Bitcoin down almost 50% from year’s high. The search query “Should I sell my bitcoin?” soared on Google over the past week.

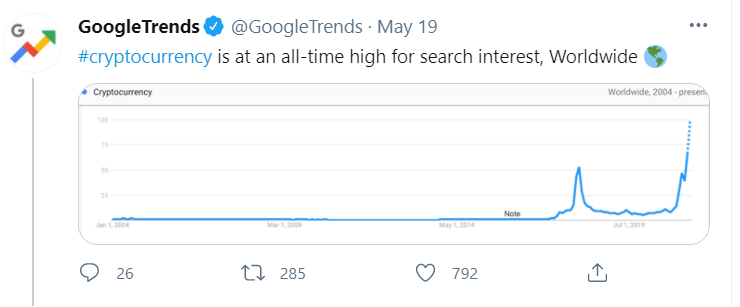

Bitcoin fell 13% on Sunday after the world’s biggest and best-known cryptocurrency suffered another sell-off that left it down nearly 50% from the year’s high, according to Reuters. Cryptocurrency-related search queries have surged in popularity to a new all-time amid the last week’s panic sell-offs, according to Google.

Bitcoin fell to $32,601 at 1800 GMT (2 p.m. ET), losing $4,899.54 from its previous close. It hit a high for the year of $64,895.22 on April 14. Earlier in the afternoon it had reached as low as $31,179.69.

According to Nick Mancini, analyst at crypto sentiment analytics platform Trade the Chain, the specific reason for Sunday’s bloodbath was news from crypto exchange Huobi, which said it’s scaling back some of its offerings in some countries due to China’s increasingly hard line on crypto.

“Right after the news broke, short term Bitcoin sentiment scores plummeted to levels not seen since May 19th, this was followed by a drop in price,” Mancini wrote.

The moves by Huobi are the first concrete steps by a crypto company in response to China’s crackdown and it appears to be making the hard line much more real to investors.

Bitcoin had been under pressure after a series of tweets last week by billionaire Tesla Chief Executive and cryptocurrency backer Elon Musk, chiefly his reversal on Tesla accepting bitcoin as payment.

In addition, on Friday China cracked down on mining and trading of the largest cryptocurrency as part of ongoing efforts to prevent speculative and financial risks.

China’s Financial Stability and Development Committee, chaired by Vice Premier Liu He, singled out bitcoin as the asset it needs to regulate more.

The statement, which came days after three Chinese industry bodies tightened a ban on banks and payment companies providing crypto-related services, was a sharp escalation of the country’s push to stamp out speculation and fraud in virtual currencies.

China’s latest campaign against crypto came after the U.S. Treasury Department on Thursday called for new rules that would require large cryptocurrency transfers to be reported to the Internal Revenue Service, and the Federal Reserve flagged the risks cryptocurrencies posed to financial stability.

The search query “Should I sell my bitcoin?” soared on Google over the past week, according to CryptoSlate.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: