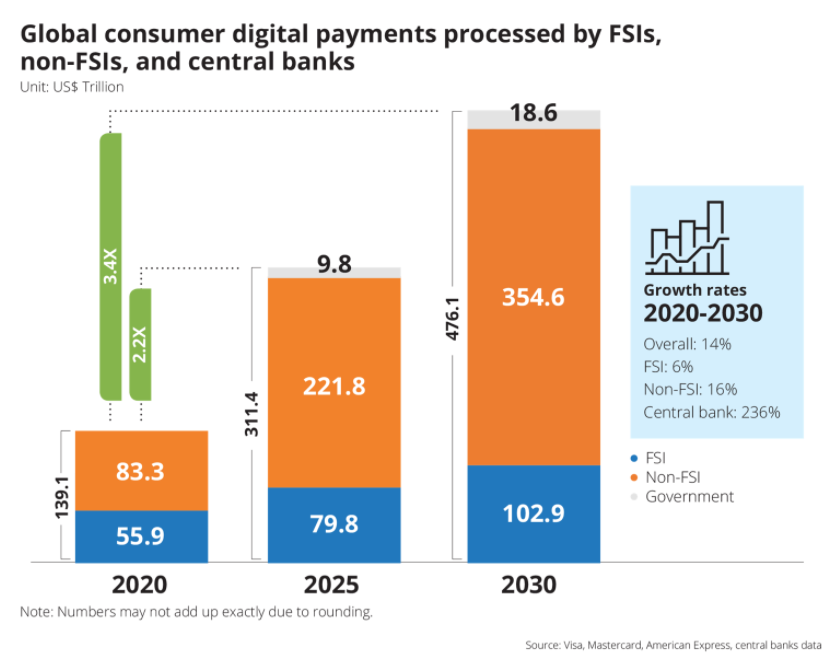

This figure is an increase from 60% in 2020, putting added pressure on incumbents such as banks, insurers and credit unions.

“Future ready” paytech investment to date by Financial Services Institutions has not been sufficient in slowing down this shift, resulting in a loss of $250 billion in payments revenue by 2030, according to a new study by IDC Financial Insights commissioned by Episode Six, a payments technology company.

Disruptive change in the payments industry is reshaping the landscape, including the participants and the roles each plays. The innovators in payments are creating new embedded customer experiences which are rapidly acquiring market share and leveraging the foundation they have built from payments to expand their product offerings. The rise of innovators is hastening incumbents to reposition themselves in the payments ecosystem.

By 2030, 60% of global consumers will have made a transaction using an asset class other than fiat currency.

95% of physical non-cash payments will be through contactless methods and BNPL. BNPL grew 79% compared to 5% for cards in 2020 and is set to continue to grow by 15% annually through 2030. Cards will grow at 4% per year.

Financial Service Institutions must now be able to compete creatively and rapidly by responding to marketing demands and evolving end-user behaviors.

However, the IDC InfoBrief finds that 73% of FSIs globally currently have paytech infrastructures that are not well equipped to handle payments for 2023 and beyond. IDC deemed only 3% of FSIs to have ‘future ready’ paytech – meaning payments infrastructure that enables payments anywhere and everywhere for any possible present and future asset class.

„Traditional financial services institutions will continue to lose consumer payments market share, and corresponding revenue, until they have infrastructure that is able to support new ways to pay,” said John Mitchell, CEO of Episode Six.

„FSIs need to be able to process value in whatever form consumers demand – fiat, crypto and gaming currencies, loyalty points and value denominations that don’t exist today. That requires paytech infrastructure that’s fast to deploy, highly configurable and future ready. IDC’s data shows that FSIs are investing, but also suggests that they’re focusing on maintaining a quickly diminishing position, rather than ensuring an ability to compete in the future.”

This IDC InfoBrief commissioned by Episode Six outlines actionable strategies and examines the forces driving these changes and how new payments technologies enable any business with a digital front door, not only banks and fintechs, to create new value in the form of novel revenue streams and engaging customer experiences.

The IDC InfoBrief commissioned by Episode Six, ‘Future Ready Payments Technology Reshapes the Playing Field for the Industry: Driving Over 70% of Payments to Shift to Non-FSIs by 2030’, can be downloaded free of charge here.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: