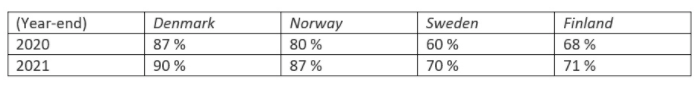

Denmark leads the pack with a staggering 90 per cent of card payments now contactless. Norway is close behind at 87 per cent. Sweden and Finland have now both surpassed 70 per cent.

Nets, part of leading European PayTech Nexi Group, has published new data on card payments and in-app card mobile payments in 2021. In the Nordics – a region renowned for being a digital payments pioneer – the share of contactless card payments increased from 74 per cent in 2020 to 80 per cent in 2021.

Denmark is the leader in the region, with a staggering 90 per cent of all card payments being contactless. Norway, which was much further behind just a couple of years ago, is closing the gap with 87 per cent. Sweden, like Norway, introduced contactless at a later stage, but has achieved the largest growth last year and is now at 70 per cent. Finland remains just ahead of Sweden at 71 per cent.

Growth of contactless payments in the Nordics

Robert Hoffmann, Head of Merchant Services, Nets, commented: „The Nordic region is the most digitised in the world and certainly among the leaders in digital payments. Nordic consumers have adopted contactless as the standard way to use their payment card at physical sales locations and the pandemic has been a strong driver for these ‘tap and go’ payments. This is positive for merchants, who get a faster payment flow, as well as for consumers who can pay more conveniently and without physical contact with the payment terminal.„

Data from the Nets Nordic Payment Report in 2021 also showed that seven out of ten consumers value contactless payments highly or very highly, and about 90 per cent are regular users of contactless payments.

The contactless limit set by EU law is EUR 50, which is reflected in the local limits in all four Nordic countries. Contactless payments via mobile devices, such as Apple Pay and Samsung Pay, work on all payment terminals with the contactless NFC functionality, but have no transaction limit as the purchase is validated on the phone.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: