Alipay & Concardis cooperates to enable merchants to acces Chinese tourists in Germany – Austria will soon follow

Alipay, the world’s largest payment and lifestyle platform run by the Ant Financial Services Group, and Concardis, one of the leading payment providers in Europe, announced their cooperation in Germany. Through this partnership, Alipay solution can be easily integrated by all merchants of Concardis, by far the largest credit card acquirer in Germany with a market share of 40 percent, servicing 110,000 merchants in 210,000 store locations.

Further to the payment, the Alipay App is also a lifestyle application, the „Global Lifestyle Platform”, which gives Alipay users useful information to nearby shops including offers, ratings and reviews.

Together with Concardis, Alipay will offer the payment and marketing solution to enable merchants to access Chinese tourists in Germany. Chinese tourists are an interesting target group for merchants because of their growing numbers and purchasing power. This integrated solution can be integrated with a software update into the POS terminal and no additional infrastructure is needed for merchants to accept Alipay.

Concardis serves as a leading payment service provider in Europe with around 110,000 customers at 210,000 store locations. Alipay will be integrated into the entire Concardis merchant portfolio first in Germany, then in Austria.

Integrated Payment and Marketing Solution

The „Global Lifestyle Platform” in the Alipay App adapts to the location of the user and informs about nearby merchants including offers, ratings and reviews. German merchants will be able to push their promotions and activities through the Alipay App to attract Chinese tourists before and during their journey in Germany. This service reinforces that Alipay is not only a mobile payment, but also represents a lifestyle platform for the consumer.

Through Concardis, the German merchants are able to offer Chinese tourists a payment method they are accustomed to and gives them the same experience abroad as in China. In addition, it helps Chinese tourists to save the hassle of exchanging money in advance. Alipay currently has more than 450 million active users and more than 50 percent of China’s market share in online payments and 80 percent in the mobile sector.

This strategic partnership between Alipay and Concardis stresses the importance of Chinese tourists for German merchants: The night stays of Chinese tourists from 2004 to 2014 have increased according to the German National Tourist Board by more than two and a half times. In 2014 there were about two million night stays. The German National Tourist Board expects another growth for the next few years. According to Financial Times Chinese tourists spend during their travel in Germany an average of $ 5.200.

Simple and innovative payment process

The Concardis solution is integrated directly into the existing equipment of the merchant (both hardware and software), so no additional infrastructure is needed. To start with the integration of Alipay, only two steps are necessary: The download of a software and the signing of a contract. Concardis will first introduce Alipay infrastructure in all H5000 terminals and thereafter gradually take over in the entire Concardis portfolio.

Through Concardis and Alipay the German merchants are able to offer Chinese consumers a simple and straightforward payment process: On the terminal, a QR code is generated, which the consumer scans with the Alipay app. This makes payment for tourists who are travelling as easy as at home.

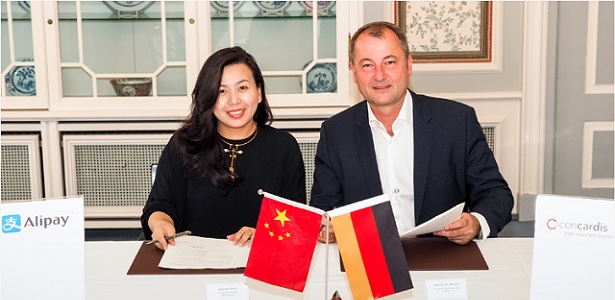

Sabrina Peng, president of Alipay International, comments on the new collaboration: „We are delighted to have the opportunity to cooperate with such an important partner like Concardis for Alipay in Germany. With this partnership we are able to connect German merchants to the many Chinese tourists in Germany through our payment and marketing solution and simultaneously offer a payment method they are used to from home.“

Marcus W. Mosen, CEO Concardis: „For us and our trading partners the cooperation with Alipay offers innovative opportunities: The merchants receive through this payment option and by the additional marketing service the opportunity to attract more customers and target a new audience. This collaboration shows the innovative approach of Concardis: We want to seize the opportunities of digitization in order to create real value for our customers. Payment is not an isolated functionality, but must be integrated into the entire customer communication. The Global Lifestyle Platform of Alipay provides us with this opportunity. „

About Alipay:

Launched in 2004, Alipay is the world’s leading third-party payment platform. It currently has over 450 million active registered users and more than 200 financial institution partners. During the 2015 11.11 Global Shopping Festival, China’s equivalent of Cyber Monday, Alipay processed RMB 91.3 billion worth of transactions from Alibaba’s marketplaces.

In addition to online payment functions such as online shopping payments, money transfer, and utility bill payments, Alipay is expanding to offline payments both inside and outside of China. Over 600,000 brick-and-mortar merchants and over one million taxis now accept Alipay as a payment method across China.

As of December 2015, Alipay was accepted in more than 50,000 retail stores outside of China, and tax reimbursement via Alipay is supported in 24 countries and regions, including South Korea, Germany and France. More than half of the transactions processed by Alipay are conducted on mobile devices. Alipay has evolved from a digital wallet to a lifestyle enabler. Users can hail a taxi, book a hotel, or buy movie tickets directly from various modules within the app and purchase wealth management products such as Yu’e Bao.

Source: concardis.com

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: