Germany-based neobank N26 has announced that its paid premium accounts are now available to residents in Greece and Slovenia.

All of these premium accounts come with benefits beyond those offered by basic free N26 accounts, including travel insurance coverage and special perks from brands like WeWork and Hotels.com, while Metal accounts additionally offer a special metal debit card, car rental insurance while traveling, and mobile phone theft and damage coverage.

The banking platform stated: “While You and Business You are perfect for everyday work and travel, N26 Metal offers the ultimate in premium banking. Choose from one of the exclusively designed metal card colors: Charcoal Black, Rose Quartz or Slate Grey, and experience a host of additional premium benefits such as dedicated customer phone support, mobile phone insurance up to €1,000 and vehicle hire abroad cover up to €20,000.”

N26 Business You accounts also boast 0.1% cash back on purchases. The perks come at a price, however, in the form of monthly fees: N26 You and Business You accounts cost EUR 9.90 (USD 10.88) per month, and Metal accounts cost EUR 16.90 (USD 18.58).

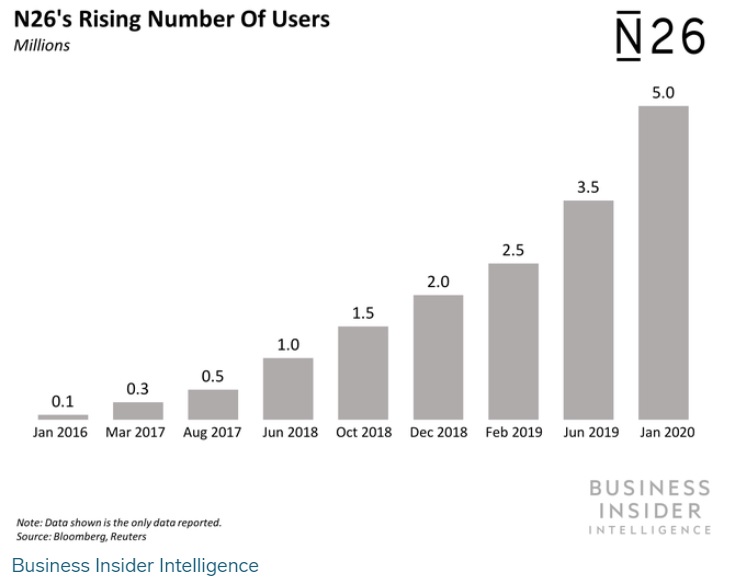

The premium account launches in new markets represent a new revenue opportunity after the neobank’s departure from the UK market, according to Business Insider. The rollout comes on the heels of the N26’s announcement that it will close all UK customer accounts effective 15 April due to Brexit.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: