Brokerage as a service: Less than half of European consumer neobanks have introduced an investment proposition – research

Neobanks are perfectly positioned to introduce investments to their product range, „so we expect an increasing number to enter this space. Barriers to entry exist, but Application Programming Interfaces (APIs) facilitate integration, allowing neobanks to add the necessary capabilities quickly and easily” – Bricknode said in a blog post.

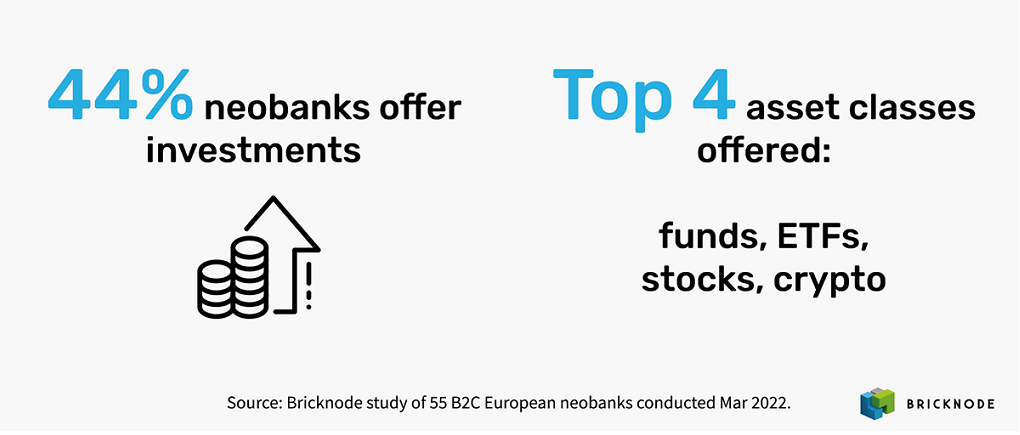

According to research conducted by Bricknode in March 20221, despite the scale of the opportunity, less than half of European consumer neobanks have introduced an investment proposition. Only 44% of Europe’s top neobanks offer investments to their customers, with 54% listing more than one asset class. Funds are the most common, followed by ETFs, stocks and cryptocurrency.

The neobanks offering investment products have adopted different business models. Two thirds have partnered with investment and SaaS solutions like Bricknode Broker, leveraging the underlying infrastructure to go to market quickly and keep costs to a minimum. One third of neobanks, meanwhile, utilise proprietary or parent company technology, and notably, most of these were owned by large incumbent banks.

To draw a conclusion from this research, „neobanks are supporting the further democratization of investing, but many haven’t tapped into this sizeable income stream yet,” according to the authors of the research.

Even among those that have, 46% have scope to increase their offering from a single asset class. One particular area of growth is sustainable investing, where Bricknode’s research showed that one quarter of neobanks provided such an offering. Dutch neobank Bunq launched an ESG product in February, to be followed shortly by Germany-based Tomorrow.

Barriers to entry

While the opportunity seems enticing, launching an investment proposition isn’t without challenges.

Time to market: the timescale involved is typically measured in years. The software and infrastructure required to manage investments are complex, and neobanks rarely have the in-house expertise to build it, let alone ensure it meets regulatory requirements.

Licensing– Few neobanks secure licenses to carry out investments because of the demanding application process, timeline and fees.

Regulatory requirements– Ensuring a fintech stays on the right side of regulations like the Markets in Financial Instruments Directive (MiFID) requires significant resources. Failure to do so risks heavy penalties- the US Financial Industry Regulatory Authority (FINRA) fined Robinhood $70 million in June 2021 for outages and misleading customers when market volatility spiked at the start of the pandemic.

Build vs partner vs buy

Neobanks have three options when it comes to adding investments to their product range.

Building a solution in–house may grant greater control over design and implementation, but the time to market is very slow and this demands significant resources.

Partnering with a third-party investment provider presents a quicker route to market but less flexibility because neobanks are tied to the partner’s product, brand and revenue share or commercial agreement.

Buying a dedicated investment SaaS solution provides the best of both worlds – a quick route to market and complete flexibility over design, so a neobank can offer a broad investment proposition and enhance or make changes at any time. What’s more, owning the solution means the neobank receives all the revenue.

The arguments in favour of buying a SaaS solution were strong enough to persuade Revolut and Lunar, while Swedish fintechs Alwy and Sigmastocks recently decided to work with Bricknode.

___________

1 Research carried out by Bricknode in March 2022 by analysing 81 neobanks with headquarters in Europe, based on a NeoBanks.app list plus five additional companies known to Bricknode. Pre-launch, B2B and kids/teenager neobank companies were excluded from the final analysis, leaving a sample size of 55. All investment product data including asset classes was sourced from the neobanks’ own websites or apps. Data pertaining to investment/SaaS partnerships was sourced from neobanks’ websites and press releases.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: