Non-bank ATM operators bounce back from the pandemic with acquisitions of bank terminals to expand their reach, boosting fleet numbers and increasing functionality

Non-bank deployers find growth opportunities in a changing climate

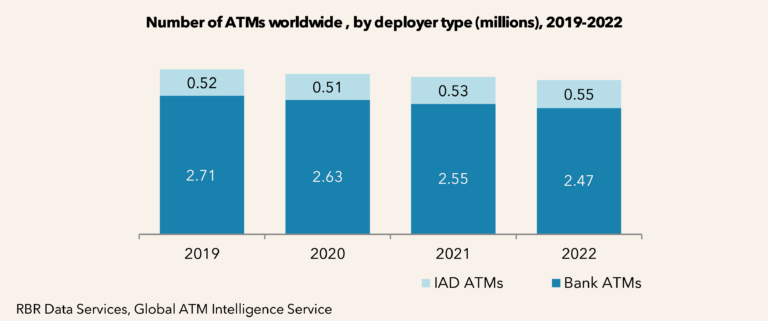

The latest research from RBR Data Services’ Global ATM Intelligence Service reveals continued expansion in the independent ATM deployer (IAD) sector worldwide. While many banks slim down their fleets in pursuit of cost savings and digitisation, IADs have stepped into the breach with over 17,000 new installations in 2022 and an 18% share of total ATM numbers globally.

IADs’ progress is aided by their versatility; from partnerships with retailers, to buying up bank fleets, to expansion into tourist hotspots or underbanked neighbourhoods, non-bank operators have multiple strategies for growth.

USA remains the largest IAD market, although growth has slowed

The USA has by far the most non-bank ATMs globally, mostly thanks to a proliferation of terminals in small retail premises with the IAD and merchant sharing the profits from surcharging. RBR Data Services’ research shows that non-bank ATM numbers in the USA remained stable in 2022, as post‑pandemic recovery eased off and demand for cash weakened. Nevertheless, IADs account for over half of the country’s total ATMs and are generally outperforming the bank ATM sector. RBR Data Services forecasts ongoing modest IAD expansion in the USA in the future, with IADs expanding the number of terminals they operate through outsourcing agreements with banks.

NCR has become the USA’s largest deployer, and also the leading IAD globally, thanks to its acquisition of Cardtronics’ international business and the Allpoint ATM network in 2021.

IADs and bank partnerships answer some of the sector’s biggest problems

IADs and banks are finding more opportunities to collaborate, with ATM-as-a-service agreements proving a boon to IADs’ market presence and solving the thorny problem of costly ATM maintenance and management for banks.

Outsourcing and ATM-as-a-service are the key to IAD growth in France, where non-bank ATM numbers nearly quadrupled in 2022, the fastest rise recorded in any country. Brink’s France, the country’s largest IAD, struck an agreement with the BPCE banking group in 2019 to operate and manage the group’s ATMs. Progress in the partnership in 2022 saw almost 7,500 ATMs transferred from the group’s biggest banks to Brink’s, leaving the IAD with a 20% share of the entire French ATM market.

RBR Data Services’ research also identifies the importance of partnerships between banks and IADs in emerging markets to expand services into underbanked areas. ATMi, a joint venture in Indonesia between a bank and a network, installed over 3,000 new ATMs in local convenience stores in 2022. Meanwhile, Thailand’s FSMART doubled its presence during the year, with the aim of reaching customers without access to the branches or terminals of its bank partner, Kasikornbank.

Non-bank operators make progress on functionality

RBR Data Services’ Global ATM Intelligence Service has tracked progress in ATM functionality over several decades, studying the rollout of automated note deposits, recycling and other services at terminals globally. This is an area where IADs have typically lagged behind, with a more basic and less functional range of machines than banks.

The situation is shifting in countries where IADs are coming into possession of more sophisticated ATMs, as they acquire or take on the management of bank fleets. This is most advanced in Poland, where leading IADs Euronet and Planet Cash have built up their fleets in large part from terminals bought from banks, and now operate ATMs offering services including cash deposits, contactless transactions and fund transfers.

Mandy Eagle, who led RBR Data Services’ Global ATM Intelligence Service research, remarked: “IADs have proved themselves to be highly adaptable, recovering from the pandemic and finding continued opportunities for growth in a world where the role of cash and physical banking infrastructure is changing rapidly. IADs will expand their footprint in the coming years, largely by re-purposing bank terminals into their own networks, rather than an organic expansion.”

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: