s public transport services saw contactless card usage rise rapidly at the expense of cash. As a quick way to pay for low-value transactions, contactless cards (and mobile payment tools, although these are much less widely used in Europe) are well-positioned to supersede cash at the POS. These cards are also largely responsible for the decline in cash usage in Poland, which was an early adopter of contactless technology.

But overall, cash remains king in Europe – for now. The pace of change in payments generally is quick, and the rapid decline of cash in the UK and Poland shows the progress that can be made when consumers switch over to electronic payment tools.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: