3D Secure payment authentication market size worth $3.49 billion by 2032

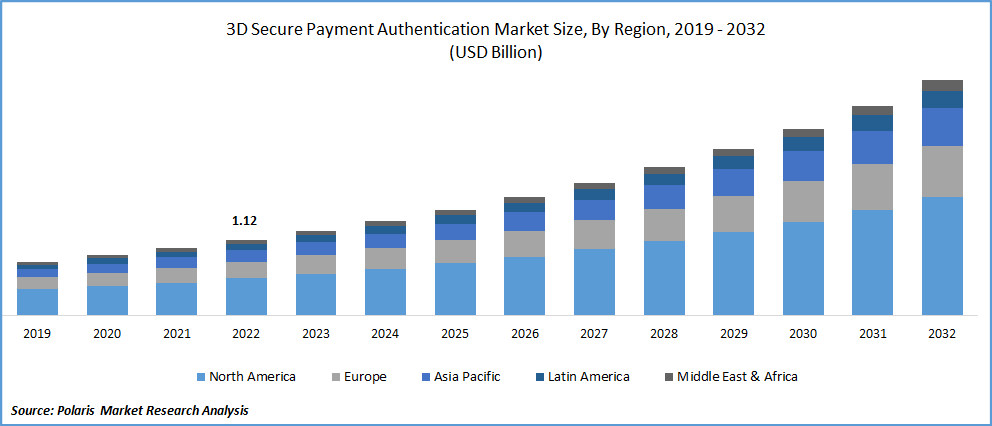

The global 3D secure payment authentication market was valued at USD 1.12 billion in 2022 and is expected to grow at a CAGR of 12.0% during the forecast period.

The global 3d secure payment authentication market size is expected to reach USD 3.49 billion by 2032, according to a new study by Polaris Market Research. The report “3D Secure Payment Authentication Market Share, Size, Trends, Industry Analysis Report, By Component (Access Control Server, Merchant Plug-in, and Others); By Application; By Region; Segment Forecast, 2023 – 2032” gives a detailed insight into current market dynamics and provides analysis on future market growth.

The increasing technological advancement in payment authentication technology, adoption of digital technologies for processing online payments, and a growing number of 3D secure payment authentication launches across the globe are key reasons behind the significant growth of the global market.

The shift in consumer preferences towards online shopping with the emergence of several online channels and growing proliferation of smartphones, resulted in a high number of digital fraud activities. Thus, the demand for these types of solutions is gaining high traction for fraud prevention.

For instance, in November 2022, Network International launched its new 3D Secure authentication solution in collaboration with Mastercard. With this collaboration, authentication using Mastercard’s Smart Interface will now be available for merchants in UAE and further using the N-Genius online payment gateway to effectively process eCommerce transactions.

The increase in digital economy and e-commerce across the globe are becoming increasingly important in order to cater to the current sustainable development goals, which is creating high growth opportunities and challenges as well. However, as payment systems are becoming more autonomous, the need and prevalence for automation and standardization among both interbank and intrabank networks between nations is growing at a rapid pace and is likely to contribute positively to the market growth over the next coming years.

With the integration and proliferation of PSD2 standard in 3D secure payment authentication technology, the necessitate forced requirement for Strong Customer Authentication and Two Factor Authentication across various hotels and restaurants to be precise the safer and more securer carrying out of online payments has gained significant traction. EMV 3D Secure is the latest version of the current authentication protocol and is generally used to authenticate online card transactions effectively while address to several SCA requirements.

3D Secure Payment Authentication Market Report Highlights

The merchant plug-in segment accounted significant share in 2022 due to rapid rise in the adoption of this solution across several businesses and need for innovative ways of cards verification

Merchants & payment gateway segment is witnessing highest growth at a CAGR owing to increasing proliferation of minimizing fraud and chargebacks and upgradation to 3D secure 2.0.

North America dominated the industry with a holding of significant revenue share on account of increased number of online card transactions and increasing prevalence of CNP frauds in countries like US and Canada.

More details here

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: